“It is a situation today where every country will try naturally to get the best deal possible for its citizens, will try to cushion the impact of these high energy prices and that is exactly what we are doing.”

– Dr. S. Jaishankar, Minister of External Affairs of India.

India, one of the world’s fastest-growing economies, has been actively diversifying its sources of energy imports to meet its ever-increasing demand. In recent years, India’s purchasing spree of Russian oil has gained significant attention.

India is the world’s third-largest oil consumer and imports over 80% of its oil from overseas markets. Since the onset of the conflict between Russia and Ukraine in February 2022, India has been heavily relying on Russian Oil to beat the inflation in global oil prices and fulfil its consumption needs.

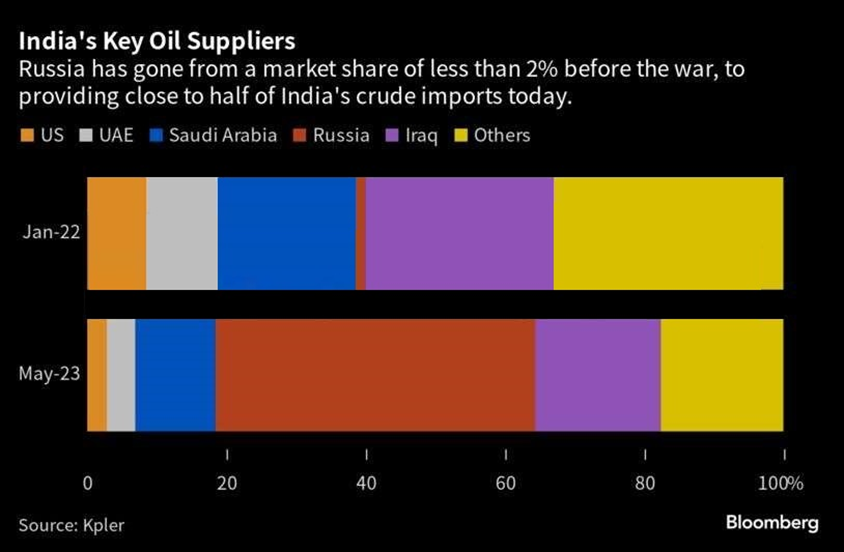

As per data from Kpler, in May 2023, Moscow accounted for 46% of India’s total oil imports, up from less than 2% before the invasion. On the other hand, India became the largest importer of Russian Crude (Urals) in January 2023, with 70% of Urals exported to India in the month.

There are several reasons for the purchasing spree:

1. Cheaper Fuel Option:

Amid the sanctions imposed by NATO and Europe, Russia has been selling energy at discounted rates to soft allies like India and China. Hence, as per Government Data, while the price of Saudi Oil stood at $86.96 per barrel in April, Russia supplied the crude at merely $68.21 to India. The difference is especially significant to Indian Households since cheaper oil has enabled India to manage inflation and keep fuel prices under control. The cost advantage makes Russian oil lucrative for Indian refiners and incentivizes them to diversify their crude oil sources.

The Foreign Minister of India himself clarified India’s stance, ” I have a country which has a per capita income of $2,000. These are not people who can afford higher energy prices. It is my obligation, my moral duty to actually get them the best deal that I can from the world.”

2. Diversification Strategy

India’s decision to diversify its energy sources aligns with its geopolitical strategy of decreasing its reliance on any one country or region. By reducing dependence on a single oil supplier, India aims to create a balanced portfolio of energy imports, which helps stabilize prices and ensure a steady supply even during periods of market volatility.

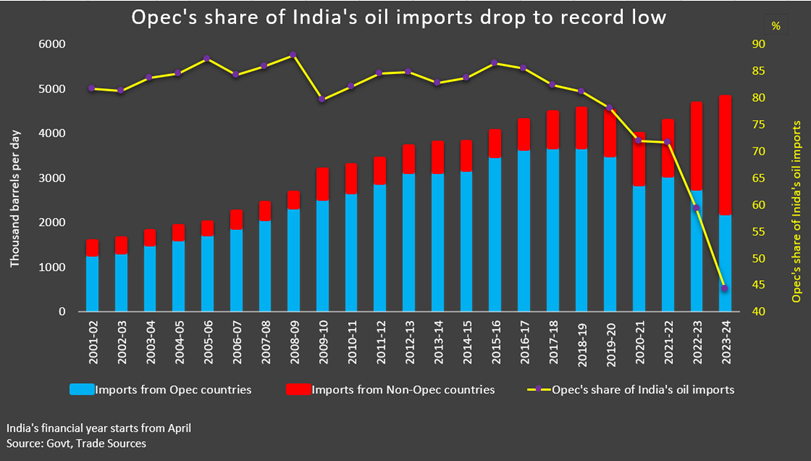

Historically, India has been dependent on Middle Eastern countries for oil imports. By expanding its energy partnerships to include Russia, India aims to enhance its energy security and minimize vulnerability to supply disruptions caused by regional conflicts or geopolitical tensions.

3. A reliable and strategic partnership for the long run

India’s current trade with Russia is a testimony to the strength of the diplomatic ties between New Delhi and Moscow. Both share a close relationship dating back decades, deeply rooted in security. Moscow is India’s largest supplier of weapons. For fuel, too, India is looking to diversify and expand its trade with Russia. India has actively pursued long-term contracts with Russian oil companies, ensuring a stable and predictable supply of crude oil.

The Government is also working on infrastructure development for processing Russian crude. India has invested in developing strategic infrastructure projects to facilitate the procurement of Russian oil. The construction of the International North-South Transport Corridor (INSTC), which connects India with Russia via Iran, has played a crucial role in strengthening bilateral trade and energy ties between the two nations.

The RBI is also chalking out a “Rupee-Rouble” payment mechanism so that India and Russia can transact bilaterally without depleting their foreign (US Dollar) reserves. This measure was taken in light of sanctions imposed on Russia that bar it from using the international SWIFT system for payments. India is working on internationalizing the rupee to diminish the demand for the dollar and empower its economy to fare better against global shocks. Such a mechanism will also benefit India, as it would further encourage the export of ‘Made in India’ Goods to Russia.

4. India’s Growing Energy Demand

2023 marks the year in which India has become the world’s most populous country. In light of this and India’s fast-paced GDP growth, it is not surprising that India is the world’s third-largest oil consumer. With limited domestic resources, India relies heavily on imports and such demand is only expected to rise. India cannot solely depend on a few countries to act as its energy suppliers. Russian oil presents an attractive option due to its ample reserves and ability to fulfil India’s increasing requirements.

5. India’s improving economic condition

India has emerged as the world’s fifth-largest economy, with a GDP of over $ 3 trillion. The India of today is less vulnerable to a spike in the price of oil on a macro level owing to economic reforms and the expansion of foreign exchange reserves. Oil imports as a percentage of GDP have declined significantly over the past ten to 15 years, from a peak of 9.3% in Q4 of FY12 to only 6.2% in Q4 of FY22.

India has an enhanced sense of self-confidence on the international stage today. The Government has been consistent in its public stance that it will continue to act in its national self-interest, while also avoiding international sanctions.

According to reports from Money Control, despite all the sanctions, Russian oil continues to make its way into Europe through India. Indian Companies are importing Russian crude, converting it into refined fuels and shipping them to Europe at a higher price. Bloomberg has also indicated that India is on track to become Europe’s leading supplier of refined fuels.

However, there are several challenges to the Russian Oil spree in India. Many experts even speculate that India is beginning to reach the limits of its splurge. The obstacles can be best described via the following:

1. Infrastructure Limitations

While India’s imports of Russian Urals have increased manifold, the infrastructure of Indian Oil and Gas Companies is lacking to process the Russian oil. More specifically, Indian refineries were not initially built for processing Russian barrels. Unlike Middle Eastern Oil, the Russian Ural is rich in sulphur. Indian refiners have tried their best, by not only replacing lookalike grades but also replacing a few others by blending them. However, India only has a few commercial blending tanks, which limits its ability to optimize Russian crude supplies. These facilities will need to be modified or expanded, which would cost a lot of money and time.

2. Narrowing Discounts

India’s switch to Russian oil is primarily due to the Russia-Ukraine Conflict, as European purchasers continue to turn away from Russian Energy. Faced with sanctions, Russia has little choice but to sell its stockpiles to partners like India and China at huge discounts. However, these discounts are not sustainable in the long run. Already, financial pressure is mounting on the Kremlin. Putin urgently requires funds to fight domestic threats and safeguard his position at the apex. Russia’s economic and political situation hampers its ability to maintain its lucrative pricing strategy for India.

Russia and Saudi Arabia, the leading oil suppliers in the world, have already announced a tightening policy whereby they will cut oil exports in August. They believe a reduction in supply would help revive global oil prices that have been diminishing in recent months.

3. Trade Deficit

Bloomberg has recently reported that the surge in imports of Russian Crude oil has aggravated India’s trade deficit with Russia. From April to November 2022, India’s imports of Russian goods exceeded its exports to the latter by nearly 16 times. In fact, between April 2022 and January 2023, India’s trade deficit with Russia skyrocketed to $34.79 billion. Russia, which was ranked 25th among India’s largest trading partners, has leapt to the second position behind only China. As per Government Data reported by Money Control, India’s commodity imports from Russia have increased by 369%, from merely $9.87 billion in FY22 to $46.3 billion in FY23. Almost two-thirds of this increase consists of crude oil. Imports of Russian Crude increased in India for 11 consecutive months leading up to May 2023.

4. Turning down Rupee

The dampening of the trade deficit has serious implications for bilateral trade in Rupees between the two nations. As per Bloomberg, over the course of the last year, the Indian rupee has depreciated the most against the US Dollar among emerging Asian Currencies. Due to Russian exporters’ growing scepticism about the currency, there hasn’t been a single transaction between Indian oil purchasers and Russian vendors in the rupee. Russian Banks have no interest in stocking Indian currency.

As reported by Reuters, some Indian refiners have also started to pay some Russian exporters in Chinese Yuan and the UAE Dirham. The use of the Yuan is particularly concerning as India’s relationship with China remains sore. Indian Oil Corporation, India’s largest importer of Russian Urals, became the first state refiner to settle a transaction in Yuan in June 2023. In addition, sources claim that two of India’s three private refiners have also used the Renminbi to pay for their imports. The situation aids Beijing’s attempt to internationalize its currency. However, as political differences between the two nations persist, the Indian Government has asked Banks and traders to avoid the Yuan.

5. Damage to Traditional Relationships

India’s newfound reliance on Russian energy imports has several implications for its age-old ties with the Middle East. Historically, Saudi Arabia, Iraq and the United Arab Emirates have been long-standing and reliable suppliers to India. However, recently, Russia overtook Saudi Arabia to become India’s largest supplier of crude oil. Increasing imports from Russia have challenged the dominance of Middle Eastern suppliers. According to Reuters, Russian oil made up roughly 40% of India’s crude oil imports in May, reducing shipments from Saudi Arabia to levels unseen since September 2021 and from Iraq to a three-year low. The findings reveal that Saudi Arabia’s supply fell 15% to 616,100 bpd (barrels per day), while India purchased 801,400 bpd of Iraqi oil in May, a decrease of around 13.7% from April.

As per reports, several Indian refiners fear that a long-term shift to Russian imports would not only be expensive but would also damage connections with their existing counterparts. While the success and longevity of India’s purchases of Russian crude hang in the balance, India must not drift apart and remain steadfast with its traditional partners in OPEC.

In conclusion, India’s diversification of energy imports to include Russian oil has brought both benefits and challenges. The cheaper fuel option and strategic partnerships have provided India with an alternative to traditional suppliers, enhancing its energy security. However, the country faces hindrances like infrastructure limitations, narrowing discounts, and a growing trade deficit with Russia. Therefore, while India’s reliance on Russian oil has advantages, the country must maintain its traditional partnerships and carefully manage its energy imports to ensure long-term stability and security.

SOURCES

- https://www.hindustantimes.com/india-news/india-was-never-defensive-about-stand-on-russian-oil-jaishankar-101660761995185.html

- https://economictimes.indiatimes.com/industry/energy/oil-gas/india-is-starting-to-reach-the-limits-of-its-russian-oil-splurge/articleshow/101322341.cms

- https://www.bloomberg.com/news/articles/2023-06-27/india-is-starting-to-reach-the-limits-of-its-russian-oil-splurge?leadSource=uverify%20wall

- https://www.reuters.com/business/energy/indias-russian-oil-buying-scales-new-highs-may-trade-2023-06-21/

- https://www.reuters.com/business/energy/india-refiners-start-yuan-payments-russian-oil-imports-sources-2023-07-03/

- https://www.reuters.com/business/energy/saudi-arabia-will-extend-voluntary-cut-1-million-bpd-august-spa-2023-07-03/

- https://www.bnnbloomberg.ca/india-s-soaring-russian-oil-imports-render-rupee-trade-futile-1.1883443

- https://www.moneycontrol.com/news/business/economy/indias-trade-ministry-acts-to-cut-ballooning-trade-deficit-with-russia-reaches-out-to-epcs-sources-10567221.html

- https://www.moneycontrol.com/news/world/russian-oil-is-still-powering-europes-cars-with-help-of-india-10495491.html

- https://www.business-standard.com/economy/news/india-s-trade-deficit-with-russia-rose-nearly-seven-fold-last-year-123041800865_1.html