In this week’s newsletter, we discuss the RBI’s strategy to defend the rupee, ₹1 flight tickets, money tips, and a lot more.

If you’d like to receive our 3-min daily newsletter that breaks down the world of business & finance in plain English – click here. Or, download the Finshots app here.

P.S We are on the lookout for talented Graphic Design, Content Writing and influencer Marketing interns to join our Marketing team. If you wanna be a part of an exciting startup, then this might be the right opportunity for you.

Think you have what it takes? Then email us at intern@finception.in 🙂

Is the RBI defending the Rupee?

The Indian rupee is near record lows!

And the RBI has launched an offensive. The word on the street is that the central bank is trying its best to not let the rupee fall beyond ₹83 per dollar.

But before we get into how the RBI is defending the rupee, there’s something you should know. Over the past two months, the rupee actually has been pretty stable against the rest of the world currencies. In fact, India Data Hub says that if we measure the rupee against a basket of six other major currencies, we’ve actually gained by 1%.

That means it’s not really a case of the rupee weakening, but, it’s about the dollar strengthening.

But why is that happening, you ask?

Well, right now, everyone’s laying the blame on the price of oil which is inching upward.

Look at it from an Indian perspective. Since we import a lot of oil, importers have been clamouring for more dollars to make payments. And the demand for dollars is greater than the demand for rupees. And you can imagine that most of the world will be running through a similar exercise. Because almost every oil trade is settled in dollars. So yeah, there’s bound to be quite a bit of demand for the greenback. And it becomes stronger in the process.

But you can bet that the RBI doesn’t want the rupee to plummet. Because — inflation!

You see, as a country, we’re net importers. If the rupee falls in value, we now have to shell out more money to buy the same stuff. And this higher cost is eventually passed on to consumers like us. In fact, as per the RBI, almost every 5% fall in the Indian rupee increases inflation by 0.15%. And the RBI most certainly can’t let that happen! Inflation is already high and we can’t “import” any more inflation.

So, how does the RBI go about defending the rupee, you ask?

Well, it’s quite complicated and involves a lot of esoteric terms and techniques. So we’ll try and simplify it as much as we can. Now one thing you have to remember is that the RBI doesn’t always intervene directly. It typically uses public sector banks to do the deed. And when such banking activity increases, everyone knows that the RBI has a hand in it.

So there are primarily 3 ways in which the RBI intervenes.

There’s the spot market.

Think of this as the everyday market where buy and sell orders for currency are met. If the RBI thinks there’s not enough demand in the market for the rupee, it steps in — it offloads dollars from its reserves and buys the rupee. There’s a ‘delivery’ or an actual exchange of currency that takes place. So when the RBI buys the rupees, it reduces the available supply from the market as well. This is the most straightforward approach to shoring up the rupee value.

Then there’s something called the offshore Non-Deliverable Forward (NDF) market

Yes, the name sounds complicated. But let’s say you’re a US-based business person with interests in India. You deal with the Rupee and you repatriate your earnings back to your home base. But you fear that the currency will drop in value. You worry that you’ll have to convert more rupees to get 1 dollar in the future. And you want to hedge that risk.

So you find a counterparty. You say, “The current rate is 83 rupees to the dollar. At the end of the month, if the spot or daily market reveals that it has fallen to 85 rupees to a dollar, then you have to pay me the difference in dollars.” You shake hands and the deal’s done.

On the face of it, it sounds like a regular Forward contract, right?

But there’s a difference. See, in a forward contract, a ‘delivery’ would occur at the end of the month. Consider the same situation. In this case, irrespective of the rupee-dollar exchange rate in the future, you would give the counterparty ₹83 and get $1 in return. That’s what you agreed upon. But in the case of the NDF, there’s no delivery of the rupee needed at all. It’s just the difference between the agreed upon NDF rate and the prevailing rate that gets settled in dollars.

That means the demand for US dollars increases if people start betting against the rupee.

Now this is just a very crude example of how the NDF market works. In reality, the price or quotes are affected by lots of things. There’s the fee or cost of entering into such a deal. Maybe interest rate differences. Or maybe the number of trades or liquidity for that currency.

Anyway, if the RBI feels that there’s some threat to the rupee’s value, it’ll place the opposite bet and supply dollars in the offshore NDF market.

There’s the futures market

Now this is pretty much the same as a ‘forward’ contract we just spoke about. The difference is that this is traded on the exchange in India. That means they aren’t custom contracts. They’re standardized deals. So they operate on some predetermined parameters — such as which currency pairs (INR/USD, INR/EUR) can be traded. Or what’s the minimum value of a trade. Or in what multiples of value a trade can be placed. Even a small payment or margin to be deposited upfront.

So if people think that the rupee is heading down, they’ll begin speculating. They’ll bet that the rupee will fall from 83 to 85. Now if more people place similar bets, it becomes a self-fulfilling prophecy. Everyone starts to believe it’s true. And that might feed into prices in reality. People will buy dollars instead of the rupee for their daily affairs too.

And to prevent that sort of volatility, the RBI comes in and starts nudging bets in favour of the rupee. It just wants to make its presence felt. Let people know it’s there to intervene. And sometime in 2015, the RBI became one of the few central banks in the world to officially announce they were dipping their toes in the futures market too.

So yeah, at the end of the day, whether it’s the spot, futures, or NDF market, the mainstay of the defence strategy is the same — sell dollars, buy rupees. And everyone believes the RBI is doing that now.

But wait…does that mean that our forex reserves are dwindling?

Not exactly.

Only intervening in the spot market* calls for an immediate need for dollars. The forwards and futures markets are settled at a future later. So the dollars requirement happens on a later date. And maybe the RBI has chosen to concentrate less on the spot market and that’s why the forex reserves haven’t really dipped in the past couple of months.

But yeah, if the pressure on the rupee continues, we might see that change quickly too. Keep an eye on the RBI reserves report and you’ll get an inkling of what’s happening.

*The RBI can delay dollar delivery in the spot market too by getting into something called a swap agreement wherein it promises to settle the deal at a future date. But we won’t get into it now.

Today’s Discussion : Flight tickets at ₹1?!?

: Flight tickets at ₹1?!?

Yup, it’s true.

The story starts in 2003 when the aviation industry was dominated by two state owned airlines, Air India and Indian Airlines and flying was only for those with deep pockets.

That’s when Air Deccan stepped foot in the market to make the common man’s dream to fly a reality. But how?

Well, the name of its game was: AFFORDABILITY and ACCESSIBILITY

You see, it operated on something called the “NO FRILLS; LOW COST” mode— which meant the company would cut costs by not offering any extra benefits

For context, a flight ticket that would typically cost between ₹1200-₹1500, would only cost ₹500 if you flew Air Deccan — that’s even cheaper than a railway ticket!

And in 2005, it decided to up the ante even further and offered tickets for just ₹1 at a first come first serve basis.

It was a bold move all right.

But why? Wouldn’t the company make heavy losses?

Well, Air Deccan believed selling at heavy losses was worth it as long as they were able to capture a big chunk of the market!

And luckily for them, the campaign was a roaring success— they were able to capture 19% of the market in just 3 years!!

Soon, other airlines were forced to bring down prices in order to compete with them. And while they did that, Air Deccan focused on expanding its routes to smaller cities that weren’t served by the major players!

This made it the pioneer of affordable and accessible aviation as we see it today.

But this success story was short-lived as new players began to replicate Deccan’s business model at even lower price points. And with the merger of Air India and Indian Airlines in 2007 and the subsequent financial crisis of 2008, the management just couldn’t keep up.

The airline was eventually sold to Kingfisher; only to be shut down in 2012 as Kingfisher went under.

Yet their story remains one of great importance to the transformation of an industry once considered to belong to only the rich.

What do you think?

Money Tips  : It’s okay to be shameless with your money

: It’s okay to be shameless with your money

Imagine you’re dining at a fancy restaurant with your buddies on a weekend. When it’s time to pay the bill, most of your friends take out their phones or cards to pay. But you just volunteer to pay with the intention of recovering everyone’s share from them later.

Often we shy away from making it clear at the table that you paying up doesn’t mean that dinner’s on you. And a lot of your friends might misunderstand this as “Hey, you don’t have to be formal. It’s okay if you don’t pay me.”

Now, even if most of them send across their share later there’s always one or two friends who forget. But does that mean that you hesitate to recoup your money?

Not really. I know it may sound rude on the face of it. But think of it this way. You may have neatly drawn up a monthly budget and this dinner may have weighed it down. So unless all your friends sincerely split the bill, it could be hard for you to get through the rest of the month.

That’s why it’s always wise to keep money and relationships in their own separate spaces. It’s okay to be clear about your bill splitting intentions or even send a “Split the bill” request on a common payment app that all of you use.

After all, budgeting isn’t just about you alone. External factors could shake it up and it’s always important to learn how to shamelessly take control.

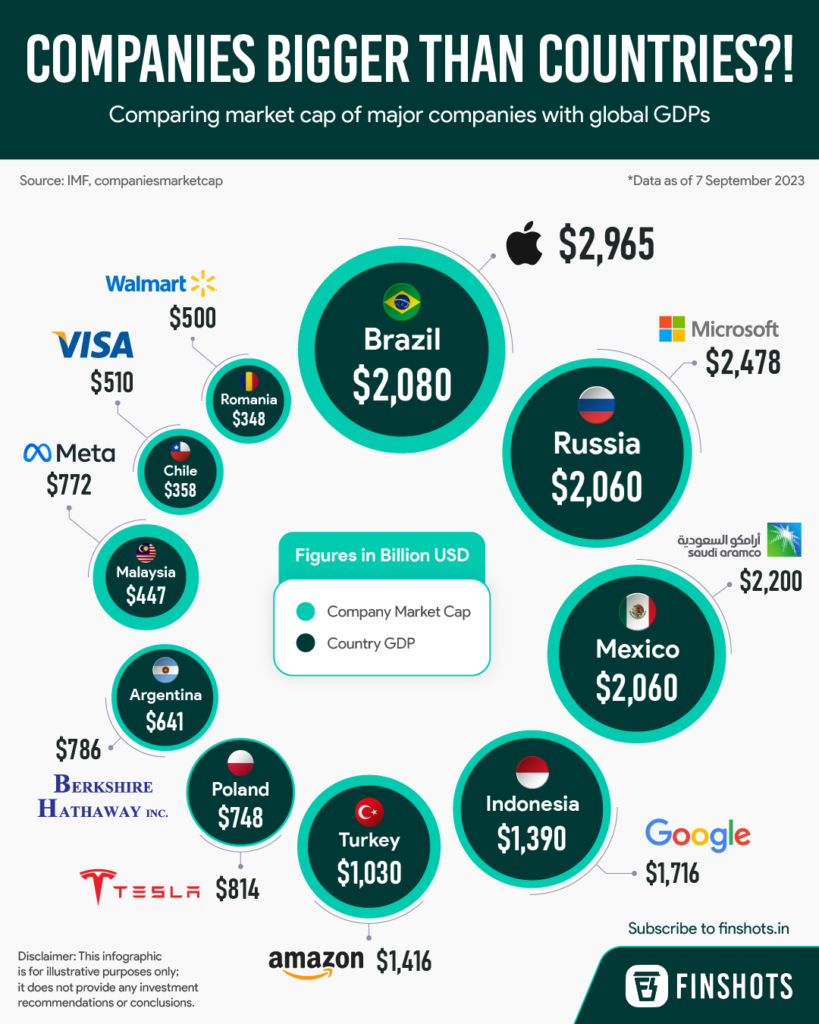

Infographic of the week!

College Weekly Exclusive Referral

3 benefits of introducing your friends to Finshots:

- They get access to insightful, easy to understand and trending financial and business news updates

- You get their appreciation & gratitude (or so we hope

)

) - You stand a chance to win the EXCLUSIVE Finshots Merchandise Kit!!!!

Yup. That’s right!

Introducing The Finshots ‘Refer & Win’ Program.

Now sharing = caring = WINNING!!

All you need to do is fill out a quick form, copy a unique referral link and share it with your inner circle. And just like that you could be the proud owner of our new & exciting merchandise.

So, what are you waiting for? Get sharing now. Link here.

And that’s all for today folks! If you learned something new, make sure to subscribe to Finshots for more such insights 🙂