Announcement of the “Made in China 2025” plan expressed China’s interest and inclination in dominating high technology fields. Derek Scissors, an Asian economist, argues that China predominantly eyes the acquisition of information and the technical know-how of foreign companies. This practice of technology transfer followed by foreign companies being driven out of business in China owing to a takeover by equally or more capable Chinese firms, is believed to be one of the chief reasons behind falling incentive for FDI.

Where on one hand there is a significant decline in investment flowing into the country, on the other China is seen vigorously undertaking infrastructural projects, leaving its mark on neighbouring countries as it progresses towards what is possibly the most ambitious project undertaken by any state.

The One Belt One Road initiative spanning 3 continents and targeting 65 countries, which contribute to a third of the global GDP, is as controversial an investment as it is costly. It finds itself a place in this article because of an apparent ‘Debt Trap’ which China intends to subject these 65 countries to.

On the surface, the need for OBOR is to bridge the infrastructural gap dampening world trade. The 4 to 8 trillion-dollar project seeks to link myriad cultures, achieve socio-economic development, financial cooperation and in the process, create thousands of jobs.

However, with just how China seems to be approaching OBOR, it suggests the pursuit of something the country has lately aspired – global domination. Sri Lanka, one of the countries through which the Maritime Silk Road passes, became the recent victim to China’s ‘debt trap’ policy. The latter sanctioned a loan of 8 billion dollars for the construction of Hambantota port and on former’s default, ended up earning controlling interest and a 99-year lease on the asset. Montenegro, encouraged to undertake a highway construction project costing 3.2 billion dollars, more than half its GDP, funded by Chinese state-owned companies, could find itself in a similar position. Other nations taking this leap of faith include Djibouti, Kyrgyzstan, Laos, the Maldives, Mongolia, Pakistan and Tajikistan.

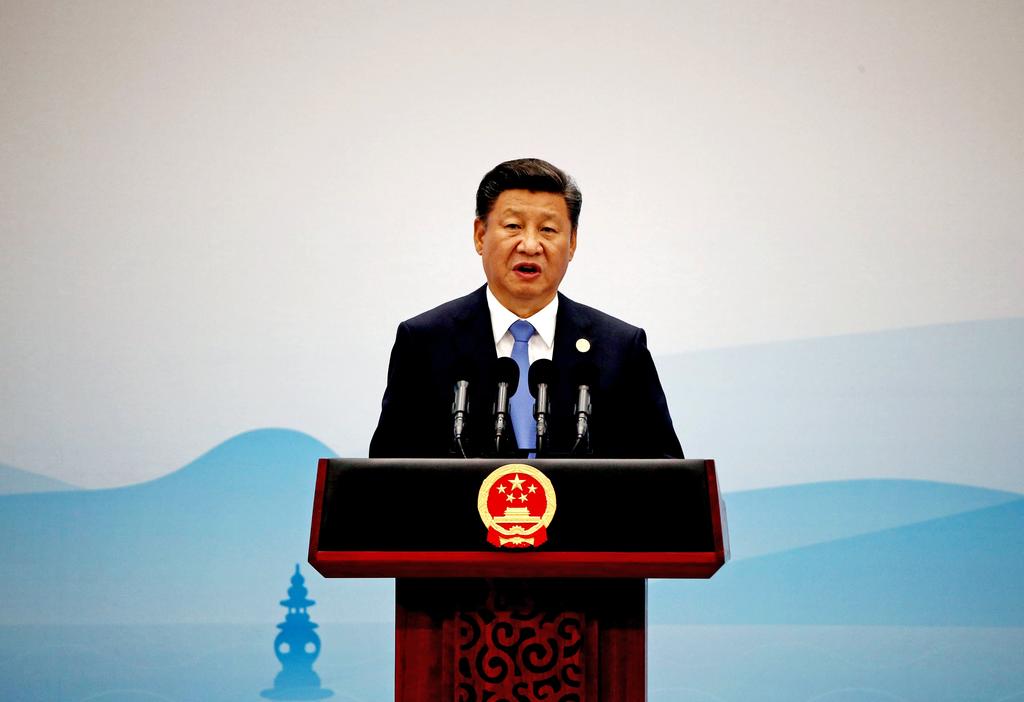

Chinese president, Xi Jinping, addressing the World Economic Forum in 2017 said, “pursuing protectionism is like locking oneself in a dark room; while wind and rain may be kept outside, that dark room will also block light and air.” The lopsidedness in FDI- depreciating inflow as opposed to outflow, which in 2017 was four times than in 2012, throws light on Chinese hypocrisy. At a time where USA continues imposing tariffs, China has found the perfect opportunity to dub itself as the ‘Defender of Global trade’. The imperialist intentions of the country vividly showcase its desire to see Yuan flourish as a trade currency and eventually as a reserve currency.

Prachi Sharma

AlumnaDuring her time at the Finance and Investment Cell, Prachi served as Editor-in-Chief. She undertook several projects, the most notable of which was producing an annual newsletter for Divide.

Pranav Verma

AlumnusPranav was one of the most exceptional Vice Presidents the Finance and Investment Cell has ever seen. His commitment to his work and ability to garner knowledge with utmost patience set him apart.