A. Business Segments and Introduction

Pidilite Industries Limited (NSE: PIDILITIND) is an Indian adhesives manufacturing company. It is the market leader in the India Adhesives and Sealants Industry with a share of almost 48%, thus continuing its dominant position for the past few years.

PIL-IP is the Industrial Products business segment of Pidilite Industries Ltd. and comprises nine divisions:

- Paper Chemicals

- Industry Chemicals

- Textile Raisins

- Leather Chemicals

- Industrial Adhesives

- Footwear Adhesives

- Industrial Bonding Solutions

- Maintenance, Repair and Overhaul Solutions

- Organic Pigments and Preparation

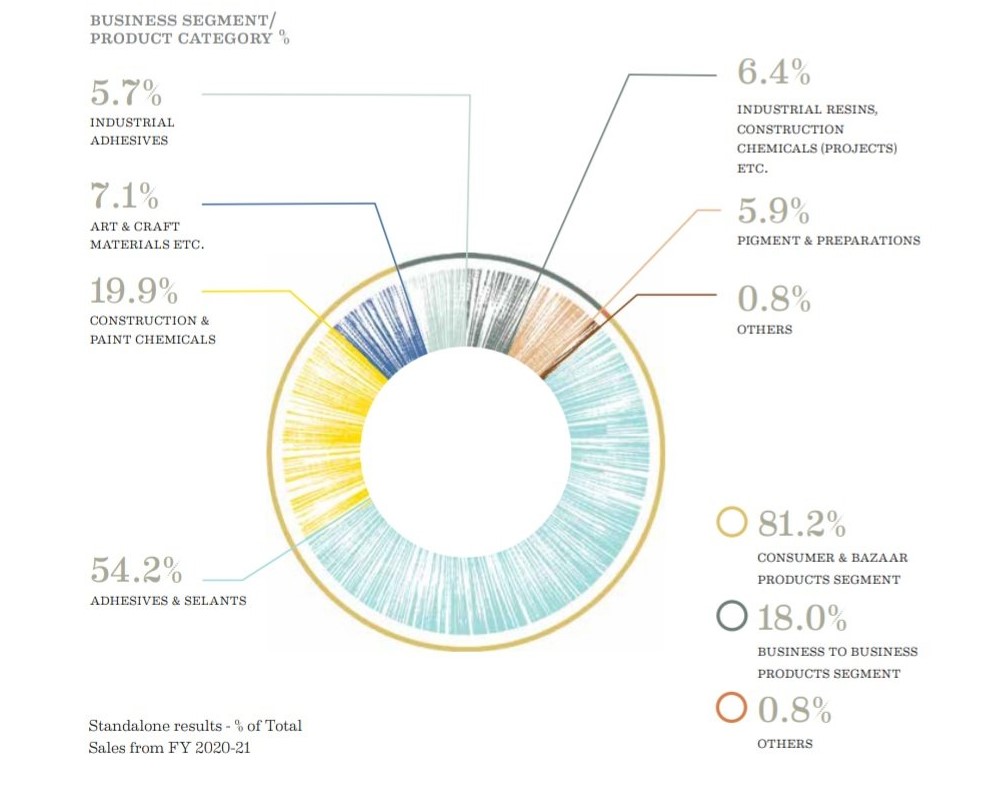

The Company operates under two primary business segments i.e. Branded Consumer & Bazaar and Business to Business.

- Products, such as Adhesives, Sealants, Art & Craft Materials and Others, Construction and Paint Chemicals are covered under Branded Consumer & Bazaar segment. These products are widely used by carpenters, painters, plumbers, mechanics, households, students, offices etc.

- Business to Business segment covers products, such as Industrial Adhesives, Industrial Resins, Construction Chemicals (Projects), Organic Pigments, Pigment Preparations, etc. and caters to various industries like packaging, joineries, and textiles, paints, printing inks, paper, leather, etc. In both the above business segments, there are a few medium to large companies with a national presence and a large number of small companies which are active regionally. Multinational companies are also present in many of the product categories in which the Company operates.

To diversify its revenue stream and facilitate global reach, the company has subsidiaries in the US and UAE, Brazil, Thailand, Bangladesh, Indonesia, Egypt, Singapore, Sri Lanka, and China.

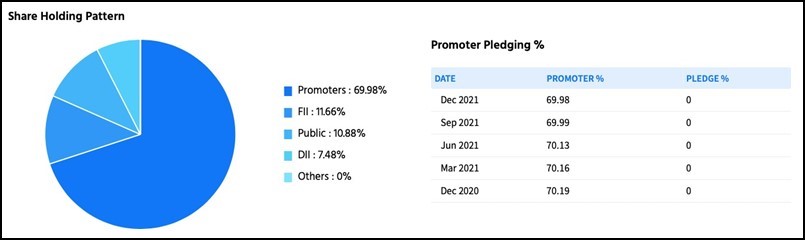

The Shareholding Pattern page below of Pidilite Industries Ltd. presents the Promoter’s holding, FII’s holding, DII’s Holding, and Shareholding by the general public etc.

Recent Developments

- In Nov 2020, Pidilite Industries Ltd announced that it completed the acquisition of the US-based Huntsman Group’s Indian subsidiary, Huntsman Advanced Materials Solutions Private Ltd (HAMSPL), for INR 2,100 crore. The deal also includes the company’s Indian subcontinent business, apart from a trademark license for the Middle East, Africa, and ASEAN countries.

- In Jul 2020, Arkema Group announced the proposed acquisition of Fixatti, a company specialised in high-performance thermobonding adhesive powders. This acquisition will enable Bostik to strengthen its global offering of hot melt adhesive solutions for niche industrial applications in the construction, technical coating, battery, automotive, and textile printing markets.

B. Industry Overview, Value Chain and Profit Tools

Market Overview

- The Indian adhesives and sealants market is projected to reach USD 1,703.68 million by 2026, growing at an estimated CAGR of 8.07% over the forecast period (2021-2026). Major factors driving the market studied are increasing demand from the packaging industry and the growing construction industry in the country.

- On the flip side, the slowdown of the automotive industry and the detrimental impact of COVID-19 are hindering the growth of the market studied.

- Increasing electronic operations in India and rising demand for bio-based adhesives are expected to offer various opportunities for the growth of the market studied over the forecast period.

Key Market Trends

- Increasing Usage of Acrylic Water Borne Adhesives: Water-borne acrylic adhesives are considered an environmentally friendly and economically feasible substitute for solvent-based adhesives. Acrylics are majorly used on exterior and interior surfaces, used by various end-user industries and also acrylics are majorly used by paper, board, and packaging industries.

- The packaging industry dominates the demand for acrylic adhesives with numerous applications in products, such as tapes, labels, cases, and cartons. With the growing demand for paper, board, and packaging in India, the demand for acrylic-based adhesives is also increasing. Such positive growth is likely to increase the demand for acrylics in the forecast period. Factors, such as e-commerce, online food deliveries, and innovation and development in the packaging industry have been driving the growth of the packaging industry in the region.

- A new report by Google and Boston consulting group has indicated that the rapid digitisation, growth in both online buyer base and spending along with variety in cuisines have been pushing the country’s food packaging sector growth to a new high. The food packaging sector is expected to grow by more than 20-25% which is expected to boost the demand for acrylic-based adhesives in the country. Major factors driving the market studied are increasing demand from the packaging industry and the growing construction industry in the country.

- Electrical and Electronics Segment to Drive the Market Growth: Due to their excellent characteristics and physical properties adhesives and sealants are extensively used in the electronic industry. Sealants are an integral part of electronic parts and are used to manufacture and assemble various electronic items. There is a steady rise in the demand for electronic sealants, primarily due to the growth and advancement of electronic goods and the high penetration of smartphone devices. The electronics industry in India is one of the fastest and most major end-user industries, contributing to the Indian economy. According to the Ministry for Electronics and IT, the electronic products market in India had a total market size of INR 4,580 billion (USD 66 billion) and witnessed a CAGR of nearly 5.5 % over the last four years. Several global producers of consumer electronic products are shifting or starting their manufacturing bases in India, due to the availability of cheap labour costs and easy access to raw materials. This scenario has been observed for the past few years, and the trend is likely to increase at a faster rate, primarily due to the Make in India initiative launched by the Indian government. Thus, this is estimated to propel the demand for adhesives and sealants in the electronics sector for various assembling applications. Despite the decrease in production in the electronics industry due to the COVID-19 pandemic, the electronics industry is likely to grow in the future, due to the growth in the electronics sector by increased consumer spending in the country. Therefore, this boom in electronic products in the country is quite instrumental in propelling the market demand for adhesives and sealants in the electronic industry over the forecast period

C. Revenue Sources and Competitive Advantages/Disadvantages

Competitive Advantage:

- Leading position in the consumer adhesive and sealant market: Pidilite is the largest player in the consumer adhesive and sealant industry. It is an iconic brand in the domestic adhesives segment, where it is synonymous with the product itself. It has leveraged Fevicol’s favourable market presence to acquire and develop new products and variants and build its market position. Having a well-established brand and the ability to customise the product portfolio provide the company, with a competitive edge over unorganised players. Furthermore, apart from steady growth in the adhesive and sealant categories, Pidilite is also likely to see healthy double-digit growth in newer categories such as waterproofing and floor coating in the medium term. Additionally, increasing focus on some of the overseas markets (a few countries in South & South East Asia, Central Africa and the Middle East) will also support the growth in the medium term.

- Strong brand management, backed by extensive marketing and distribution network: The strong brand equity is backed by a greater focus on quality, a diversified distribution network, and strong advertising support. Over the years, the company has imparted brand equity to commoditised products, through its aggressive and innovative marketing style. It has also developed an extensive pan-India network, comprising over 5,000 distributors, servicing 200,000 dealers, retailers and contractors. The company’s presence across price points and categories acts as an effective barrier against competition.

- Strong financial risk profile: Financial risk profile is marked by a healthy net-worth and gearing, and strong debt protection metrics. Net worth may improve further, led by healthy accretion to reserves over the medium term. The company is likely to maintain its near debt-free status over the medium term, given that its annual capital expenditure (cap-ex) requirement will be met through internal accrual. The polychloroprene rubber project has been put on hold, and the management is looking for a strategic partner to invest in and take the project forward. Any additional investment in the project will be a key rating sensitivity factor.

Disadvantages:

- Moderate profitability and volatility in the industrial chemicals segment: The industrial speciality chemicals segment, which is a bulk commodity business, includes industrial adhesives, synthetic resins, organic pigments, and surfactants, and accounted for 16% of total revenue for fiscal 2018. Competition from international and domestic players limits the scope for passage of any hike in cost to customers.

- Weak, though improving, the performance of overseas subsidiaries: The performance of overseas subsidiaries, which account for 8% of overall revenue, has sustained and earnings before interest, depreciation, tax and amortisation (EBIDTA) have been positive since fiscal 2018. However, these subsidiaries, specifically in Brazil and the Middle East, operating on a smaller scale, with high input costs, and face competition and economic challenges. While the Brazilian subsidiary has been able to trim its losses by improving the operating efficiency, the Middle East facility was commercialised in fiscal 2016 and is currently on a ramp-up mode. The performance of international subsidiaries should improve gradually over the medium term.

D. Financial Overview

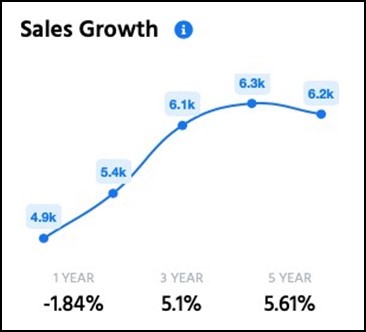

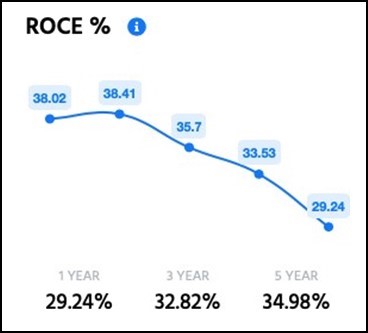

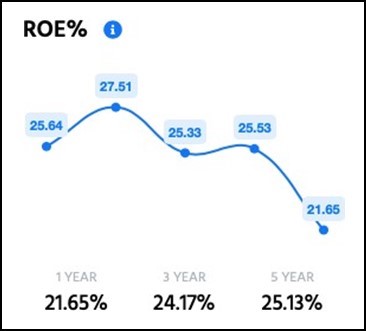

For the past five years, sales growth has been greater than 5%. The previous year was negative, but the firm will improve. For the past five years, profit growth has been greater than 7%, and the ROE has been remarkable. ROCE has also been quite excellent overall.

Debt/Equity: 0.01 Price to cash flow: 100.26 Interest Cover Ratio: 86.73 CFO/PAT (5 yr avg): 1.00

Pidilite Industries has a D/E ratio of 0.01 indicating a low share of debt in its capital. The greater interest cover ratio indicates that the corporation can pay interest on its existing debt today. CFO/PAT is 1, indicating that the corporation is converting profits into cash.

E. Thesis/ Anti-Thesis Pointers in Valuation

Thesis Pointers in Valuation

- The operating performance of Pidilite will remain strong, and the management will remain focused on growing the business in existing product lines where it has an established market position.

- Liquidity should remain strong, aided by no long term debt, sufficient net cash accrual, the surplus cash and cash equivalent, and the bank limit (fund + non-fund based) being partially utilised for the six months. The cash accruals stemming from a continued increase in profitability will suffice to cover the working capital and cap-ex requirement in the medium term. Moreover, the company, on a standalone basis, has a surplus cash and cash equivalent of over Rs. 700 crores crore as of March 31, 2021.

Anti-Thesis Pointers

- Substantial capital expenditure, acquisition or unrelated diversification, leads to the gearing of over 0.3 time and substantial erosion of liquidity.

- Substantial reduction in the market share in the adhesives and sealants segment

F. Stock Performance in Past One Year

With a CAGR of 34.4%, the share price has gone from Rs. 1685.95 in February’21 to Rs. 2377 in February’22.

G. Valuation

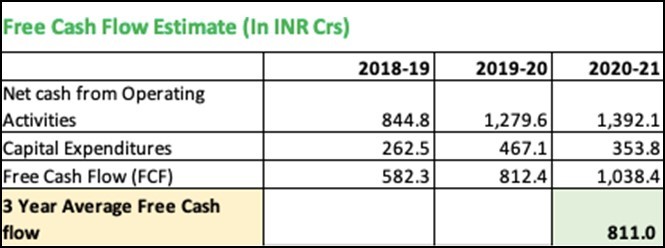

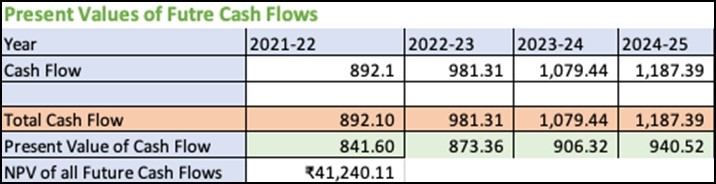

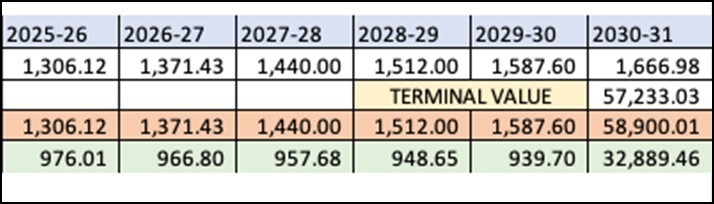

Discounted Cash Flow Valuation:

Using the assumptions above, we get the value of Rs. 816.24 per share. This is far lower than the Market Price of Rs. 2,377 which means that the market is giving the stock a premium for the expected revenues in the future.

We issue a hold recommendation and would not recommend it for buying at the current levels.

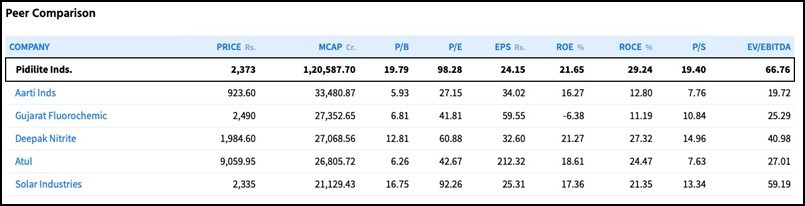

H. Peer Comparison

India’s adhesives and sealants market is highly concentrated in terms of revenue. The top five players account for a combined share of more than 90%, thus making the market highly competitive. Pidilite Industries Limited is the market leader in the India Adhesives and sealants industry with a share of almost 48%, thus continuing its dominant position for the past few years.

The speciality chemical industry has been presently growing at a CAGR of 9%. While Pidilite and the majority of its peers are following the industry CAGR, only Deepak Nitrite’s revenue grew at a CAGR of 18% in the past 7 years. Pidilite, despite having revenue growth of just 8.5% is trading at a very high valuation, it is being traded at a PE of 98.05 which is the highest among peers who are having the same or even higher revenue CAGR. Also, Pidilite is trading at 19.75 times its book value which again is far higher than its peers.

Although the company has a very good ROE and ROCE but still paying a very high premium is not that worthy as the future plans of diversification do not impress that much. The company is largely dependent on its adhesives and sealants segment and in our view, it should look to expand further either in the field of industrial adhesives (electronic assembly adhesives and flexible packaging adhesives) or in the field of speciality chemicals. But Pidilite does not seem to be interested in the same presently, so investors should look at its peers which are trading at relatively lower valuations.

Raghav Mittal

Member

Kunal Arora

MemberSOURCES

https://www.pidilite.com/Annual-Reports/Annual-Report-2020-21/

https://ticker.finology.in/company/PIDILITIND