In this week’s newsletter, we discuss the index fund attack on JFS, the origin story of a tech giant, yet another Adani scam, and more.

If you’d like to receive our 3-min daily newsletter that breaks down the world of business & finance in plain English – click here. Or, download the Finshots app here.

P.S We are on the lookout for talented interns to join our Marketing (Content Writing & Influencer Marketing), Human Resources & Operations teams. If you wanna be a part of an exciting startup, then this might be the right opportunity for you.

Think you have what it takes? Then email us at intern@finception.in 🙂

The Big Story – The index fund attack on Jio Financial Services is over. Almost.

Jio Financial Services can finally breathe. The stock is in the green.

You see, for a few days after this newly demerged Reliance entity hit the stock exchange, things weren’t good. It kept dropping 5% every day. And that’s due to a simple fact — forced selling by index funds.

Let us explain.

When JFS was demerged from Reliance Industries, it ended up on stock market indices such as the Sensex 30 and the Nifty 50. It didn’t really deserve to be there. It didn’t meet any of the typical criteria laid out for inclusion in these prime benchmarks. But, a small change in the rulebook meant that it landed up here anyway. The new rule simply said that in case a stock that’s part of an index is involved in a demerger, the new stock or the demerged stock will also find a temporary home in the index. And since Reliance Industries was the biggie within the index, its spawn found a place too.

So for a brief period, the Sensex 30 became the Sensex 31.*

Now, for the uninitiated, index funds don’t have a fund manager at the helm to pick good stocks and dump bad ones. No one’s doing the research and pulling the strings. There’s no one behind the curtain who’ll dump a stock when a scathing new report alleging misdeeds at a company. Or who’ll buy a stock when a company snags a big deal too. Instead, these funds are “passively managed.”They simply buy and hold stocks in the same proportion as an index such as Sensex 30. If a stock drops out of the index, they sell too. They copy, they mimic, and they mirror the index. That’s it.

So you know what they would’ve had to do with JFS, right?

If the index was dumping it, they’d have to exit too. They didn’t care if the stock had a sound business or not. They’d break up with it once it leaves the index. That’s the forced selling we alluded to at the start.

But what if they chose not to sell for a while? What if they took their own sweet time?

Well, they could. But on the flip side, if they didn’t sell, it would introduce something called a tracking error. Which, simply put, is the difference between the returns of the index and the fund mirroring it. And investors don’t like a large tracking error in these funds. They want it to be as close to each other as possible. So if an index fund begins to exhibit these deviations, investors will lose trust. They’ll look for alternatives. And that’ll affect its business prospects too.

But what the JFS incident also goes to show is the power of index funds. Even in a nascent market like India, these funds were able to drive down the price of a stock quite easily. No one else stood a chance against the relentless selling pressure. After all, by some estimates, there’s over ₹5 lakh crores in funds tracking the various Nifty indices. That’s quite a bit of ‘mindless’ money that’s buying and selling stocks without a care in the world.

Now some folks might point to this ‘attack’ on JFS and remark, “Look at the harm caused by the mindless mimicry by index funds. It’s distorting the market.”

But what if we told you that these events might actually be good for active fund managers? You know, the ones who spend hours poring through annual reports and speaking to management before making a buy or sell decision.

You see, the breed of active management has been going through some tough times. People are questioning whether the fees they pay for these funds are worth it. And that’s because the performance of these actively managed funds has been quite underwhelming. Take this stat for instance — in 2022, 88% of such funds that pick stocks of large companies failed to beat the benchmark. And if you extend the timeline to 3, 5, or even 10 years, you’ll see a similar trend. They just can’t seem to outperform the index.

But think of these situations. Such as when the stock is being deleted from an index. Passive funds have no option but to sell en masse. It could knock down the share price. And if the fundamentals are strong, it gives a perfect buying opportunity for an active fund. They might be able to snag it for a bargain.

Or it could happen in reverse too when a stock is added to an index. Now this addition doesn’t happen out of the blue. Investors know about it a few weeks in advance. And active fund managers can start buying the stock in the lead-up to that event. Because they know that passive funds have to wait on the sidelines. They’ll take action only once the stock makes its appearance in the index. And once it does, the massive influx of passive fund money can drive up the price. It’s called the “Index Inclusion Effect.” And the active fund manager who entered earlier benefits.

Heck, there are actually funds out there globally that bet on such situations. The active fund manager can basically ride the passive wave for their own benefit. Sure, you could argue that these events don’t happen every day. And that’s true. But hey, when it does, it’s exciting times for sure.

So yeah, the next time you hear a fund manager complain about how passive funds are spoiling their party, maybe think about this story, eh?

*As of 1st September, JFS has been dropped from the Sensex 30. But, it still continues to be part of the Nifty 50 and could exit this week.

Today’s Discussion : From Dried Fish to Smartphones – The Hidden Story of a Tech Giant

: From Dried Fish to Smartphones – The Hidden Story of a Tech Giant

You see, back in 1938, a young entrepreneur named Byung-Chull Lee founded a small trading company in South Korea.

Its specialization?

Exporting dried fish, noodles, groceries & other local goods!

However, in the 1950s & 60s, he started venturing into various industries – like textiles, food processing, insurance & even opened a department store!

But why are we talking about a trading company with such a variety of operations??

Well, because in the late 1960s, the company decided to enter the electronics industry and became one of the biggest brands of all time. We are talking about none other than Samsung!!!

Surprising right?

Well, Samsung initially began manufacturing black and white televisions, an essential consumer electronics product at that time. But what took the business to the next level was their commitment to R&D and innovation!

See, by the 1990s, Samsung had its first breakthrough when it started producing memory and hard drives for use in personal computers. And this is still a big part of Samsung’s business today!

And, in 1995, they finally ventured into the mobile phone market. Though initially, their products didn’t work out.

When this was found out by the company’s then-chairman Kun-Hee Lee, he had the entire inventory burned!

But thankfully, that wasn’t the end. Samsung kept innovating. And finally in 2010, they made a significant impact on the tech world with the release of the Galaxy S – a smartphone that rivaled Apple’s iPhone!

This marked the beginning of Samsung’s dominance in the smartphone market! Quite a rollercoaster, right?

But Samsung didn’t stop here, it became a pioneer in producing OLED screens, revolutionising displays in TVs and smartphones.

Fast forward to today, Samsung is a household name worldwide with operations in over 70 countries.

From a humble dried fish exporter to earning a revenue of $234 billion in 2022 – all thanks to the company’s ability to adapt and innovate!

What do you think? Let us know

Video explainer  : New Adani Groups Controversy | OCCRP Report Allegations

: New Adani Groups Controversy | OCCRP Report Allegations

Adani Groups is in the news AGAIN– for all the wrong reasons.

After the Hindenburg fiasco accusing them of share price manipulation, defrauding the Indian public & corruption– leading to a SEBI investigation under the Supreme Court.

Just when Adani started doing damage control, another report came out– this time from a group called OCCRP– a global network of investigative journalists who uncover organised crime and corruption.

So, we thought we’d explain the whole saga in a crisp yet insightful YouTube video. Watch it here now!

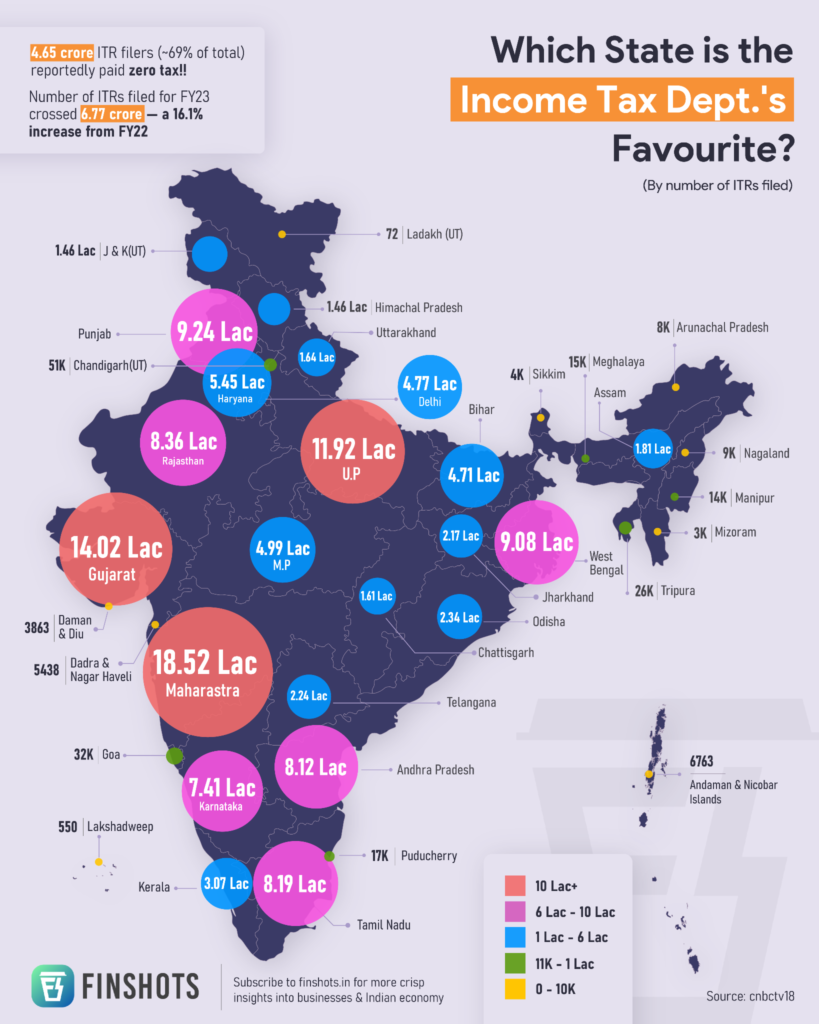

Infographic of the week!

And that’s all for today folks! If you learned something new, make sure to subscribe to Finshots for more such insights 🙂