On 1st February 2022, the Finance Minister of India in a bold move unveiled one of the shortest annual financial budgets ever which received mixed responses from stakeholders. With the economy still recovering from the pandemic, the government has decided to give a big push to infrastructure through this budget, in hopes of reviving demand and investment. It announced Rs. 2.37 lakh crores towards MSP and other technological improvements for farming and aims to stay committed to domestic production for defence and technology.

By leaving the tax slabs untouched, the government has played a dangerous gamble by risking a chance of high inflation for growth. Even though inflation is high globally, India’s high rate of inflation is a matter of substantial concern. With the Wholesale Price Inflation already in double digits due to high fuel and commodity prices, consumer inflation is expected to soon follow a similar trend. To counter these high inflation rates, the Indian economy will have to grow at a massive rate, and as per our observations, it does have the potential to do so.

VIRTUAL DIGITAL ASSETS

In the financial budget 2021-22, the Finance Minister of our country, Dr Nirmala Sitharaman, declared a 30% flat tax rate on the gains arising from Virtual Digital Assets. The given definition of virtual assets is very vast and includes all forms of a virtual asset, be it any information, code, number or token generated through cryptographic means or otherwise. Cryptocurrency, NFTs, and tokens of similar nature are included in the definition. There will be no deductions allowable except for the cost of acquisition, and the losses arising from it cannot be set off. Recipients of Virtual Digital Assets as gifts will also be taxable.

The core feature of cryptocurrency is in its form of decentralized digital money which is not regulated by any institution. However, now the same has been terminated by the government by bringing in the TDS provision. Now on every transaction of cryptocurrency exceeding the threshold limit, that is 1%, TDS will be deducted. This means the government will have a record of every transfer, which further implies that cryptocurrencies are not anonymous anymore. This move is enough to discourage cryptocurrency investors as the most important & basic feature of cryptocurrency is compromised.

Blockchain is a system of recording transactions, where data entry is passed in all the systems connected with the blockchain making it a difficult task to alter the information. From a futuristic perspective, blockchain technology can be seen as revolutionary technology as it addresses the basic issues prevalent in the modern world such as data privacy and transaction security. It can be used to store sensitive information in fields like money transfer, data sharing, creation of digital identity, digital voting, medical record keeping, and essentially all fields in which data privacy is a major concern.

In the speech, there were also mentions of formulating a Digital Currency using blockchain technology which will be issued by the RBI in the upcoming financial year. In the words of Dr Sitharaman, “Introduction of digital rupee using blockchain technology will help in reducing financial and physical efforts required for money management,”

By introducing the digital rupee, the government will create a new channel of digital payment, which will help India in moving closer towards the vision of a cashless economy. Moreover, as all transactions will have electronic entries, disputes related to transfers will be reduced.

INFRASTRUCTURE

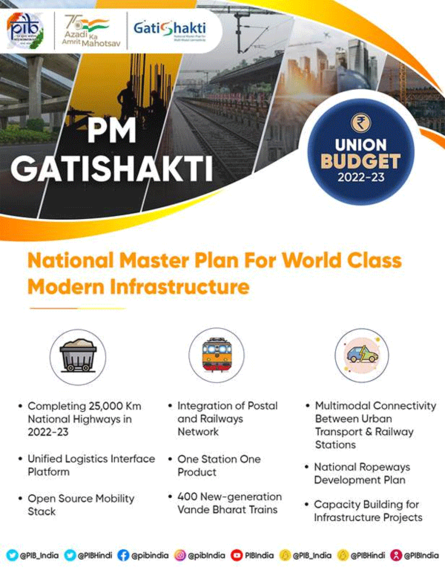

Ever since Independence, our country’s investment in infrastructure has been poor and inadequate. As a result, average logistics account for 14% of the GDP in India, as compared to 8-9% of any other advanced economy. To give much-needed legs to infrastructure, the government announced a hike of 35.4% in capital expenditure.

The Gati Shakti initiative occupied the spotlight in the budget, focusing on multi-modal transport and achieving international cost competitiveness. With an allocation of ₹20,000 crores, the government has set an ambitious plan to extend the National Highways by 25,000 kilometres along with 400 new Vande Bharat trains and 100 cargo terminals.

However, such projects have been launched in the past too but to no avail. Shockingly, there are more than 9300 pending projects in India! Execution remains a major challenge for the government as the level of bureaucracy and red-tapism has always been a concern with businesses. Despite popular campaigns such as ‘Make in India’ and ‘Aatmnirbhar Bharat’, India has always ranked poorly in the ‘Ease of Doing business’ Index, so it will be interesting to see what the government does differently this time.

To develop infrastructure for Electric Vehicles and increase their use, the government has introduced a Battery- Swap Policy which is expected to give a big push to the EV industry. This is expected to speed up the process of developing a battery swapping network throughout the nation and reduce India’s carbon footprint on the world.

Additionally, the states will also be able to draw up to ₹1 lakh crore for capital investment, thereby increasing the role of state governments in infrastructure development. “Higher capital spending by central and state governments will ‘crowd in’ private investments,” said the Finance minister.

But all is not well with this proposal. There has always been a dispute between the Center and States over the distribution of funds. There are huge delays by the Union Government in disbursing funds to the states, so the question as to how a harmonious relation be achieved in the sharing of Capital Investment Funds still remains unsolved.

MSMEs

MSMEs act as the backbone of the Indian economic system. Currently, there are 63.4 million MSMEs in India which constitute around 29% of India’s GDP and 49% of exports. They also create numerous job opportunities as the work they provide is labour-intensive.

To increase connectivity in rural areas and to promote small farmers and businesses, the government plans to integrate postal and railway networks along with smooth logistical services. However, transportation is not the only concern for them. Availability of cheap credit, storage facilities, modern technology and bargaining power still remains a major challenge. Even though the Emergency Credit Line Guarantee Scheme (ECLGS) has been implemented for them, it is rather doubtful that funds will reach the people on ground zero. They also face strong competition from big FMCG companies which are quickly entering the rural areas to expand their market shares.

The growth of MSMEs is crucial for the sustainable growth of the economy. As foreign corporations enter India, there is an urgent need to improve the competitiveness of MSMEs which will facilitate them to become a part of the global supply chain.

It will be a challenge for the government to protect local businesses from the cunning business strategies of corporates. And the question of whether MSMEs will ever be able to grow enough to utilize new and huge infrastructure projects or if they’ll only ease out logistical problems for corporates still remains.

EDUCATION

The Union Budget allocated for education is ₹1.04 lakh crores which is an increase of around ₹11,000 crores from the previous allocation.

People from the underprivileged section have been deprived of two years of formal education due to the pandemic, as they don’t have the means to shift to online platforms due to a lack of resources.

The programme of PM E-vidya is now to be expanded across 200 TV channels. Dr Sitharaman in her speech said, “We recognise the need to impart supplementary teaching and to build a resilient mechanism for education delivery.” The government also plans to promote virtual labs and skilling e-labs to promote critical thinking skills and a simulated learning environment. Moreover, it also plans to develop high-quality e-content for delivery through digital teachers. A Digital University is also to be set up in order to impart world-class quality universal education with a personalized learning experience.

However, before taking steps towards the digitalisation of education, we must check whether or not we have the infrastructure required to facilitate the same. It has been seen during the time of the pandemic that most educational institutions had to make the transition to the online mode. This has created visible disparities among different economic classes.

We must also have a check on whether online education is efficient enough to replace the traditional modes of learning. The primary focus at the current stage should be to increase the outreach of education in rural areas and increase the quality of education in government schools.

HEALTH

India has always lacked in its health infrastructure, and this was evidently seen during the Covid-19 pandemic in the shortage of hospital beds, oxygen cylinders and many such pieces of equipment.

Even after the first wave of the covid-19 pandemic, we failed to improve our health infrastructure or increase the reach of medical facilities in rural areas. As a result, the second wave wreaked havoc throughout the country. However, India’s vaccination phase has been impressive with more than 1.6 billion doses administered till February 2022.

The allocation to the health sector has been hiked up by 16% but the expenditure on public health has been cut down by Rs 33,809 crore citing “lower requirement of vaccination”. However, vaccination is not the only area that needs improvement. Local dispensaries, Primary Health Centers (PHCs), Community Health Centers (CHCs), sub-centres, hospitals with X-ray facilities, blood testing, and ECGs also require attention.

There is also a need for more medical professionals to serve the population. The growth rate of India’s private health infrastructure has been impressive, which shows that India has the potential to develop sound health infrastructure throughout the country, but it will need greater commitment from the government’s side.

DIRECT TAX REFORMS

According to the new budget, assessees will now have two years to file an updated return for the income missed out to be declared in the previous returns on the payment of additional tax and the penalty on the same. This will open a window for the taxpayers to rectify their mistakes on their own.

Cooperative societies

Minimum alternate tax (MAT) has been brought down from 18.5% to 15% and the has also been reduced from 12% to 7% for those cooperatives whose aggregate total income is more than Rs. 1 crore and up to Rs. 10 crores. This will lead to an increase in the in-hand cash for cooperatives which can be further channelised towards their main objectives and goals.

The period for incorporation for eligible start-ups & Incentives under the concessional tax regime under section 115 BAB has been given a year’s worth of extension. The motive of the government behind this step is to provide a boost to the Start-up culture in India.

Start-ups can help India in addressing various problems at the grass-root level. There has been a tremendous increase in the number of Unicorns from 8 in 2018 to an aggregate of 85 in February 2022 with a projected increase of further 45 start-ups in the next 12-18 months.

Rationalization of Surcharge

Surcharge on AOPs has now been capped at the level of 15%. Surcharge for the Long term capital gains (LTCG) under section 112 has also been capped at 15%, earlier it could go up to the level of 37%. This will account for significant tax savings for high net income individuals, having a total income of more than 2 crores.

Moreover, this will also help the start-up community as it will amount to relaxation in the capital gain taxes.

No Changes in Tax Slab and Tax Rates

Budget 2022 gives a skip to the middle class. There were various speculations prior to the release of the budget regarding the limit of deductions under section 80c which were expected to see a hike. However, they have been left untouched and are still standing at the level of Rs.1.5 lakhs.

During a press interview answering the question on the reduction in Income Tax, Dr Sitharaman said “we have not increased the taxes neither in a previous year nor this year”. This can be seen as an indication that in upcoming years we may witness a hike in Income Taxes.

INDIRECT TAXES

There has been a significant increase in GST collection. January 2022 recorded the peak at a level of Rs. 1.41 Lakh crores. Reforms brought in GST rules such as Adhar based GST registration. The introduction of GSTR-2B shows the entire input tax credit that one is eligible for, making the process simpler. Integration of Income-tax data with that of GST & Customs acts as a check on fake invoicing & shell companies. Moreover, the introduction of E-Invoicing has contributed to the increase in GST collection.

Customs National Portal

Custom Administration of SEZs is now to be fully IT-driven. This will make the administration process more efficient. Custom duty rates will now be calibrated on the import of wearable devices, hearable devices and electronic smart meters, in order to promote the manufacturing of these products indigenously.

Duty concession has been provided to parts of chargers and camera lenses in order to facilitate growth in domestic manufacturing. Duty on diamonds and gemstones is being reduced to the level of 5%. This will help in reducing the cost of precious jewellery that is manufactured in India.

In order to promote the use of blending fuel, unblended fuel will see an increase of Rs. 2 per litre in excise duty from 1 October 2022 and this promotion of blended fuel over unblended fuel will have various environmental as well as economic benefits.

DEFENCE

There has been a significant hike in the defence budget for FY 22-23 i.e. ₹5,25,166 crore, which is a 9% hike from the previous allocation. The 68% of capital expenditure on the procurement of indigenous weapons and 25% of the R&D budget has been reserved for the private sector.

This move will encourage the private sector to participate in the design and development of military equipment with the DRDO and other organizations under the SPV model. This has been seen as a step in the direction of India in becoming aatamnirbhar in the defence sector by decreasing dependence on foreign nations for defence procurements.

Under the ‘Make in India’ campaign, India has put more emphasis on the indigenous development of defence equipment. Foreign procurement as a percentage of total capital acquisition has gone down from 48.68% in 2018-19 to the present level of 39.44% until December 2021. Significant projects include the 155mm artillery gun system: Dhanus; the LCA Tejas; Akash Missile system; submarines of INS class Kalvari and Khanderi; destroyer INS Chennai; and the anti-submarine warfare corvette INS Kavaratti.

Several projects that are in the pipeline may give India a significant boost in defence. These include the LCA Tejas M2, a 5th generation fighter jet AMCA, DRDO Ghatak and many more which will strengthen the warfare capabilities of India in the near future.

MISCELLANEOUS

The 5G spectrum auction will be conducted in 2022 to improve connectivity and optic fibres will be used to connect villages as it is more accessible and affordable. E-Passports with embedded chips and futuristic technology are also to be issued by the government. Unique Land parcel Identification Numbers for IT-based management of land records will help in reducing disputes arising from the claims of ownership of landholding by getting the data in the IT-driven method.

This is an important step in India’s transition towards a digital economy. An animation, visual effects, gaming, and comic (AVCG) promotion task force will also be set up in order to realize the potential of the gaming sector. Officials from Deloitte India said that the move could possibly create up to 20 lakh jobs in the sector.

However, according to reports from the US Federal Aviation Administration, the 5G network interferes with aircrafts’ radio altimeters which could prevent them from stopping on the runway. This has also led to the cancellation of Air India flights such as Delhi- JFK, Delhi- San Francisco and many more. These problems will have to be resolved before a uniform 5G network mechanism can be successfully launched in the country.

Within the Pradhan Mantri Awas Yojana, 48,000 crores have been allocated to the completion of more than 80 lakhs worth of housing projects in 2022-23. This will provide affordable housing to beneficiaries from economically weak & middle-class backgrounds in urban areas.

1.5 lakh post offices are to be brought under the core banking system. Scheduled Commercial Banks are to set up 75 DBUs covering over 75 districts. This move will promote rural banking which in turn will allow small businesses to grow easily.

INDIA ON ITS WAY TO BECOMING A $5 TRILLION ECONOMY

In 2019, India had set an ambitious target to become a $5 trillion economy by 2024 and hence, firmly establish itself in the international community. Before we pass our final verdict, let us first take a look at all the major economic events that have taken place in the last 5 years.

In 2016, the government’s move in Demonetising 97% of the currency brought the economy to a virtual standstill and crippled the rural economy. The implementation of GST failed to reduce the rate of inflation and even increased the prices of certain everyday commodities. This was followed by the pandemic, and the economy has been struggling since then.

On the contrary, the digital payments sector has boomed during this period and is all set to achieve unprecedented growth in the years to follow. The forex reserves are at an all-time high due to record FDI. With low per capita income and high inflation rates, the common man has to face the brunt of the recession, but the announcement of the Gati Shakti program has revived hopes of the implementation of world-class infrastructure and the availability of fresh jobs in the market.

During the pandemic, the startup sector has grown exponentially and is expected to drive huge growth in the future. By allocating huge amounts towards capital expenditure the government has raised the fiscal deficit to 6.9%, thereby also increasing the country’s debt to GDP ratio. However, this is a gamble which the government is ready to make for high growth in the future.

In order to achieve and sustain such an ambitious target, one must be ready to exploit the upcoming futuristic technologies and develop strong exports. Getting our economy to $5 trillion is not enough. We should also make sure that the real benefits of this reach across every class of society. The creation of jobs in the formal sector will be a tough task because as of now the percentage of formal employment to total employment is very low. And although we are on the track to growth we must not exploit our resources unsustainably.

There are various opportunities available to India. As of now, major MNCs are looking at India as a successful manufacturing hub. The setting up of manufacturing factories brings in job opportunities and increases the collection of Corporate Tax.

India’s automobile sector is also capable of doing wonders in the future, but the current chip crisis is acting as a blockade. Rather than seeing this as an issue, India has seen it as an opportunity to develop chip manufacturing domestically, for which the government has also rolled out a $10 billion incentive scheme. In order to sustain our economic growth, different sectors such as Chemical, Pharma, Engineering goods, Electronic goods, the IT sector and all other major export-oriented sectors will have to do exceptionally well.

CONCLUSION

To achieve the target of a $5 trillion economy by 2025-26, India needs a double-digit growth rate. However, its growth rate had fallen to 4.2 per cent even before the pandemic began. The pandemic has disrupted every sphere of business but the corporate sector has bravely held its position. The reforms introduced in the budget will definitely strengthen the economy but for any reform to be successful in India, it requires cooperation between the states and the central government, which have not been doing so well of late. The central government will have to go out of its way to achieve a harmonious working relationship with the states, and this is imperative to the overall good of the Indian economy.

SOURCES:

https://prsindia.org/budgets/parliament/union-budget-2021-22-analysis

https://www.moneycontrol.com/budget-2021/

https://www.moneycontrol.com/bud

Tarun Jindal

Member