In this week’s newsletter, we talk about the link between art and big oil, how Russia could end up involuntarily paying for invading Ukraine, a special giveaway and a lot more.

If you’d like to receive our 3-min daily newsletter that breaks down the world of business & finance in plain English – click here.

The unholy relationship between Art and Big Oil

The Mona Lisa isn’t safe. She had soup thrown at her last week!

And this isn’t the first time she’s been attacked. Since 1956 she has been doused with acid, hit with a coffee mug, had cake smeared on her face and more before finally being splattered with soup this year.

Luckily, the folks at the Louvre Museum in Paris put her safely behind bulletproof glass after the first such incident. And that’s why she can continue to smile at us even today.

But it’s not just the Mona Lisa. Van Gogh’s Sunflowers was smeared with soup a couple of years ago too.

And there’s a common link in the recent soupy attacks — climate activists!

Now they’re not trying to destroy the paintings. They seem to be choosing the ones behind the protective glass. They’re just doing this to make a point and ask,

“What is worth more? Art or life? Is it worth more than food? Worth more than justice? Are you more concerned about the protection of a painting or the protection of our planet and people?

The cost of living crisis is part of the cost of oil crisis. Fuel is unaffordable to millions of cold, hungry families. They can’t even afford to heat a tin of soup!”

Confused?

Let us explain.

See, 45% of anthropogenic or human-influenced greenhouse gas emissions come from the oil and gas industry. So, you could call them the biggest contributors to climate change.

And climate change affects crop output. The yields may dwindle, and it will result in a rise in food prices.

Also, more erratic weather means that we use more electricity to cool or heat our homes. And most electricity in the world is still powered by fossil fuels such as coal. The increased demand for electricity could push up coal prices too.

Unfortunately, families get caught in this inflation spiral.

And the thing is many art organisations worldwide have a long-standing history of taking monies from companies in the oil and gas industry — such as Shell, BP and Exxon Mobil. They get donations to run exhibitions.

In return, these fossil fuel companies get to stamp their logos everywhere in the art world. It helps them dress up their public image. They can claim that they care about preserving cultural heritage even though they’re responsible for aggravating a climate crisis.

For instance, here’s what Shell said about sponsoring a music and arts festival:

Shell continues to invest billions of dollars into safely running and growing our operations [in New Orleans]. “We can do this because people know us and trust us — Jazz Fest is a big part of how we earn that trust.

Meanwhile, Shell continues to damage the Niger Delta in Africa with its oil spills. It has destroyed the water bodies and hurt the livelihoods of communities.

And even though the company initially said it would reduce oil production by 1-2% every year till 2030, it has now backtracked and said it will keep production levels the same.

So, you can see why activists are all riled up about Big Oil’s unholy relationship with the Arts, no?

The question is – can’t art organisations survive without money from big oil corporations?

Well, oil money seems to be helping.

For instance, there’s the Getty Museum in Los Angeles which boasts a massive collection of ancient Greek sculptures, thousand-year-old manuscripts and Van Gogh’s popular Irises painting too.

In 2017, a piece of burning coal sparked a fire in the area around the museum. It burnt down entire structures in the neighbourhood but the Getty Museum remained unharmed. And that’s because of its expensive protective systems. It’s built with fire-resistant stones, has a massive underground water tank and an apparatus to prevent smoke from destroying paintings.

It’s one of the safest places to keep art in the world.

And all that has been possible, thanks to the oil money from the Getty Trust which was formed after the death of oil tycoon J. Paul Getty.

But you could also argue that this is a unique case.

Because most estimates suggest that oil companies might only account for 1-2% of a museum’s annual income. That’s what numbers from Tate, the National Portrait Gallery, the Royal Opera House, the Royal Shakespeare Company and the British Museum all seem to suggest. They do get money from the government, other corporations, big individual donors and art enthusiasts too.

And maybe many museums have realised this and they don’t want to draw the ire of activists. But slowly, they’re cutting ties with these environmental polluters. It definitely seems to be the beginning of the end of ‘artwashing’ by Big Oil.

The only thing is severing these direct ties might not be enough to appease people.

When the National Portrait Gallery replaced BP, it roped in a law firm called Herbert Smith Freehills as a patron.

The irony?

The firm’s clients included BP too!

So yeah, it looks like art museums will end up getting indirectly sponsored by oil money whether climate activists like it or not. And even that could land them in a soup.

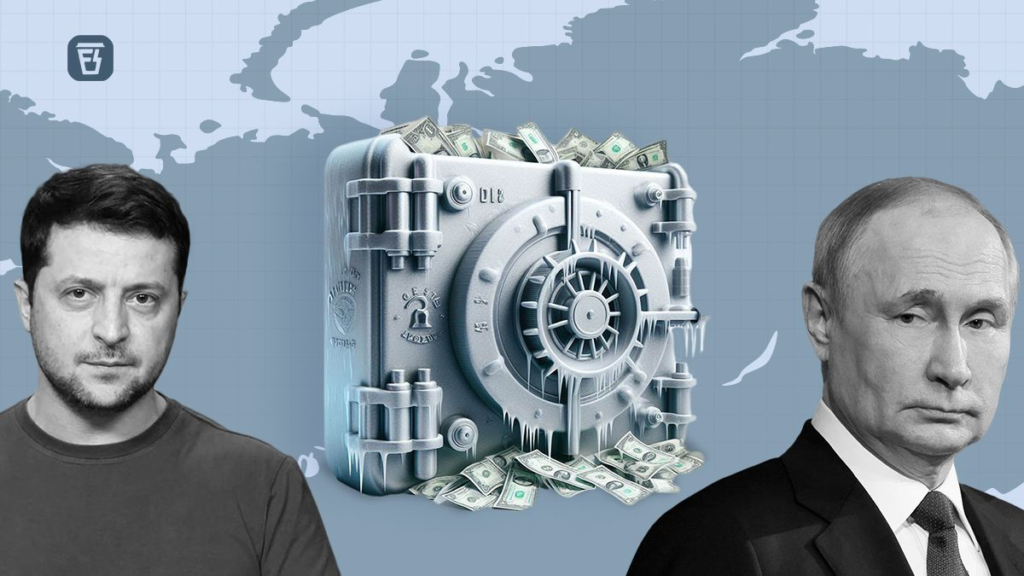

Who pays for damages in Ukraine?

In February 2022, Russia launched a full-fledged invasion of Ukraine. And almost immediately, the United Nations General Assembly (UNGA) called for an emergency special session. It was only the eleventh time the UN arm held such a session since 1950. And one of the points in contention was — how to make Russia pay for damages it was inflicting on its neighbour.

Extraordinary times call for extraordinary measures, eh?

And we get it. World Bank’s estimates say that Ukraine needs at least $400 billion to rebuild itself.

But you obviously won’t expect Russia to roll over and agree to the demands. They couldn’t care less about it.

So, how will the UN and its member nations force Russia to cough up the money, you ask?

Well, there are a few ideas being bandied about today.

For starters, when the war broke out, most Western countries slapped sanctions on Russia. They didn’t accept a bunch of goods from Russia. They denied non-essential exports to the country. And they did this to cripple the economy. But the sucker punch came when they froze the assets that Russians held in Western bank accounts — whether it was the money of Russian businesses or its government.

This was a huge deal because the Russian government had parked its emergency savings — worth $300 billion — with these Western countries.

And now, the US seems quite inclined to not just freeze it but to actually take this money away from Russia and send it to Ukraine. They’re tweaking laws to ensure that it is possible. And there’s precedent for such a measure too — when Iraq invaded Kuwait in 1990, the US seized Iraqi assets and transferred them to the UN Compensation Commission.

But not everyone’s a fan of this action. The EU is quite worried about the legal repercussions because they hold more Russian assets than the US. And Russia has already said that it will drag these governments to court if that happens. So as Luxembourg’s Foreign Minister pointed out,

Imagine if we decide politically to give billions to Ukraine. And in six months we have a judicial decision saying we are not allowed to give it to them. Who will pay then?

That would be quite a pickle.

Also, the EU is worried because Euroclear, a crucial European financial services company that helps settle transactions, has a few billion dollars worth of assets in Russia today. And if Russia retaliates and confiscates that money, it could create mayhem in the European markets. Investors could panic and try to withdraw their investments in the region. And it could even hurt the value of the Euro.

So, what tactic does the EU prefer instead?

Well, what we didn’t mention is that while the Russian assets in the West are frozen, they’re actually not idle. The money is generating interest. For instance, Euroclear made close to $5 billion in interest last year from the frozen Russian assets.

Now the EU’s rules do state that if sanctions are lifted, they have to pay Russia the full value of its assets plus interest. But the EU is tweaking those rules this month. They want to start sending at least whatever interest accrues from here on out to Ukraine.

But that’s not all. There’s also another idea in the works.

The Western countries seem to be considering banding together to create a special entity. This entity could then issue long-term bonds on behalf of Ukraine. For example, bonds worth $100 could be issued for 5 years. And the money raised will be sent to Ukraine.

But the special feature of these bonds will be that they won’t carry regular interest payments. Rather, at the end of 5 years, a lump sum of $125 will be paid back to the investors.

But who pays investors this $125?

Well, the trick here is to use the frozen Russian assets as collateral. So when the special entity eventually defaults (a likely scenario in this case), it can simply liquidate the Russian assets and make the repayment.

Quite ingenious, eh?

So yeah, there are a whole host of tactics the Western countries are trying to deploy to turn the screws on Russia. And we’ll have to wait and see which idea prevails and the consequences that come with it too.

Ask Finshots

Ask Finshots

Ever wondered about the ins and outs of personal finance? Or what’s it like working at a startup? Or maybe what it takes to build one of India’s biggest financial newsletter? Well, lucky for you!

Introducing “Ask Finshots”, an exclusive, student-centric segment where your burning financial/insurance/business/entrepreneurial questions take centre stage.

Simply send in your questions to colleges@joinditto.in, and every week our experts/founders will answer one question.

So, have a question for us? Ask away!

P.S. Don’t forget to mention your full name and college in the emails, we’d love to give you a shoutout 🙂

Finshots Recommends

This week’s recommendation is Freakonomics.

Hosted by renowned author Stephen J. Dubner, this podcast uncovers the hidden side of everything— from why airplanes are safer than cars to why the media is so full of bad news.

Giveaway Alert: Valentine’s Day

Worried about Valentine’s Day gifts? Finshots has you covered

This 14th Feb, we are giving away a very special hamper to one lucky pair.

If you’d like to win Apple Airpods Pro for you and your partner, then enter our giveaway by clicking here!!

And that’s all for today folks! If you learned something new, make sure to subscribe to Finshots for more such insights 🙂

Finshots is now on WhatsApp Channels. Click here to follow us and get your daily financial fix in just 3 minutes.

Finshots is now on WhatsApp Channels. Click here to follow us and get your daily financial fix in just 3 minutes.