In this week’s newsletter, we talk about Bengaluru’s water crisis, the reason behind gold’s rising prices, KitKat and a lot more.

If you’d like to receive our 3-min daily newsletter that breaks down the world of business & finance in plain English – click here.

Why is Bengaluru facing a water crisis?

“Keregalam Kattu, Marangalam Nedu”

Confused?

It simply means “Build lakes, plant trees”.And legend has it that was the advice given to the founder of Bengaluru Kempegowda by his mother in the 1500s.

Now it wasn’t an idea she came up with out of the blue. You see, Bengaluru’s landscape had already been through a transition from the 6th century. Back then, it was dry, arid and filled with thorny trees. But rulers at the time decided they would change the terrain. Mould it from a semi-arid landscape to fertile land. They built tanks and streams to trap rainwater and help local communities thrive.

So by the time Kempegowda came to power and laid the foundation for what would become Bengaluru as we know it today, the landscape was already teeming with water bodies. His mother simply advised him to double down on his predecessors’ achievements. So he built at least 100 lakes.

And there was a simple reason to explain this obsession with lakes — Bengaluru did not have a perennial source of water. There wasn’t a river that flowed through the city. Not even the Kaveri which traversed the states of Karnataka and Tamil Nadu but avoided Bengaluru. So the city needed man-made lakes and tanks. And they were built in such a way that when one lake overflowed, it would feed into another lake. Many lakes were interconnected, and this ensured the constant availability of water too.

But that was all a long time ago. Today, Bengaluru’s waterbodies have all but disappeared in the city’s core area — from 1,452 in the 1800s to just 193 waterbodies today.

How did they all disappear, you ask?

Well, it all began with the British.

These colonial rulers set up their military base in the city in 1809. And soon realised that they loved the place. The weather was good, and they felt that it could be the capital of southern India. And when the British came in, they needed more water. The tanks that had been built weren’t enough anymore. And as the population grew, the British decided to set up piped networks to fetch water from places afar. Since water was abundant now, the man-made lakes began to give way to human settlements.

After independence, this apathy towards lakes continued because piped water from the Kaveri River was a given.

So real estate developers lapped them up to build housing and office spaces.

Want an example?

Well, if you’ve ever taken a bus into Bengaluru or away from it, there’s a high chance you boarded it at the Kempegowda Bus Terminus (or what was known as Majestic Bus Stand). It’s bang in the middle of the city. And guess what… till the 1950s, it was actually a big water tank or man-made lake called Dharmambudhi!

It’s crazy to think about it.

But therein lies the rub of today’s problem too.

For starters, some estimates say that Bengaluru needs over 2,600 million litres per day (MLD) of freshwater. And 50% of that comes from the Kaveri River. So when the region experiences a poor monsoon, as it did in 2023, the dams and reservoirs built along its tributaries fall short of their usual inflow. And that has a knock-on effect on Bengaluru.

The other part of the problem is groundwater exploitation.

We’re a trigger-happy nation when it comes to drilling borewells for water. You know, where we drill holes that are often over 1,000 feet into the surface of the earth. We extract water from these deep rock layers known as aquifers. And Bengaluru alone has nearly 14,000 borewells dotted across the city.

The reason for the proliferation of borewells is simple too — the city’s population growth. In the past decade, it’s estimated to have shot up from 10 million people to 16 million at least. And since the city needs water to meet the needs of the burgeoning population, everyone turns to borewells.

But remember that the aquifers deep in the earth have been formed over decades and centuries. And it can only be replenished when we allow water to seep through the soil. But if you look around Bengaluru, you’ll only see a concrete jungle. And nearly 90% of the city is paved surfaces. That means we have a jungle whose land cannot absorb the water anymore.

So even if Bengaluru has a year or two of bountiful rains, it doesn’t move the needle.

So is it really a surprise that 50% of the current borewells have dried up? There is no water left underground because we’re extracting the water faster than it can be replenished.

Anyway, there’s only one question that remains — how on earth can Bengaluru fix this problem?

Well, it’s hard. But maybe we could start making a dent on this massive problem by looking at lakes!

See, Madhulika Choudhary, a ‘lake’ activist who revived the Neknampur lake in Hyderabad points out a problem in how Bengaluru attempts to revive lakes. As she told The Week,

“They [Bengaluru] follow a model in which they drain out the lake and then wait for it to get filled through surface run-offs. In my opinion that is not successful. In Hyderabad, we use a different model: we try and fill the lakes/ponds with water that is free of industrial pollution. The water, even domestic sewage, gets purified in the water bodies through processes like phytoremediation. What this does is that it recharges groundwater round the year and not just when the lake is filled through rain or surface run-offs, which no one can predict or be sure of.”

For instance, her NGO set up a ‘floating island’ in the lake in Hyderabad. Think of it as a plank topped off with soil and plants with thermocol and bottles at the base that enable flotation. These plants will help absorb the high nitrogen and phosphorous in the sewage water that’s directed into the lake. It works as a natural purifier. That’s phytoremediation.

And it looks like the folks in Bengaluru heard this too. The authorities have now decided to direct 1,300 MLD of treated water into the lakes. They’re hoping that this will replenish groundwater sources.

But of course, this won’t change the situation overnight. And with the monsoon still at least 100 days away, Bengaluru will have to keep its fingers crossed for an immediate solution.

Gold Rush

…gold is a lot like religion. No one can prove that God exists…or that God doesn’t exist. The believer can’t convince the atheist, and the atheist can’t convince the believer. It’s incredibly simple: either you believe in God or you don’t. Well, that’s exactly the way I think it is with gold. Either you’re a believer or you’re not.

We’re not saying that. That’s legendary investor Howard Marks’ take on the most polarising asset class in the world.

The reason why there are extreme opinions about gold is that, as an asset, it doesn’t generate any cash flow. Unlike a company which sells stuff and earns revenue, gold doesn’t have that feature. Or consider a bond. If you buy a bond issued by a company, you can at least earn an interest. You can’t say the same thing about gold.

Simply put, gold doesn’t have any intrinsic value. That’s why a lot of investors don’t touch it with a barge pole.

The only real value is because of sentiment.

The ‘gold bugs’ who buy it impute some magical powers to it. They say that central banks are playing fast and loose with paper money, so you need a physical asset for protection. There’s the argument that when there’s turmoil in the world, gold is a saviour that people rush towards. And also, gold is finite. It doesn’t have an endless supply. So you could accord some value to its scarcity.

And right now, the ‘believers’ are winning. Gold prices have hit all-time highs. In India, it has breached ₹66,000 for 10 grams.

So, we have to wonder why gold is on a massive bull rally right now. And we have to try and break it down a bit.

Is it global instability or a geopolitical crisis?

Well, there is definitely plenty of conflict in the world. The invasion of Ukraine doesn’t seem to have an ending, and this has hurt food supplies. Israel is still engaged in a war against Hamas in Palestine which affected shipments through the Red Sea. And there’s a worry of an armed conflict between two of the world’s big powers — India and China.

So yeah, you can see why gold would be attractive in such a situation.

But there could be a deeper issue at play here.

Remember how the Western world imposed all kinds of sanctions on Russia after it invaded Ukraine?

And one thing they did was also freeze Russia’s foreign reserves. The country had parked money in bonds and other assets in the West. And then found that it couldn’t access any of it due to the whims of the West.

Suddenly, other countries woke up to the fact that this could happen to them too if they ended up on the wrong side of the Western countries. And maybe that triggered them. But many emerging market central banks suddenly rushed to stock up on gold to park their currencies — they bought over 1,000 tonnes of gold in both 2022 and 2023. And you can be sure that trend is continuing even today.

Okay, what about inflation?

Typically, people say that gold is a hedge against inflation. But today, it’s cooling inflation that could be making the case for gold.

Confused?

See, the thing with gold is that it doesn’t offer any yield. There’s no interest paid out. So when a central bank like the US Fed keeps interest rates high, people prefer to buy things like a US government bond. It’s a more attractive proposition.

And since the US was battling high inflation ever since the pandemic, the US Fed also kept interest rates higher than it had been in the past decade.

So people rushed to buy bonds and gold took a backseat. And that inflationary hedge argument kind of broke down a bit.

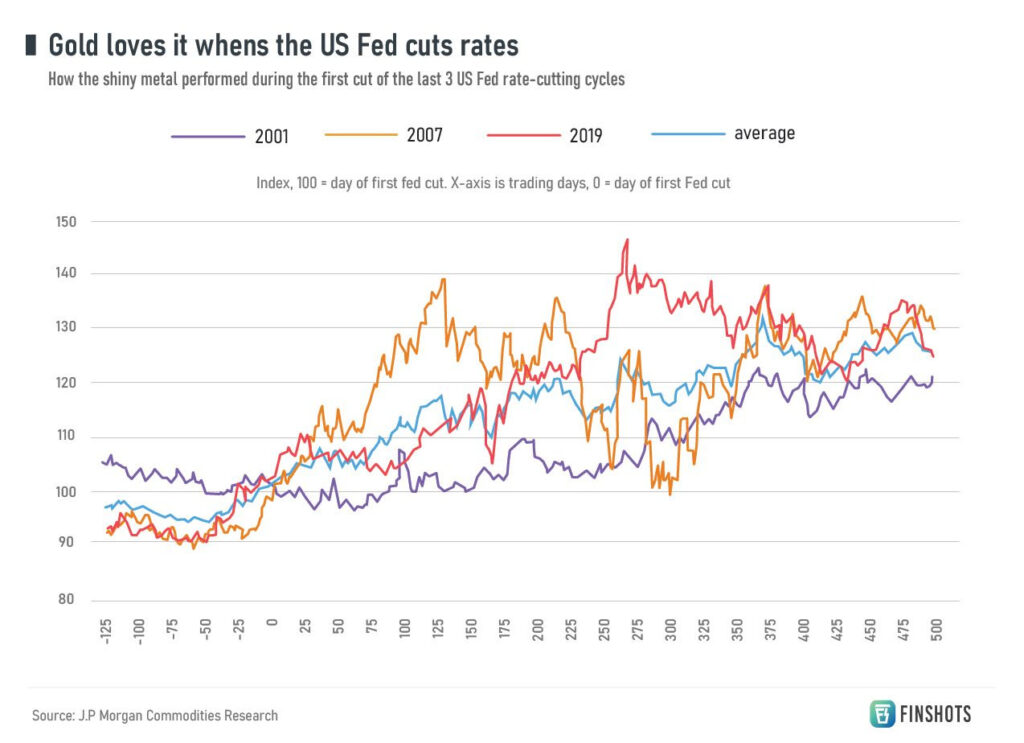

But imagine this in reverse now. Imagine the US Fed starts cutting interest rates.

Gold wouldn’t suddenly seem so bad, would it? Investors won’t lose out on much ‘yield’. And it makes sense, especially considering the geopolitical mayhem in the world.

And that’s what is on the cards for gold today. The US economy isn’t battling high inflation anymore and the economy isn’t growing at a scorching pace either. There are worries about a slowdown leading to a recession. And since Jerome Powell, the man in charge of the US Fed, has pretty much said they’re “not far from” cutting interest rates, you can see that there’s some anticipation building up around gold.

Because as per a Morgan Stanley report, gold is quite sensitive to changes in interest rates. Over the past 25 years, the price of gold has jumped by 10% for every 1% fall in the inflation-adjusted interest rates of the US 10-year government bond.

So yeah, you can see why investors seem quite excited to buy the metal today.

Will it work out the way the gold bugs are hoping for? Or will inflation rear up again and spook the US Fed and gold as a result?

We’ll have to wait and see.

A quick side note

If you’re someone who has great communication skills and are looking to join a dynamic team, Ditto is recruiting new Insurance Advisors. You don’t even have to know much about Insurance – We will train you from scratch and you can enjoy working remotely with a great team. Click here to apply.

Today’s Discussion  : Japan’s Love Affair with KitKat

: Japan’s Love Affair with KitKat

Japanese people are head over heels for KitKat bars in a way that’s more than just loving a tasty snack – it’s a whole cultural thing.

But how did this happen?

You see, it all started back in the late 1990s when Nestlé came up with a genius marketing move.

They noticed that KitKat in Japan is pronounced as Kitto Kaato which sounds similar to the famous saying Kitto Katsu in Japanese meaning – “You will surely win.”

So they started pitching KitKat as a lucky charm for students facing exams and this is how the obsession for KitKat was ignited!

But what sets Japan apart is the mind-blowing variety of KitKat flavours you can find there.

Forget plain old milk chocolate – in Japan, they’re rocking flavours like green tea, sake, and even wasabi!

And it’s not just about the flavours – it’s also about where you can find them.

Different regions in Japan have their own special KitKat flavours, celebrating local goodies like Hiroshima’s lemons or Hokkaido’s melons.

Plus, they roll out special editions for different seasons and holidays, like cherry blossom KitKats for spring and pumpkin pudding ones for autumn. It’s like a whole culinary journey packed into a little chocolate bar!

But it doesn’t end here!

The gift-giving culture in Japan is huge. KitKat has become a go-to souvenir for travellers, with gift boxes full of assorted flavours flying off the shelves during holidays and special occasions.

It’s the perfect way to share a taste of Japan with your friends and family back home.

So if you ever find yourself in Japan, grab yourself a KitKat or two – you won’t regret it!

Money tips  :Your friends can become your personal finance foes!

:Your friends can become your personal finance foes!

Wait… what?

A couple of years ago, my friend asked me for help. Her tax filer had claimed wrong income tax deductions to get back the taxes her employer had deducted from her pay in the form of TDS. And in the process, she ended up sharing her income tax return with me.

I couldn’t help but get into a comparison trap. Simply put, she was earning much more than I was at the time despite having the same educational qualifications. That gave me immense FOMO (fear of missing out).

Oftentimes we get into similar traps because situations can make it look like the grass is greener on the other side. And impulsively, we try to spend more to show people that we’re living as lavishly as they are. Or maybe even lie about how stable we are with our finances.

But here’s the thing. Getting into the comparison trap can only erode your savings and affect your mental health involuntarily. And that means that you deprive yourself the opportunity to live a better financial life in the future.

So, what do you do to remain unaffected?

Okay, let’s be honest. Maybe you can’t be completely unaffected. But here are 3 things you can do:

1/ Try to upskill in your field of work that could help you climb the pay or career ladder.

2/ Set aside a slightly higher portion of your income as savings, so you can rely on it in the future.

3/ And the most important thing, don’t forget to factor in the difference between the work experience that you and your friend have or even the industry in which you both operate. Some jobs pay differently, but that doesn’t mean what you’re doing is contributing any less. Learn to appreciate what you do.

And maybe that will help you push away the FOMO associated with the comparison trap? I really hope so.

And that’s all for today folks! If you learned something new, make sure to subscribe to Finshots for more such insights 🙂

Finshots is now on WhatsApp Channels. Click here to follow us and get your daily financial fix in just 3 minutes.

Finshots is now on WhatsApp Channels. Click here to follow us and get your daily financial fix in just 3 minutes.