In this week’s newsletter, we talk about India’s GDP growth, a kidney transplant scam, money tips and a lot more.

If you’d like to receive our 3-min daily newsletter that breaks down the world of business & finance in plain English – click here. Or, download the Finshots app here.

Decoding India’s 7.6% GDP

At first glance, the headline 7.6% GDP growth is spectacular. We’ve surpassed all expectations. And there’s ample reason to celebrate. Especially since the rest of the world is struggling a tad bit.

But there’s a lot hiding behind the data. So let’s look at the GDP growth figure in a little more detail.

Now the first thing you’ll notice is that the Manufacturing sector has grown by a whopping 13.9%! This segment primarily consists of factory activity. It involves folks that make apparel and textiles, petroleum products, office machinery and a whole host of other similar stuff. So when you see manufacturing picking up, it’s a happy moment. You believe that the factories are running at full tilt because the demand for goods is soaring and they’re producing what’s needed.

This growth has surpassed all expectations and has been a primary driver in pushing the country’s GDP. However, it’s important to look at the 13.9% figure with some added context. If you look closely, you’ll see that the manufacturing sector actually sputtered during the same period last year. It fell by -3.8% and lost value. As T N Ninan from Business Standard pointed out, that means today’s manufacturing growth looks good because it’s come on the back of a low base. Or put another way, say during July to September of 2021, the value of manufacturing activity was 100. During the same period next year, it fell by 3.8% to 96.2. Now while the the sector has grown by 13.8% during the next year, the overall value is still only 109.5. Basically, manufacturing has indeed grown in the last couple of years, but perhaps the headline number doesn’t capture all the details.

We can also look at another metric known as the Index of Industrial Production or IIP to get a better understanding. It calculates the value of manufacturing activity too. This is what we call a high-frequency indicator since it’s released monthly. And it kind of reveals the same thing. There’s increased activity when compared to last year, however, manufacturing companies haven’t been producing as much stuff in the last few months.

Should we be concerned?

Well, it’s hard to say for sure. Because factories will only feel emboldened to produce more goods if there’s demand from people like you and me. We need to open our purse strings and spend at the end of the day. So, the question is — what’s happening on the expenditure side? Are people spending or are they cautious?

Well, let’s look at another number. The government calculates something called the ‘Private Final Consumption Expenditure’ during the GDP exercise. Think of this as the money that people like you and me actually spend in the economy. And this has grown by 3.5% over the past year. That’s still growth. However, this comes with a caveat. If you’ve been reading Finshots, you’ll remember that we’ve written a couple of stories about the rise of unsecured personal loans in the country (here and here). People have been borrowing money to spend. So some experts believe that the growth in private expenditure could be attributed to the loans. And now that the RBI is trying to turn the tap off on these loans, could consumption actually take a tumble? We hope not.

The other thing here is that the agriculture sector hasn’t contributed to the GDP growth a lot. If you look at the GDP data, you’ll see that it has grown only by 1.2% in the past year. That could be a dampener for rural income. In fact, if you listen to what FMCG companies such as Britannia and Marico have to say, they’re all concerned about a slowdown in the rural segment.

And here’s the crux of the problem – Consumption drives 60% of the value of our GDP. And if this engine isn’t firing as expected, it will eventually be a drag on growth. The only way out then is for the government to spend money instead. Try and keep building stuff like roads and bridges in the hope that it will create jobs and people will spend money. But you and I know that it’s not a long-term solution. The government might need to resort to borrowing money to fulfil this obligation. At some point, that will have to end. So we need both household and private sector spending to do some of the heavy lifting too.

So yeah, in a nutshell — India is growing. But there are some hurdles along the way. And if we can iron that out, we could keep this momentum going. And hopefully, we’ll get to the mark of being a $5 trillion economy sooner rather than later.

Why is Apollo Hospitals in the midst of a controversy?

There could be a massive kidney transplant scam unfolding in India’s capital city. And this might be taking place at one of India’s largest hospital groups — Apollo Hospitals!

At least that’s what the British media house The Telegraph revealed.

What’s going on, you ask?

Well, it begins with our neighbour Myanmar. See, organ transplants in Myanmar can only happen between relatives. So when someone’s kidneys fail, that person can’t really take out an advertisement asking for donors and promise they’ll pay for a kidney. They have to find a relative. Or, they could find some random individual willing to do it out of the goodness of their heart. It’s the same rule in India. Now apparently, wealthy Myanma are flying across the border to India for organ transplants. And they’re finding poor villagers from their country to donate kidneys.

But what about the relationship status?

That can be fixed by some forged documents, of course. The middlemen or the agents who connect the donor with the recipient will take care of all the dirty work — they’ll create a family tree, fake household documents showing family ties, drum up a marriage certificate if needed, stage a photo op to show the two people visiting a temple or taking a holiday, and then cook up a false story.

Oh yeah, they need a false story too. Because you can’t just waltz into a hospital and say, “I’m the donor. Take my kidney.” Oh, no. In many cases, there could be an interview with a transplant authorisation committee. The ones who make up this committee are officials from the hospital and even a member appointed by the government. These folks need to believe the documents. They need to buy into the story. And only then will they sign off on the transplant.

So yeah, there’s definitely a process in place. And if the documents and story seem genuine enough, it could be quite easy to fool this committee too.

Now the big question is — was Apollo’s top brass involved in this scam too?

Well, the hospital has vehemently denied any knowledge of course (We’ve added a statement from the Group at the end of this article). And maybe the rot is just limited to its Myanmar office. Because when the Telegraph’s reporter posed as a relative of someone who needed a kidney transplant, they were told by a Dr Htet Htet Myint Wai from the Apollo office, “It’s easy to find a donor.”

So yeah, it could be a case of a few dubious individuals trying to make a quick buck.

But here’s the thing…

Apollo’s been embroiled in a kidney scam before. Back in 2016, similar accusations were leveled against the hospital. And at that time, the donors and recipients in the picture were all Indians. People from poor parts of Uttar Pradesh would be paid ₹3–4 lakhs for a kidney. And again, documents would be forged.

But Apollo said that it was “a victim of a well-orchestrated operation to cheat patients and the hospital”. Apparently, the traffickers managed to fool the committee into believing these fake relationship statuses.

So it could be a similar story playing out again.

But the question is — despite knowing that organ trafficking was rampant, and having been on the receiving end before, what did Apollo do to tighten the screws?

We imagine that Apollo will probably have to answer this sooner or later.

And in the meanwhile, it also raises a few other questions regarding organ trafficking.

You see, India is one of the epicentres of commercial organ trafficking. Sure, we have a law in place. The Transplantation of Human Organs and Tissues Act came into effect in 1994. But if you go by media reports, it’s still quite easy for unscrupulous people to get around it.

Now there might be a couple of reasons why organ trafficking is so rampant here.

Firstly, there’s massive income disparity in the country. So when the poor get desperate for money, they resort to whatever means necessary to hold on to their life. For instance, in 2001, 305 people in Chennai who had sold their kidney were asked why they did it. And 96% of them said it was to pay off debts. They had no other way out. Now sure, that survey is over two decades old but the inequality in the country has only been expanding since then. So it’s not hard to imagine that the situation could be even worse than before.

The other problem is a demand-supply gap. In India, there’s a need for 200,000 kidney transplants each year. But just 10,000 transplants are conducted. And whenever there is a mismatch of this magnitude, it opens the doors for the black market. The illegal business thrives.

So how do we solve this problem, you ask?

Well, for starters, the simple answer is that we need more organ donors. Currently, the organ donation rate among the dead is just 1 per million people. Experts say we need to get the ratio higher to around 65 per million. And one method to improve this is to train ICU hospital staff on recognising when the organs of a deceased can be used and counsel families for donation.

But you can imagine that’s not a frictionless ploy. Getting people, who’re dealing with loss, to consider donating organs of their loved ones is a tall order.

So maybe the other way is to move from an opt-in model for organ donation to an opt-out model.

What do we mean?

Well, this means that the default state is that as soon as you’re born, you become an organ donor. You don’t need to take the effort and sign up to be one. Rather, if you decide that you don’t want to donate your organs, and that you want to opt-out, that’s when you actually have to fill up a form. And this system seems to work. A decade or so ago, researchers looked at some data in Europe. They found that in Germany, which had an opt-in policy, only 12% of people registered as organ donors. Whereas in Austria where it was an opt-out policy, 99% of people were organ donors.

Sure, the idea might be a bit controversial. Giving away one’s organs, even if it’s after death, might make people squeamish. But you could justify it on the “as-judged-by-themselves” principle. In simpler terms, what will you want if you were struggling to get a transplant for a loved one? We’re guessing you’d be hoping more people are organ donors, no?

And it seems like Indian authorities are mulling over using the opt-out system as well.

Now we don’t know how it’ll all turn out. But we do need to do something to put a full stop to illegal trafficking of organs. We need to stop the exploitation of vulnerable people. And we need hospitals like Apollo to be more accountable for what goes on behind closed doors. No?

PS: The company spokesperson for Indraprastha Medical Corporation Limited (IMCL) that’s part of the Apollo Hospital group,shared the below statement with us.

“The allegations made in the recent international media against IMCL are absolutely false, ill-informed and misleading, All the facts were shared in detail with the concerned journalist. To be clear, IMCL complies with every legal and ethical requirement for the transplant procedures including all guidelines laid down by the government as well as our own extensive internal processes that exceed compliance requirements. For example, IMCL requires every donor to provide Form 21 notarised by the appropriate ministry in their country. This form is a certification from the foreign government that the donor and recipient are indeed related. The government appointed transplant authorisation committee at IMCL reviews documents for each case including this certification and interviews the donor and the recipient. It further re-validates the documents with the concerned embassy of the country. The patients and donors undergo several medical tests, including genetic testing. These and many more steps far exceed any compliance requirements for a transplant procedure and ensure that donor and recipient are indeed related as per applicable laws. IMCL remains committed to the highest standards of ethics and to delivering on our mission to bring the best healthcare to all.”

Money Tips  : A letter to your future financial self

: A letter to your future financial self

More often than not we derail from our financial goals. Last year you probably thought that you’d save up enough money for a new laptop by the end of next year. But it’s now time and you don’t see this happening. Or you may have thought of setting aside a set amount of money to meet a long-term financial goal 5 years from now. If you don’t succeed, how do you keep yourself motivated to keep going?

Well, there’s a way. You could write a letter to your future self. You could tell yourself what your goals are and why you set them. But that’s just the positive part. You also have to remind yourself that it may not always be possible for you to achieve your goals. And getting demotivated or giving up on them isn’t the solution.

When you read this letter a couple of years later, it could give you a reality check. You could look back at your efforts and contemplate if you were disciplined in your financial journey. If you were, this letter could be a pat on the back and act as further motivation. And if you weren’t, it could axe the regret of not being committed and help you get back on track.

Ready to imagine your future financial self?

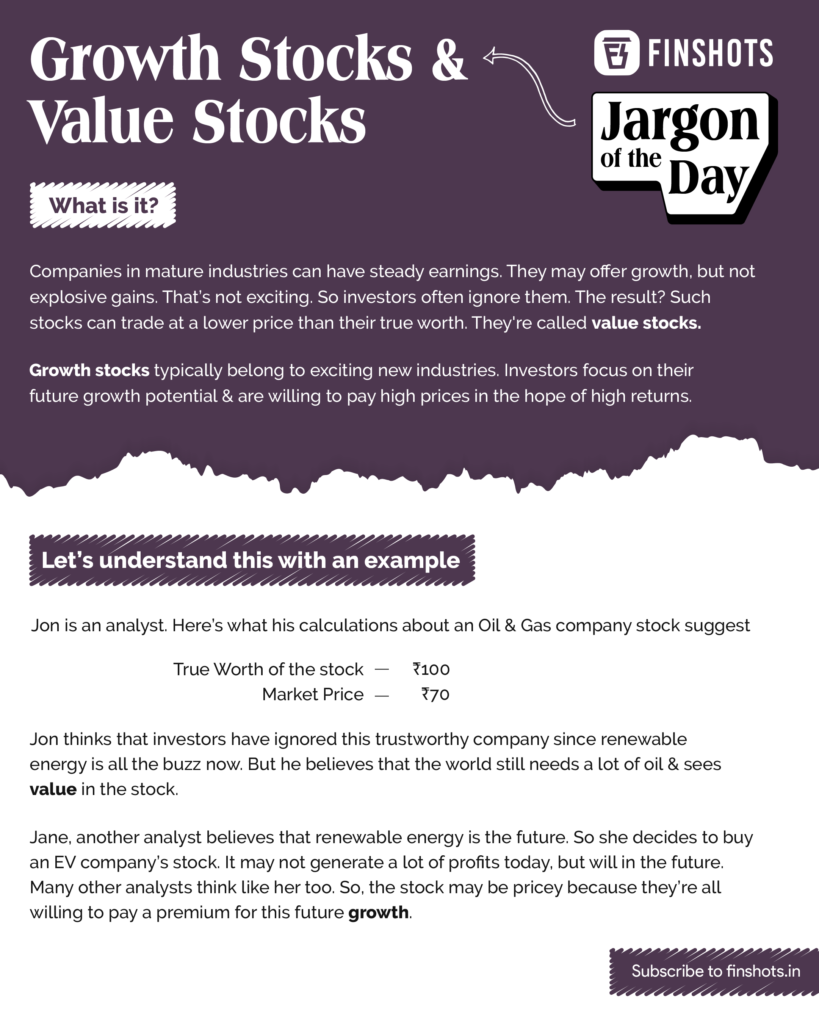

Jargon Explainer  : Growth & Value Stocks

: Growth & Value Stocks

Today’s quote

”Beware of small expenses; a small leak will sink a great ship.”

– Benjamin Franklin

And that’s all for today folks! If you learned something new, make sure to subscribe to Finshots for more such insights 🙂

Finshots is now on WhatsApp Channels. Click here to follow us and get your daily financial fix in just 3 minutes.

Finshots is now on WhatsApp Channels. Click here to follow us and get your daily financial fix in just 3 minutes.