Historical Appraisal of the Company

Leonardo Del Vecchio, an entrepreneurial genius and visionary, saw the potential of the optical industry and created the Luxottica group in 1961. He remained the chairman of what is now known as Essilor Luxottica group till 2022. He was guided by his quest for independence and integration of the industrial chain of eyewear, from design to distribution.

He signed his first license agreement with Giorgio Armani in 1988, in hopes of shifting people’s outlook of eyeglasses from a medical device into a fashion accessory. Finally, by working to bring Essilor and Luxottica closer together, he created an integrated, world-class global industry player in his sector. In less than 60 years, he revolutionized the industry, turning a medical necessity into a must-have fashion accessory.

Acquisition History of Essilor Luxottica

1995-Acquisition of Gentex Optics

1995-Acquisition of Persol and LensCrafters

1998 -Acquisition of EyeMed

1999-Acquisition of Ray-Ban

2000-Listing on Milan Stock Exchange

2000-Joint-venture with Nikon to combine R&D capabilities

2001-Acquisition of Sunglass Hut

2003-Acquisition of OPSM

2004-Acquisition of Cole National

2007-Acquisition of Oakley

2008-Acquisition of Satisloh

2010-Acquisition of Shamir Optical, Signet Armorlite and FGX

2012-Acquisition of Tecnol

2013-Acquisition of Alain Mikli

2013-Acquisition of Costa and Bolon

2014-Acquisition of Transitions Optical

2015-Acquisition of Vision Source, PERC/IVA

2016-Acquisition of VisionDirect, MyOptique and Photosynthesis Group

2016-Acquisition of Salmoiraghi & Viganò

2017-Acquisition of Óticas Carol

2018-Acquisition of Fukui Megane

2019-Acquisition of Barberini

2019-Acquisition of Brille24

Luxottica Operations

Italy-based company engaged in the design, manufacture and distribution of prescription frames and sunglasses in the mid-and premium-price categories. It operates in two segments: manufacturing and wholesale distribution and retail distribution. Through its manufacturing and wholesale distribution segment, it is engaged in the design, manufacture, wholesale distribution and marketing of house and designer lines of mid-to premium-priced prescription frames and sunglasses. The Company operates its retail segment principally through its retail brands, which include, among others, LensCrafters, Sunglass Hut, Pearle Vision, OPSM, Laubman & Pank and its Licensed Brands (Sears Optical and Target Optical), as well as through the retail brands of its business, Oakley, which include, among others, Oakley Stores and Vaults, Sunglass Icon, The Optical Shop of Aspen and Bright Eyes.

The company also provides EyeMed Vision Care and is the second largest player in the vision insurance industry which has an approximate market size of $150 billion.

Luxottica also has a large retail footprint that prescribes and sells eyewear. This includes Sunglass Hut, LensCrafters, Pearle Vision, Target Optical, Ray-Ban, Oakley, Glasses.com, EyeMed Vision Care, and Spectacle Hut. It also did Sears Optical when that was a thing.

These retail stores carry mostly Luxottica brands, although they do occasionally carry third-party brands. Because it has a virtual monopoly within its own retail store shelves, it pulled off the Oakley takeover.

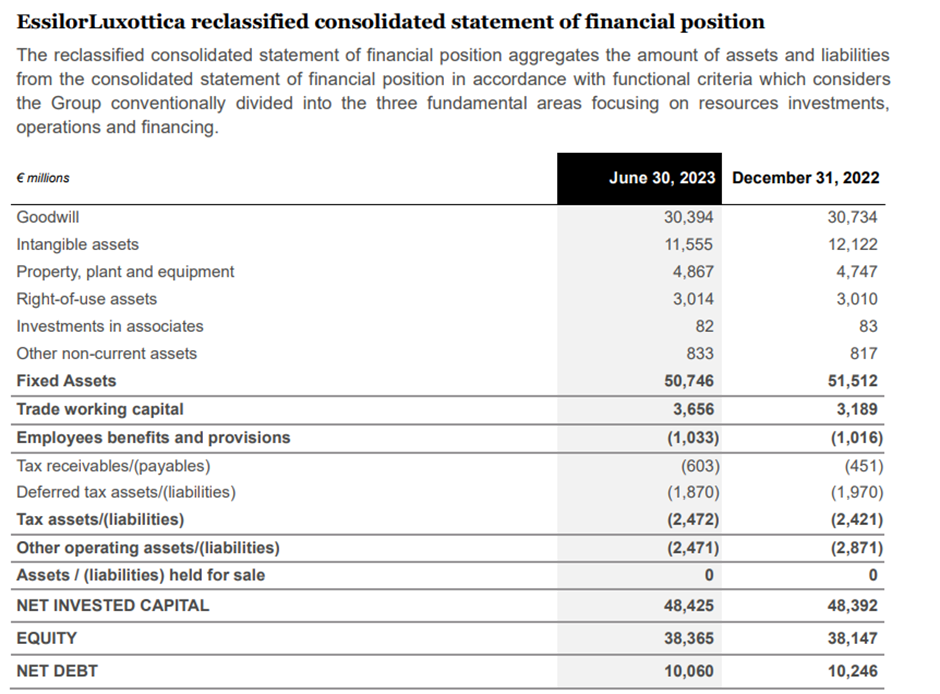

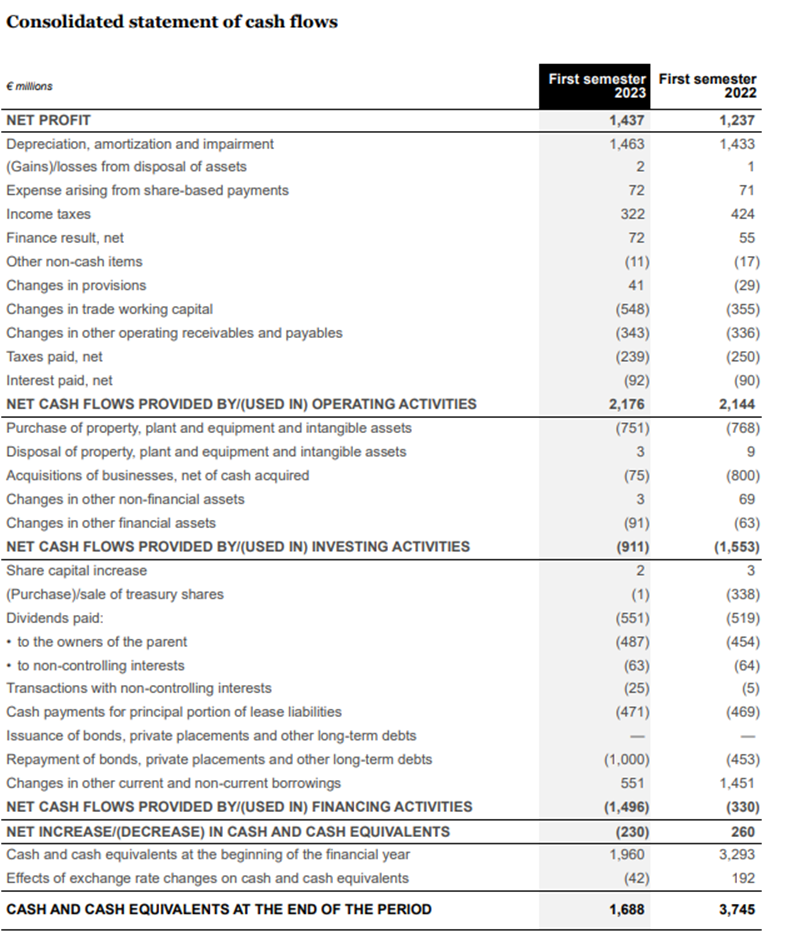

Financial Statements of Essilor Luxottica Group

Monopoly of Luxottica

Luxottica Group is vertically integrated Italian Conglomerate and one of the biggest players in the eyewear industry. Its parent company Essilor Luxottica owns a large portfolio of popular eyeglass brands, a large footprint of optometry chains, and it’s the second-largest vision insurance company in the country. The company was featured on TruTV’s Adam Ruins Everything with host Adam Conover claiming it holds 80 percent of the market. Snopes and other online fact checkers put the company’s market share as low as 10 percent. Still, its vertical integration and aggressive business tactics have gotten it into trouble over the years.

In fact, its hostile takeovers of Ray-Ban and TIL Oakley in the 1990s and 2000s made the brand name infamous in North America. At the time, Oakley was at the height of its popularity and seemed unstoppable. But Luxottica strangled the company out of its retail stores over a pricing dispute and ended up acquiring the brand.

There are three types of monopolies, and Luxottica qualifies as only one of them. First is a natural monopoly that has a high cost to entry that keeps competitors away. A railroad is an example of a natural monopoly because you can’t compete without laying your own rails. Warby Parker’s rise disproves this.

The second type of monopoly is a state monopoly in which the government has full control over a company. Luxottica runs independently of the Italian and French governments.

Finally, there are unnatural monopolies, such as those granted by a patent. This is where Luxottica could be considered a monopoly, because intellectual property is its most important asset. The company flexes design patents on all competitors to keep its designs selling for high markups.

Rajveer Rohra

Senior MemberVedant Kumar

Senior MemberDeepseek: A journey from Hedge Funds to AI

Introduction: In this busy and bustling day to day life of ours managing our Finances…

Beyond Numbers: The Human Cost of Infosys’ Layoffs and the Global Normalization of Workforce Reduction

A Familiar Script: Infosys and the Corporate Playbook of Disposable Labor: On February 7, 2025,…

Understanding Tariffs and Their Impact on India

What Are Tariffs? Tariffs are taxes governments levy on foreign imports to make the goods more…

The Economics of Player Transfers in Football

Introduction: In the world of football player transfers are more than just transactions, they are…

Session 5

Session 5- Unraveling Equity Derivatives: Insights from the Fifth Development Session The Fifth Development Session…

An Attempt To Deteriorate The Creditworthiness of Indian Entities

Introduction: The growth story of India in almost every sector is not alien to the…