Introduction

“Wall Street in Crisis: Lehman Collapses, AIG Teeters, Markets Shaken.”

-The Guardian

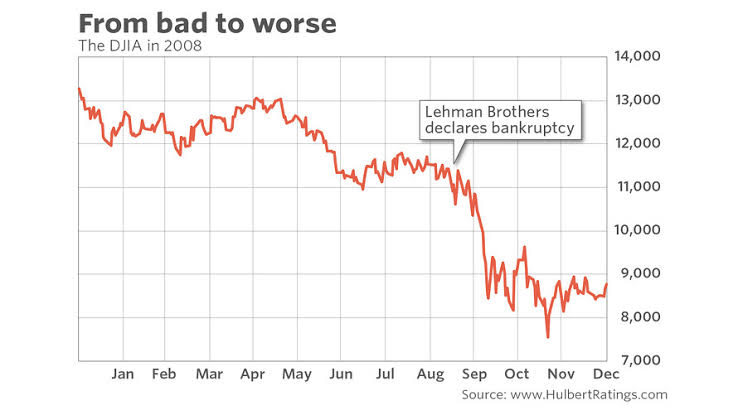

This was the headline that sent shockwaves around the market on 16th September 2008 , the bankruptcy of Lehman Brothers Inc. shocked everyone not only in the US but around the world leading to global recession. But who exactly were the Lehman Brothers, Lehman Brothers Inc. was a global investment bank with over 25,000 employees in 40 countries, which used to play a pivotal role in the American economy before it’s bankruptcy.

With this article allow us to give you a walkthrough of the breaking of titans of the wall street, who were considered too big to fall.

The origins of the Lehman Brothers were quite humble, tracing back to 1844 when Henry Lehman along with his brothers Emanuel and Mayer started off as a general store in Alabama to become one of the largest investment banks in the world and 4th largest in the USA. But things took a fast turn making Lehman Brothers the largest ever bankruptcy in the U.S owning assets over 639 Million $.

This article aims to breakdown the rise and fall of the corporation, by delving deep into the reasons of this tragedy we will get better in understanding how negligence and greed of few affect millions. In the modern era vulnerabilities exposed by the case might look obsolete but in practical terms, the case resembles current trends of a possible recession where once again we might echo the old conditions due to investors allured by high returns without adequate risk assessment.

In the next segment let us talk in detail about how the general store in Alabama became an investment bank.

Lehman Brothers: A Journey from Cotton to Capital

Lehman Brothers began its journey when a new immigrant from Germany started his general store in Montgomery, Alabama. In those days cotton was used as currency by many farmers, so the store received a good quantity of cotton produce from the cotton farmers of Alabama. While selling cotton , soon enough they developed relationships and started acting as a broker for buyers and sellers of cotton.

The Lehmans even set up an office at New York and played a crucial role in starting The New York Cotton Exchange. As Lehman grew in the cotton market, they realized the cotton industry is full of risks and to mitigate that they diversified into underwriting between companies and investors, they were able to find success in this sector too. They were always able to find new industries with future growth from retail to aviation to technology underwriting for all of them.

Finally in the early 20th century, Lehman Brothers recognized the demand for investment services and set up an investment decision which took up post world war II ,the period of economic growth.

The point here to note is that Lehmans survived the Great Depression, Two world wars and capital shortages throughout their working life due to their adaptability, prudent risk management and strategic partnerships.

The exponential rise

In the early 1900s, many investment banks were expanding their services and client bases. The firms started diversifying into underwriting and advisory roles for their future growth. Mergers and acquisitions became more common as firms pursued to increase market share.

In the 1980s, American Express acquired this investment bank, helping it expand its reach and resources. This acquisition allowed the bank to leverage American Express’s brand and financial strength, solidifying its position in the investment banking sector.

The bank eventually went public through an IPO, raising significant capital and increasing its visibility in the financial markets. Over time, strategic decisions led to its spin-off as a separate entity, allowing it to operate independently while focusing on its core investment banking services.

In the 2000s, the firm began venturing into mortgage-backed securities, capitalizing on the housing boom. This move was part of a broader trend in the investment banking industry, as firms wanted to profit from the growing demand for these financial products.

As the housing market started flourishing, the firm pursued various acquisitions to enhance its capabilities and market share in the MBS space. These strategic moves positioned the firm as a leader in mortgage finance, although they also exposed it to significant risks when the housing bubble burst.

Laying up of bricks for recession

The dot-com bubble burst in 2000 led to a stock market crash, which caused investors to seek safer, more stable investments. Real estate became an attractive option as housing prices were perceived as a more reliable store of value.

In response to the recession following the dot-com crash, the Federal Reserve lowered interest rates. This made borrowing cheaper, encouraging a larger audience to take out loans to purchase homes. As it lowered the monthly payments, more people entered the housing market, increasing the demand and leading to the prices going up.

During this period, banks and financial institutions, including Lehman Brothers, made the lending standards flexible where subprime loans, which were given to borrowers with poor credit histories, became widespread. These loans had floating rates that could increase after a period of time, making them risky.

Lehman Brothers was heavily involved in the Collateralized Debt Obligations and Mortgage- Backed Securities. These financial products bundled various mortgage loans and sold them to investors. Lehman neglected the background checks on borrowers, underestimating the risks associated with these loans.

Lehman Brothers employed significant financial leverage, borrowing up to 30 times its equity to increase its investment capacity. This high leverage increased their exposure to risks. When housing prices began to decline and defaults on subprime loans increased, Lehman’s leveraged position meant that losses were boosted, ultimately leading to its bankruptcy.

Financial Crisis and Collapse

In the mid-2000s, many lenders offered adjustable-rate mortgages, which were initially low. Although when these rates adjusted upward, many homeowners faced higher monthly payments, leading to increased defaults. As these defaults increased, the market was flooded with homes increasing the supply and hence the prices went down. This created a vicious cycle: declining home values further increased the number of defaults, as homeowners owed more than their properties were worth.

Lehman Brothers, who were invested in the mortgage-backed securities and other real estate-related assets, encountered a severe strain on its balance sheet. Although seemingly solvent on paper, the value of its assets drastically declined due to the housing market collapse. With diminishing confidence in its financial stability, the firm faced challenges in securing short-term funding. With this, Lehman Brothers started exploring potential buyers as a solution. But the interested parties were discouraged by the company’s escalating losses and market conditions.

By September 2008, Lehman found itself devoid of viable alternatives and had to file for bankruptcy on September 15, 2008, marking a monumental bankruptcy event in U.S. economic history. Despite outward appearances of a positive balance sheet, the true value of Lehman’s assets painted a different picture. The liquidity crunch meant that even if the firm technically possessed assets surpassing its liabilities, it struggled to liquidate these assets to meet its financial commitments.

Global Consequences

Lehman Brothers, a major investment bank, filed for bankruptcy after failing to secure a government bailout. This event shocked investors and led to a massive sell-off in financial markets.The collapse prompted a severe liquidity crisis. Investors, fearing further failures, began pulling their money out of banks and financial markets, leading to a decline in stock prices and an overall drop in consumer confidence. Banks became unwilling to lend, leading to a credit crunch. Without access to credit, businesses struggled to finance operations, invest in growth, or manage day-to-day expenses.

The culmination of these factors marked the onset of the Great Recession. The U.S. economy entered a severe downturn, with rising unemployment and crashing its GDP. The repercussions of Lehman Brothers’ fall were felt worldwide. Many economies slipped into recession, and international trade contracts shrank. The interconnectedness of global finance meant that no country was immune from the effects of the crisis

Lessons from the Fall: Could Lehman Brothers Have Averted The Disaster?

In retrospect, the crisis could have been avoided easily by efficient management and not neglecting advice. Let us analyze the major factors individually which were the prime drivers of the tragedy:

1. Too much leverage– Lehman Brothers had an alarmingly high leverage exceeding 30:1, the excessing borrowing made them unable to pay back when interests rose. This could have been easily avoided by following a sustainable leverage ratio.

Figure shows liquidity ratios of the company

2. Giving out too many subprime loans- The loans given out by the company on its own risk were given out to people who had a very low chance of returning it. When the U.S. housing market cracked in 2007 the defaults went to seven year high, if only the underwriting would have been rigorous this could have been avoided.

3. Inadequate Risk and Liquidity Management: Managerial Overconfidence- The company was giving out Collateralized Debt Obligations, but the management was not ready for the adverse situation of interest rates increasing. Managers don’t listen to the advice of experts and are reduced to adapt which worsened the situation.

4. Missed opportunities for Intervention- Several companies such as Bank of America were interested in buying out the company in months leading to bankruptcy, but the negotiations failed due to disagreements. The management should have tried their best to increase liquidity by selling out the firm.

Conclusion

The collapse of the Lehman Brothers sale remains one of the most significant events in modern finance, the bankruptcy was not just limited to the company but had a ripple effect for years to follow.

The initial strength of Lehmans such as diversifying, apt management and risk mitigation became the weaknesses for future, when the overconfidence of managers ignored all these aspects. The downfall suggests whatever legacy your past holds, in the financial world present is what matters the most.

The financial world has learned about the cautions to be kept with leverage and subprime lending, but as the market moves forward the market must be aware of new risks, such as current cryptocurrency volatility-something similar to Lehman’s issue. The case is a reminder for us that established institutions might become the first to fall in case of sudden market changes.

The Lehman Collapse forced economists and policymakers to approach crisis management differently with needs of the market and focus on long term sustainability

In the end, the fall of Lehmans is not merely a financial tragedy; but is a vital lesson that we must learn from as we strive for a more stable financial system.