Lebanon’s financial collapse which began in 2019 is a story of how a vision for rebuilding a nation once known as the ‘Switzerland of the Middle East’ was derailed by corruption and mismanagement.

Lebanon has lived through a lot. Between an explosion, coupled with the adversities caused by the pandemic and the resulting shortages, rolling blackouts, and a grinding economic collapse in the background, the country is hanging on by a thread.

But, what led to this?

A country can’t just fall apart over a single day now, can it?

Well, a lot went into this.

Mounting debt and subsequent defaults, government power struggle, unsustainable policies, and the list goes on.

A long-lasting civil war (1975-90) created a long-lasting impact on the Lebanon Economy.

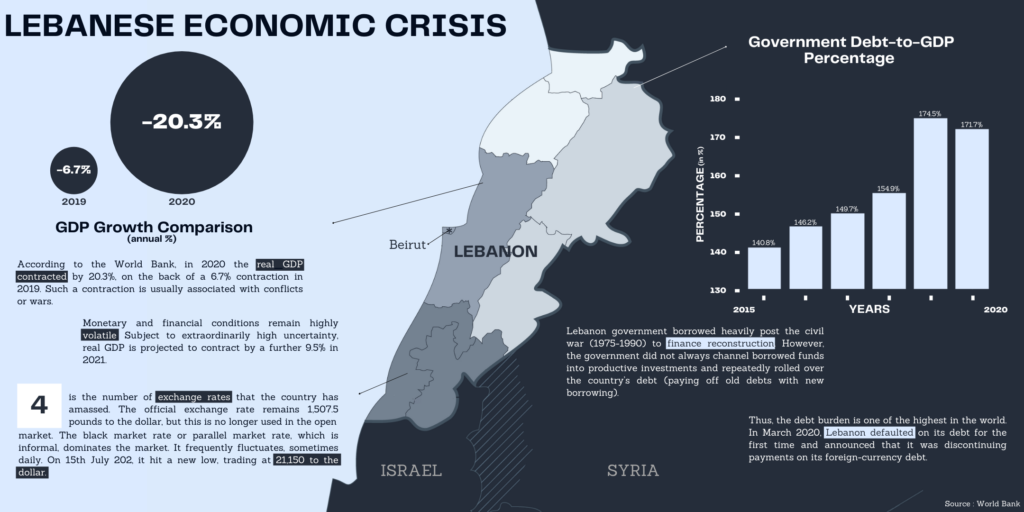

Lebanon decided to embark upon a journey to rebuild and renovate its infrastructure post the Civil War. This was facilitated by a burgeoning internal and external debt load which entailed persistent budget deficits and growing public debt that still drapes the nation.

With a debt to GDP ratio of 170% in 2020, Lebanon had been crushed by a debt of 90 billion USD. Some have even begun to describe Lebanon’s economic system as a Nationally Regulated Ponzi Scheme, where new money is borrowed to pay existing creditors.

Moreover, being an import-dependent nation with a highly service-based economy that relies extensively on tourism accelerated the rise of Lebanon’s trade deficits and the decline of its economy. Lebanon’s trade deficit in 2019 was almost 15 Billion USD and its currency has been collapsing for at least 2 years now.

On August 4, 2020, the port of Beirut had an explosion that wounded more than 1000 people and killed over 200.

What followed can only be described as one thing: Anarchy.

While Lebanon trended on social media, the Prime Minister resigned. The damages of the blasts were estimated to be between $3.8 billion and $4.6 billion. It also put the hit that the economy took at $2.9 billion to $3.5 billion. Billions that the country did not have.

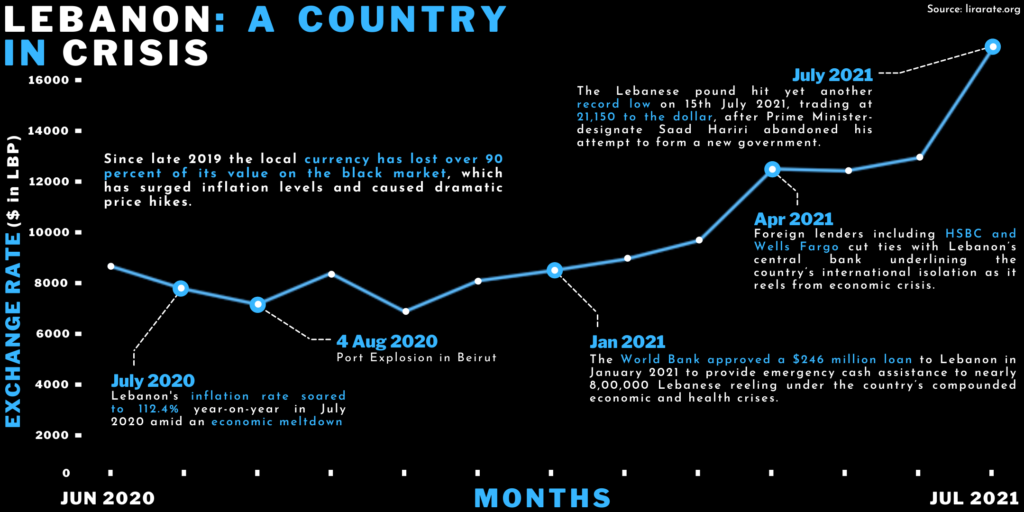

In the midst of all of this, the citizens have been protesting and its currency value has been plummeting. Before the protests broke out, the minimum wage used to be roughly 250 USD a month. But, after the protests, it fell to about 67 USD a month. Additionally, the same Lebanese Pound which was worth $800 before the crisis was now less than $80.

On 13th June 2021, the Lebanese pound was trading at around 15,150 to the dollar, losing around 90% of what it was worth in late 2019.

All that is left, is the shell of a glorious nation that was formerly the ‘Paris of the East’. A nation whose expats have to smuggle medicines and basic supplies into the country. The people have 3 rather lovely choices: go to Hariri Hospital, go to Hariri Airport, or go meet their late Prime Minister, Rafiq Hariri in person.

The dire economic depression has driven more than half of the country’s 6.8 million people into poverty and is now pushing the wealthy and middle-class Lebanese population to flee the country.

It is painful to watch. A country that was once the ‘Pearl of the Orient’ now standing at the brink of an inevitable historic breakdown.

A country whose people are so preoccupied with endless miseries that the pandemic is the least of their worries. A country that is stuck in a maze surrounded by looming losses and lawlessness. It is trying to find a way out, but all in vain.

Amidst this chaos, Lebanon lives on.

For the other parts of our GPT, check out:

For more information, check out:

Deepseek: A journey from Hedge Funds to AI

Introduction: In this busy and bustling day to day life of ours managing our Finances…

Beyond Numbers: The Human Cost of Infosys’ Layoffs and the Global Normalization of Workforce Reduction

A Familiar Script: Infosys and the Corporate Playbook of Disposable Labor: On February 7, 2025,…

Understanding Tariffs and Their Impact on India

What Are Tariffs? Tariffs are taxes governments levy on foreign imports to make the goods more…

The Economics of Player Transfers in Football

Introduction: In the world of football player transfers are more than just transactions, they are…

Session 5

Session 5- Unraveling Equity Derivatives: Insights from the Fifth Development Session The Fifth Development Session…

An Attempt To Deteriorate The Creditworthiness of Indian Entities

Introduction: The growth story of India in almost every sector is not alien to the…