At first, these ‘get loans at a click’ applications (apps) might seem customer friendly. But this disguise was primarily used by loan app companies to trap several innocent borrowers into a cycle of harassment. The Instant Loan Apps case is in fact a racket. The apps in question are not linked to any bank or NBFC, nor have they been registered with RBI.

Anyone looking for an instant loan online is directed to an aggregator app where the borrower is asked to provide a three-month bank statement, their Aadhaar card and selfie. After uploading personal details, the customer can avail instant loans, ranging from ₹1,000 to ₹50,000. And the interest rates charged for this credit can be as exorbitant as 30 percent with a ₹3,000 penalty for failing to repay after the due date. At first the loan is offered for a term of 91-360 days, but after the loan is sanctioned, the borrower is asked to repay the amount within 7 days.

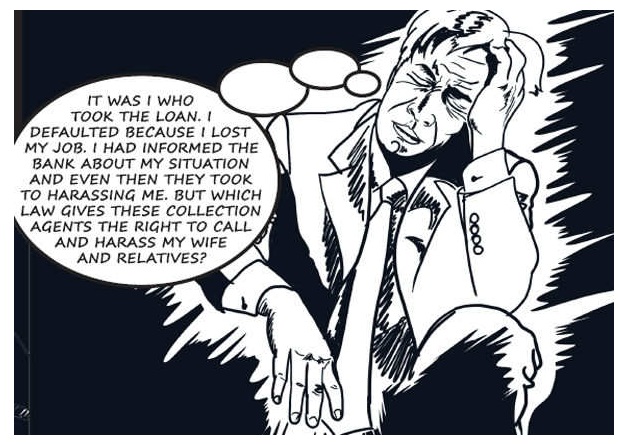

But it is after these 7 days that the worst nightmare begins. The personal details of the borrower (their relatives contact numbers, their photographs, etc.) are shared with recovery agents who use a combination of coercion, blackmailing, and threats to recover what is owed. Initially, the borrowers get dozens of calls from the agents. And after a few days, the agents have also been known to defame “the defaulter” among their relatives and friends! Harassment at the hands of agents has led many victims to register complaints with the police, while several of them succumbed to the tormenting psychological pressure.