A. Business Segments and Introduction

Dlf ltd. (nse: dlf) is the country’s largest real estate development company in terms of market capitalisation with a valuation of 90,348.57 cr. Along with its subsidiaries, associates and jvs, it is engaged in real estate development, leasing, power generation, maintenance services, hospitality and recreational service and has been excelling in this sector for over 75 years. It has an outstanding track record with 150+ estate projects covering over 300+ million sq. Ft. The total balance sheet size of the developer on a standalone basis stood at Rs. 37,136 cr as on march 2022 and made a net profit of Rs 1,335 cr that year. It has a presence in 22 cities located in 14 states and union territories across India.

Dlf offers the following in:

- Residential

- Super luxury homes

- Luxury homes

- Premium

- Offices

- Corporate parks

- Commercial complexes

- Malls

- Shops in office complexes

- Retail

- Retail spaces

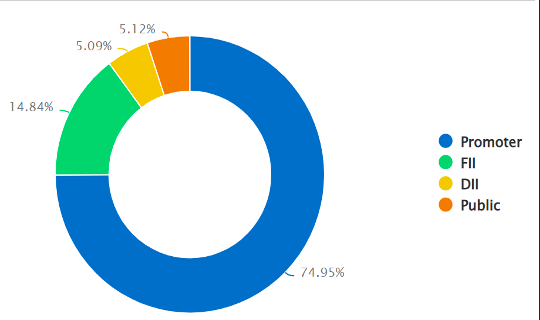

Shareholding Pattern

B. Industry Overview, Value Chain and Profit Tools

The Real Estate Sector Is One Of The Most Globally Recognized Sectors. It Comprises Four Sub-Sectors – Housing, Retail, Hospitality, And Commercial. In India, The Real Estate Area Is The Second-Most Noteworthy Employment Generator After The Primary Sector. Interest In Residential Properties Has Flooded Because Of Expanded Urbanisation And Rising Family Pay,

Internationally, India Is Among The Price Appreciating Housing Markets,

In The First Quarter Of 2022, The Gross Leasing Volume Of India’s Top 7 Markets Was At 11.55 Million Sq. Ft. In 2021, July – September, A Total Of 55,907 New Housing Units Were Sold In The 8 Micro Markets In India (59% Yoy Growth).

India’s Real Estate Sector Saw Over 1,700 Acres Of Land Deals In The Top 7 Cities In 1 Year. Foreign Investments In The Commercial Real Estate Sector Were At Us$ 10.3 Billion From 2017-21

Key Market Trends:

- Investing/ Development

The Indian Real Estate Sector Are Expected To Increase By 4% To Reach Rs. 36,500 Crore (Us$ 5 Billion) In 2021, Driven By Rising Interest Of Investors Towards Capturing Attractive Valuations Amid The Pandemic.Indian Real Estate Has Witnessed High Growth Recently With High Demand For Office And Residential Spaces.In 2021, Sebi Lowered The Minimum Application Value For Real Estate Investment Trust (From 50,000 To 10,000) Making It More Accessible For Retail Investors. Government Initiative:

Goi Along With The State Government Took Several Initiative To Promote The Concerned Sector.In October 2021, The Rbi Announced To Keep Benchmark Interest Rate Unchanged At 4%, Giving A Major Boost To The Real Estate Sector In The Country. Under Union Budget 2021-22, Tax Deduction Up To Rs. 1.5 Lakh (Us$ 2069.89) On Interest On Housing Loan, And Tax Holiday For Affordable Housing Projects Have Been Extended Until The End Of Fiscal 2021-22. Also Government Formally Approved 425 Sezs, Of Which 265 Were Already Operational.

- Increase In Office Space Absorption

With The First Few Months Of Covid Free Environment The Gross Leasing Volume (Glv) For Jan-September 2022 Was Higher By 88% And 13% Over Similar Periods In 2021 And 2022. Delhi Ncr And Bangalore Are 2 Largest Office Markets Followed By Mumbai.These States Represented More Than 66% Portion Of Occupier Movement In The Initial 9 Months Of The 2022.

C. Sources Of Revenue

(Operations)

Major Sources Can Be Categorised As:

1. Revenue From Contract With Customers

· Revenue From Sale Of Land, Plots, Constructed Properties And Other Development Activities

Contract Assets Are Initially Recognised For Revenue Earned On Account Of Contracts Where Revenue Is Recognised Over The Period Of Time As Receipt Of Consideration Is Conditional On Successful Completion Of Performance Obligations As Per Contract. Once The Performance Obligation Is Fulfilled And Milestones For Invoicing Are Achieved, Contract Assets Are Classified To Trade Receivables.

Contract Liabilities Include Amount Received From Customers As Per The Installments Stipulated In The Buyer Agreement To Deliver Properties Once The Properties Are Completed And Control Is Transferred To Customers.

The Revenue From These Jumped From ₹363,183.46lakhs In 2021 To ₹379,531.82lakhs In 2022.

· Revenue From Golf Course Operation

For The Professional Part Of The Industry, Money Is Made Through Ticket Sales, Event Attendance, Sponsorship, And Prize Money. But Money Can Also Be Made On Individuals Wanting To Play Golf Though Local Club Courses, Fees, And Selling Equipment. It Saw A Shift To 8,501.49lakhs In March’2022 From 6,870.15lakhs In March’2021.

· Amount Forfeited On Properties

Dlf Ltd. Earned A Total Of 582.88lakhs In The Financial Year 2022 From These Forfeitures On Properties.

2. Rental Income

The Rental Income Earned By The Real Estate Giant Dropped To 16,611.24lakhs In March’2022 From 18,958.65lakhs In March’2023.

3. Other Operating Revenue

The Other Operating Revenue Sources Are Royalty Income And Maintenance Income.

The Revenue Earned From These In The Financial Year 2022 Was 9,212.24lakhs.

Strengths:

A. Strong Market Position, Aided By Large, Low-Cost Land Bank And Economies Of Scale: Dlf Has An Established Track Record In The Domestic Real Estate Sector Across Segments And Regions. It Is A Well-Recognised Brand, With The Most Extensive Track Record Among Private Developers. The Large, Low-Cost Land Bank, With A Development Potential Of 187 Million Square Feet (Msf) Out Of Which About 35 Msf Is Already Identified For Development In Prime Locations, Underpins The Company’s Strong Market Position, Supports Profitability And Lends A Significant Competitive Advantage Over Other Real Estate Developers.

B. Healthy Financial Risk Profile Supported By Reduction In Debt Levels: The Company Has Significantly Reduced Gross Debt From Rs. 6,510 Crore In Fiscal 2021 To Rs. 3,900 Crore In Fiscal 2022 Due To Higher Prepayment Of Debt On Account Of Strong Collections. The Debt/Total Assets Reduced To 0.18 Time In Fiscal 2022 From 0.28 Time The Preceding Fiscal And Is Expected To Fall Further In Current Fiscal. Out Of The Outstanding Gross Debt, ~35% Is Lrd In Nature. Excluding These, The Gross Debt Would Be Rs 2,552 Crore As On March’22. Dlf Has Emphasised To Continue With Its Focus On Debt Reduction Over The Medium Term. Any Deviation From The Debt Reduction Trajectory Will Be A Key Monitorable.

C. Strong Financial Flexibility: Financial Flexibility Is Driven By Annual Dividend Expected From Dccdl Which Supports The Cash Flow Of The Company. Dlf Also Has A Track Record Of Raising Funds From National And International Investors, Banks And Financial Institutions Further Providing Liquidity Cushion. Cash Flows Are Also Supported By The Portfolio Of Leased Assets And Large Land Bank. Rental Income Of Dlf, Including Dccdl, Stood At Rs 3,544 Crore In Fiscal 2022 Against Rs. 3231 Crore In Fiscal 2021.

D. Strong Liquidity: In The Development Business Under Dlf, Liquidity Is Supported By Cash And Bank Balance Of Rs 1,220 Crore As On March 31, 2022. Utilisation Of Fund Based Bank Lines (Sanctioned Limit Of Rs 2,482 Crore) Averaged 68% And Non Fund Based Limits (Sanctioned Limit Of Rs. 850 Crore) Averaged 53% During The 12 Months Ended June 30, 2022. Financial Flexibility Is Supported By A Track Record Of Raising Funds From National And International Investors, Banks And Financial Institutions And From A Portfolio Of Leased Assets And A Large Land Bank. Cash Accrual, Cash And Equivalents And Unutilised Bank Lines Should Be Sufficient To Meet The Debt Obligation As Well As Incremental Capital Expenditure (Capex) And Working Capital Requirement

Weaknesses:

A. Exposure To Inherent Risks And Cyclicality In The Real Estate Industry: Cyclicality In The Real Estate Segment Causes Fluctuations In Cash Inflow. As Against This, Cash Outflow Towards Projects And Debt Obligation Are Relatively Fixed, Resulting In Substantial Cash Flow Mismatch. The Covid-19 Pandemic Had Caused Some Disruption And Adversely Impact The Cash Flow Of Real Estate Developers. The Company Experienced The Same During The Pandemic With Collections At Rs. 2,509 Crore In Fiscal 2021. However, Pick-Up Has Been Seen In The Business Environment Leading To Increased Sales Of The Finished Inventory. Any Decline In The Pace Of Sales In The Inventory Of Rs 4,478 Crore As On June 2022 Could Lower Collections And Expose Dlf To Refinancing Risk. Furthermore, Occupancy Levels And Rental Rates Remain Susceptible To Economic Downturns, Which Could Constrain The Tenant’s Business Risk Profile And Rental Collections.

B. Risk Of Geographical Concentration In Revenue Profile: Dlf’s Reliance On Gurgaon’s Real Estate Market Has Been High And In Case Of Any Significant Slowdown In Demand Or Oversupply In The Region, Future Revenues Will Be Impacted. However, The Company Is Slowly Focusing On Geographical Diversification And Has Re-Entered Chennai After 10 Years & Successfully Launched Parc Estate Worth Rs. 700 Crore While Has Also Planned Launches Across Goa, Panchkula And Mullanpur. However, The Extend Of Geographical Diversification In The Revenue Profile Will Remain A Key Monitorable.

C. Large Contingent Liabilities And Pending Litigations: The Group Has Significant Contingent Liabilities Because Of Matters Related To Income Tax And Service Tax Along With Indemnities Provided To Dccdl And Penalty Imposed By The Competition Commission Of India (Cci) In 2011 (For Which Dlf Has Already Deposited Rs 630 Crore With The Supreme Court Towards The Cci Penalty). Most Of The Matters Are Longstanding And Have Shown Limited Progress, And Some Amounts Have Been Deposited Pending Resolution. While There Has Been No Crystallisation Of Liabilities, The Matters Will Be Resolved In Due Course And, Nonetheless, Would Remain Closely Monitored.

Overall Outlook: Positive

Dlf Is Likely To Generate Healthy Cash Flow Through New Launches, Liquidation Of Inventory In The Absence Of Any Large, Debt-Funded Capex And Pursuit Of Short-Cycle Projects While Continuing To Benefit From Its Strong Market Position And Strengthened Balance Sheet.

D. Financial Overview

1. Ratios Sales Growth Ratio:

The Sales Growth Ratio Is A Financial Metric That Measures The Rate At Which A Company’s Sales Are Increasing Or Decreasing Over Time. It Is Calculated As The Percentage Change In Sales From One Period To Another, Typically Over A Quarter Or A Year.

The Sales Growth Decreased During 2020 Due To The Pandemic And The Entire Industry Faced A Slowdown. The Company Has Now Uplifted Itself And Going Strong!

2. ROE:

ROE Stands For Return On Equity, Which Is A Financial Metric Used To Measure A Company’s Profitability In Relation To The Equity It Has On Its Balance Sheet. It Is Calculated As Net Income Divided By Shareholder Equity, Expressed As A Percentage. It Shows How Much Profit A Company Generates With The Money Shareholders Have Invested In It. A Higher Roe Indicates Better Management Of Equity To Generate Profit.

Company Has A Poor Roe Of 6.05% Over The Past 5 Years As Compared To Its Peers, It Depends Mainly On How Much Of These Profits The Company Reinvests Or “Retains” For Future Projects

3. ROCE:

ROCE stands For Return On Capital Employed, It Is Calculated As A Percentage By Dividing The Company’s Operating Profit By Its Capital Employed, Which Includes All Its Assets, Both Short-Term And Long-Term. Roce Is Used To Evaluate The Efficiency And Profitability Of A Company’s Operations, And Is A Useful Tool For Investors To Assess The Potential Return On Their Investment In The Company.

It Measures The Return A Company Generates From The Capital It Has Invested In Its BusinessSince real estate companies have long gestation periods, the average usually remains the same when you compare it over a long-term period.

BALANCE SHEET ANALYSIS

Dlf, India’s largest real estate developer, posted a net loss of ₹71.52 crore in the June quarter. It had posted a net profit of ₹413.94 crore in the corresponding year-ago quarter. Total income dropped by 58.01% to 646.98 crore during in that period due to the lockdown, and construction activities were limited leading to almost no revenue recognition and poor operating cash flows

The company’s current liabilities during FY 22 down at Rs 7114 cr as compared to Rs 9993 cr in FY 21, thereby witnessing a decrease of -18.6%. Long-term debt down at Rs 2971 cr as compared to Rs 3162 cr billion during FY 21, a fall of 33.5%.current assets fell 9% and stood at Rs 1260, while fixed assets rose 1% and stood at Rs 2471 cr in FY 22 overall, the total assets and liabilities for FY 22 stood at Rs 37315 cr as against Rs 39545 during FY 21, thereby witnessing a fall of 4%. With the construction activities reaching pre covid levels, the profit is projected to increase over the years.

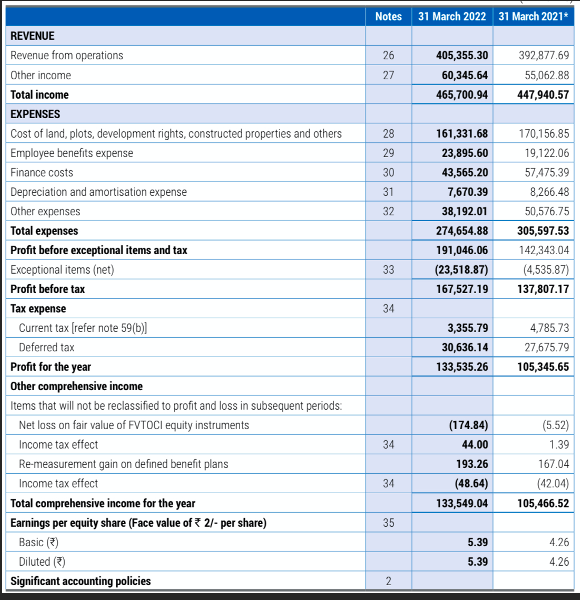

PROFIT & LOSS STATEMENT

Operating income during the year rose 5.6% on a year-on-year (yoy) basis. The company’s operating profit increased by 14.9% you during the fiscal. Operating profit margins witnessed a fall and down to 26.6% in fy22 as against 24.4% in fy21. Depreciation charges decreased by 6.3% and finance costs decreased by 26.8% you, respectively. Other income declined by 20.8% yoy.net profit for the year grew by 76.8% you. Net profit margins during the year grew from 8.8% in fy21 to 14.8% in fy22

- Lower than industry revenue growth:

Over the last 5 years, revenue has grown at a yearly rate of -8.22%, vs industry avg of 1.51%

- Higher than industry net income:

Over the last 5 years, net income has grown at a yearly rate of 15.99%, vs industry avg of 10.31%. The company has a net income approximately 60% higher than the industry average and is in a highly comfortable position as far as the income is concerned.

- Decreasing market share:

Over the last 5 years, market share decreased from 16.78% to 9.82%. One factor that can be attributed to this change is the increasing popularity of real estate towards the lower end.

E. Thesis/ anti-thesis pointers in valuation

Thesis:

1. Sustainable growth:

Dlf has managed to improve operating performance and cash flow, driven by higher sales in residential projects and healthy liquidation of inventory in the absence of any large, debt-funded capex.

2. Focus short term cycle:

Dlf has sustained its focus on short-cycle projects, thus limiting project execution and funding risks

This has lead to a better operating performance leading to significant and sustained deleveraging and strengthening of the financial risk profile, with debt to total assets sustaining under 15% and lower refinancing requirement

Anti- thesis:

1. Sharp decline in the operating cash flow, triggered by slackened saleability of ongoing and proposed projects or delays in project execution

2. Weakening of the financial risk profile, driven by lower cash flow or higher capex leading to debt/total assets exceeding 30%

ESG profile

The environment, social and governance (ESG) profile of dlf supports its strong credit risk profile.

The real estate sector has a significant impact on the environment as a result of high emissions, waste generation and impact on land and biodiversity. The impact on social factors is indicated by labour-intensive operations and safety issues on account of construction-related activities.

Dlf has an ongoing focus on strengthening various aspects of its esg profile

ESG profile:

1. Future plans:

Dlf plans to reduce energy intensity in its rental assets (energy consumption per square foot of rental portfolio) by 15% by fiscal 2030 using fiscal 2020 as the baseline and increase renewable energy intensity in its rental assets by 20% by fiscal 2025 using fiscal 2020 as the baseline.

Dlf also plans to ensure zero harm – that is, zero fatalities resulting from operations – each year. Its loss time injury frequency rate was nil in fiscal 2022.

2. On the operational side:

Dlf promotes local sourcing of raw materials within the organisation and among its supply chain partners to reduce emissions associated with transport and logistics.

The company has implemented solid waste management technology to recycle house garbage and turn it into manure, which is used for horticulture.

Dlf is focused on effective management of water quality and usage across the lifecycle of its assets. It has installed zero-discharge sewage treatment plants at multiple sites across its portfolio.

The governance structure of dlf is characterised by 50% of its board comprising independent directors, split into the chairman and chief executive officer (ceo) positions, presence of an investor grievance redressal cell and extensive disclosures

F. Peer Comparison

Dlf has a market capitalisation of 90 thousand cr, the highest among its peers. According to the table, dlf holds the highest position with the highest dividend percentage and roce, having the 3rd highest quarterly sales. Although its quarterly profits percentage is negative, the p/e ratio is average amongst its peer.

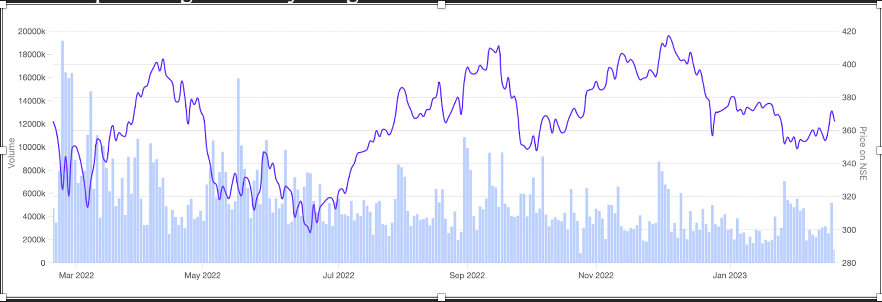

G. Stock Performance in Past One Year

During the last one year the stock price remained in the range 365.60 – 365.50. The stock has shown some great plunges and hikes during the last one year but at last came back to the same price range it had a year ago.