Business Segments and Introduction

Saregama (NSE: SAREGAMA) which is part of the RPG Goenka Promoter Group, has four business segments:

A. Music which includes the retail and licensing business

B. Film production with Yoodlee Films

C. Television Serials

D. Open Magazine

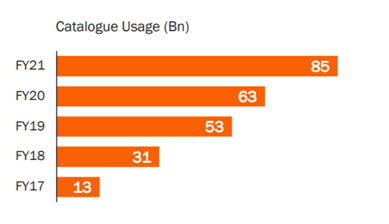

In the Music Segment, Saregama has India’s Largest Music IP which is getting more and more relevant with the trend of recreation of old songs and their attempts to create new IP with artists like Badshah, Sanam, and Pritam. Saregama gets a fixed fee every time a song from their IP catalogue is recreated and gets revenue from Streaming Platforms like Spotify, Amazon Music and Youtube Music every time their IP is played on the platforms. The second component of the music segment is the retail business in which the company sells its flagship Carvaan music player, which it aims to develop into a platform with recurring subscription revenue.

The company has a film production division called Yoodlee Films which is focused on creating low budget films for third party digital OTT platforms like ZEE5, Netflix and Disney+Hotstar. Period based licences issued to these OTT platforms for a fixed fee constitute the revenue for the firm. The content rights are also sold to TV Channels and TVoD and Airlines.

Television Segment caters mostly to the Tamil Television Industry with Saregama being the market leader there. It has shifted its focus to the industry because of IP Protection. These serials are monetized on YouTube and Facebook apart from Television monetization.

The Publication Segment consists of the Open Magazine, a 100% owned subsidiary of the company which hasn’t been able to turn a profit in its 10 years of operation.

We believe that IP monetization is going to be the main driver of profitability and revenue for the company in the future because of its asset-light nature and the popularity of streaming platforms over pirated content. Besides this, Yoodlee Films’ ability to keep upfront costs low could be beneficial if it can increase its top line.

According to our research, it would be hard for the company to transition from product to platform with Carvaan because of the popularity of streaming, and Television IP isn’t going to be as valued as music IP with the taste for shorter content and popularity of Web Series in the future. The Publication Segment isn’t expected to make profits anywhere in the future.

So our focus throughout this report would be on the prospects of the Music IP Monetization and Film Production Segments and our valuations would reflect the same focus.

Industry Overview, Value Chain and Profit Pools

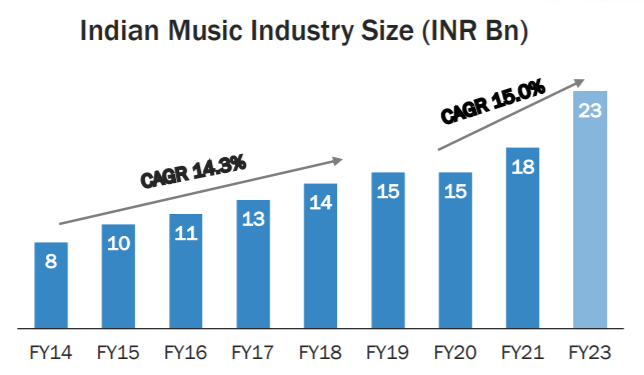

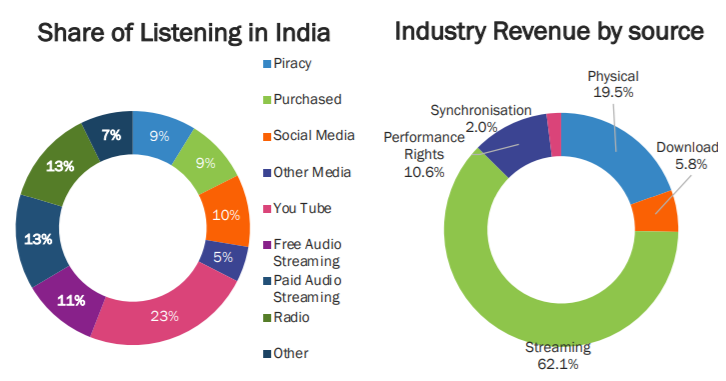

The Indian Music industry was valued at INR 15.3 billion in 2020 and is expected to grow at a Compounded Annual Growth Rate (CAGR) of 15% to cross INR 23.2 billion by 2023, according to the EY FICCI report released March 21 with digital consumption led by smartphone and data adoption driving the growth. Audio Streaming services are expected to become even more popular with their ease of access, cheap data and efficient distribution.

Digital Streaming Services have increased their Daily Active User (DAU) count in India with over 150-200 Million Active users in the country for only Spotify, Amazon Music and YouTube Music. But the overall paid subscribers are estimated to be only 1% of these users, leaving a huge headway for subscription revenues for the Platforms which would have to share with the content producers i.e., Music Production houses like Saregama.

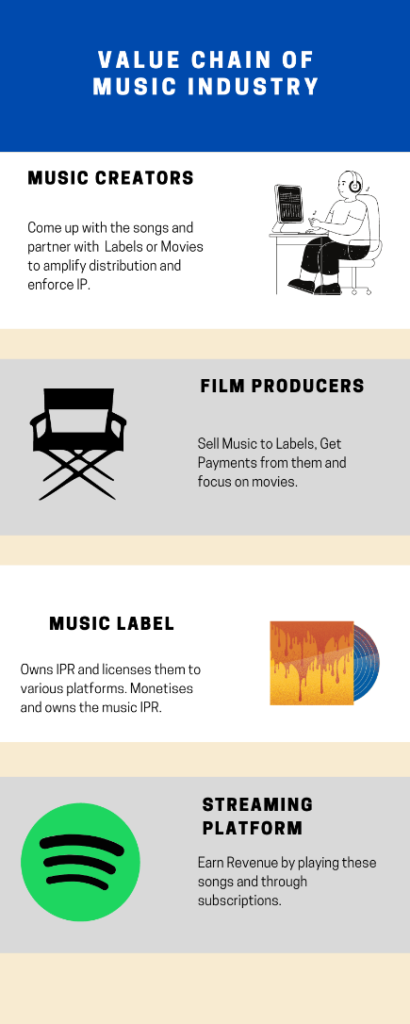

The Music Industry’s Value Chain consists of four players, Music Creators, Film Producers, Music Labels, and Streaming Platform. We need to analyze this value chain to understand where exactly the profit pool lies.

The Value Chain is explained in the infographic given.

In order to find out where the profit pool actually lies we analyze two things, the first being which of the following industries are consolidated between a few players and secondly, we would try to understand the cost and the revenue structure of the players.

Clearly, music generation, film production and streaming are not consolidated industries with many players in each industry. Streaming hasn’t been consolidated in two or three players with players like Spotify, Amazon Music, Jio-Saavn, Wynk, Youtube Music, Russo commanding significant market share. It is a fragmented industry where most companies are making losses because of large payments being made to labels for songs and a lesser number of paid subscribers.

That leaves us with the Music Labels, which is a consolidated industry with only three players commanding more than 98% of the market share in India i.e., Tips, T-Series and Saregama. The industry is also asset-light with respect to IP Generation and Storage which is then used to earn revenues for the firm.

Hence the profit pool lies largely in the music label space in the music industry.

Revenue Sources and Competitive Advantages/Disadvantages for Saregama

Music Labels like Saregama make revenue from three different kinds of sources when it comes to Streaming Platforms:

- Variable Fee- This is charged every time someone plays a song from Saregama’s IP on the platform.

- A Share of Advertising Revenue is given out to the music labels on the basis of the traffic the songs from their catalogue generate and the number of times they are heard.

- A Split of the Subscription Revenues also goes to Music Labels once people take premium services on Spotify, Amazon Music etc.

Apart from the streaming platforms, labels like Saregama have other sources of revenue too, including:

- Song IP That has to be repurchased by labels if they wish to re-create a song from the old times.

- Social sites like Facebook, Instagram, Tik-Tok pay a fixed charge to labels so that they can keep songs on their website as background for short-form content. An interesting source of revenue for Saregama emerged when the song ‘O Beta Ji’ from the 1951 film Albela suddenly became popular for short-form content.

- Fixed Licensing Fees are also levied on brands that use the songs for their advertisements and on TV Channels that use them. Saregama has charged OTT platforms like Netflix, brands like Marico, Berger and Dabur for these.

- Labels also receive royalties from the performance rights of their songs.

Advantages to Saregama

Streaming services have led to a decrease in piracy and the actual benefits being transferred to music labels. What becomes important with the mass adoption of streaming services is that your IP is relevant.

i) Retro Music has gained popularity and relevancy with its constant use in remakes of shows and television series. This has allowed for greater streaming of this kind of music, which is mostly catalogued by Saregama.

As we can see in the picture above, Saregama’s biggest source of revenue has been its 1961-1980 catalogue of music. This is because of the trend of remakes and the relevance of these songs.

ii) The second most important source of revenue is the 2001-2021 catalogue that Saregama has, this reflects the attempts that the company has made to ensure the creation of new IP by getting popular artists on board.

Thus, monetization of old IP and creation of new IP is boarding well for the company. Saregama is uniquely positioned to enjoy the larger trends that are going on in the industry.

iii) Presence Across all Indian Languages: Saregama has a diversified presence across all Indian languages unlike its competitor, Tips, ensuring a diversified and granular revenue.

iv) Saregama’s Catalogue of music is a competitive advantage in and of itself. A typical movie has around 5 songs, if we assume that a new label can acquire be part of 100 movies in a year, they will have 500 songs. Saregama by contrast has 130,000 songs, which are getting more and more relevant by the day. To compete, a new player has to run losses all the while they try to compete with these larger players. Hence the industry is expected to stay consolidated in a few players only.

This has led to a rising licensing revenue for the company, which with the growth of streaming apps, social media companies and OTT platforms, is expected to continue well into the future.

Disadvantages to Saregama

i) Small scale-independent labels have gradually gained market share in various regions of the country. The popularity of new songs isn’t really defined by the artists they feature, but by what becomes viral. It could well be possible that these small labels compete irrationally for market share, taking it away from Saregama and are able to generate much more popular IP.

ii) How long the trend of remaking songs would last is another possible disadvantage to Saregama. If music labels like T-Series have to make large payments to Saregama, they might consciously try to ensure that they re-create songs from their own IP rather than from other labels. This would be similar for content platforms. The rise in revenue can only come from higher sales of IP and not higher prices, which might discourage customers.

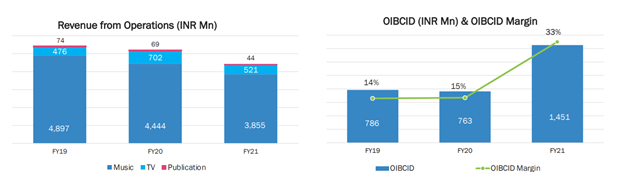

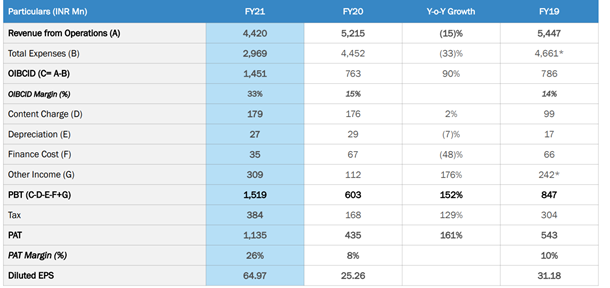

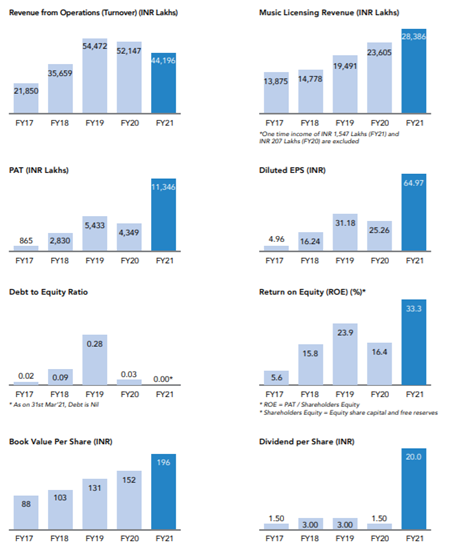

Financial Overview

The large profits posted by the company despite a decrease in the revenue have come from cost reduction, especially in the promotion costs for Carvaan, seconding that cost reduction has been the lower other expense due to lack of new content from the film business. There has been a 20% YoY growth in the Licensing Revenues for the firm and the management is guiding for a 22-25% YoY growth here guided by new music acquisition.

Hence the Topline of 4,420 has seen a 15% YoY decline, due to a 14% decline in the Carvaan sales impacted by the pandemic. The licensing revenues have continued to grow at 20% YoY on an adjusted basis due to a one-off element in FY21 streaming revenues.

Thesis Pointers in Valuation

- 20-25% Guided Growth in the Licensing Business: The company indicated in its conference call that it is aiming to gain 20-25% market share of the new Hindi Music rights available in FY22.

- 15-20% Growth in Films Division: The company has indicated again and again that they have finally created a brand in the film production industry, which would be useful in ensuring that they turn a profit from the division just like they did in FY21. Lower costs in the film production business could well turn it into a cash-generating machine for the company.

Anti-Thesis Pointers

- Advertisement Costs Return: Over the past year, the company has lowered down its advertisement cost on Carvaan. Because we believe it would be difficult for the company to achieve its plan of making Carvaan a platform from a product, if the advertisement costs return, they could be a significant expense on the income statement that does not lead to commensurate benefits for the company.

- Competition from Small Labels: Small labels could create more relevant IP than Saregama with the trend of songs in local languages gaining more ground. It could threaten the monetisation plans for the company and affect our primary assumption.

- ‘Di-worsification’ by RPG: The Open Magazine is a classic case of di-worsification, a possible threat here in the company might be that they do something similar hurting the prospects of growth for the different divisions and the company.

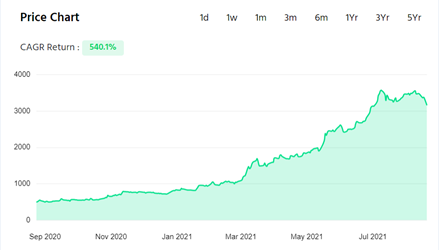

Stock Performance in Past One Year:

With a CAGR of 540.1%, the share price has gone from Rs. 493 in August ’20 to Rs. 3160 in August ’21

Valuation

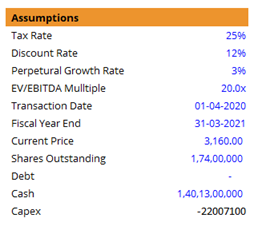

Assuming that the advertisement revenues won’t rise, and the company should be able to materialize its goals of having 22-25% growth in the music revenues every year and a 15-20% increase in revenue from the film division within the next three years. We forecast the revenues for the company.

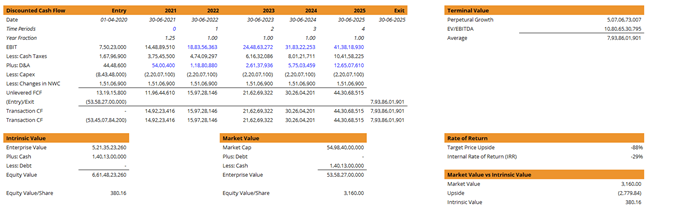

Discounted Cash Flow Valuation :

Using the assumptions above, we get the value of Rs. 380.16 per share. This is far lower than the Market Price of 3160 which means that the market is giving the stock a premium for the expected revenues in the future.

Another reason for the excessive valuation could be the liquidity in the market for the past year. We issue no buy or sell recommendations.

Peer Comparision:

| Price | M-Cap (In Cr.) | EPS | Price/Earnings | Price/Book | EV/EBITDA | ROCE | ROE | P/S | |

| Saregama | 3,239.60 | 5,648.57 | 71.11 | 45.56 | 13.21 | 31.18 | 43.96 | 32.88 | 12.78 |

| Tips Industries | 1,100.55 | 1,427.27 | 40.07 | 27.46 | 12.32 | 19.76 | 18.13 | 15.01 | 15.69 |

| Shemaroo | 115.7 | 314.5 | -3.63 | 0 | 0.55 | 21.97 | 8.16 | 5.21 | 0.61 |

Shemaroo hasn’t been performing well over the past few years, both on the business front and the stock performance front. Our main comparison should, therefore, be with Tips Industries. Looking at Tips and Saregama together, we can clearly see that the valuation assigned to Saregama is justified. However, another caveat is that the music catalogue that Tips has contains songs mostly from the 1990s which haven’t been as relevant as the IP of Saregama. A premium could hence be given to Saregama by investors who think that Saregama’s IP would continue to be more valuable down the line as well.

Sources:

Saregama Corporate Presentation May 2021

Saregama Annual Report 2020-21

Price Chart and Peer Comparision Sourced

ICCI Direct Equity Research Report

Deepseek: A journey from Hedge Funds to AI

Introduction: In this busy and bustling day to day life of ours managing our Finances…

Beyond Numbers: The Human Cost of Infosys’ Layoffs and the Global Normalization of Workforce Reduction

A Familiar Script: Infosys and the Corporate Playbook of Disposable Labor: On February 7, 2025,…

Understanding Tariffs and Their Impact on India

What Are Tariffs? Tariffs are taxes governments levy on foreign imports to make the goods more…

The Economics of Player Transfers in Football

Introduction: In the world of football player transfers are more than just transactions, they are…

Session 5

Session 5- Unraveling Equity Derivatives: Insights from the Fifth Development Session The Fifth Development Session…

An Attempt To Deteriorate The Creditworthiness of Indian Entities

Introduction: The growth story of India in almost every sector is not alien to the…