In this week’s newsletter, we talk about Tata’s Apple ambitions hitting a roadblock, the buzz surrounding Dunzo and jargon explainer.

If you’d like to receive our 3-min daily newsletter that breaks down the world of business & finance in plain English – click here. Or, download the Finshots app here.

Will Tata’s Apple ambitions hit a roadblock?

The deal is finally done — Tata Electronics is buying 100% of Wistron’s iPhone manufacturing business in India. And everyone’s calling Tata the first Indian iPhone maker.

But wait…isn’t Tata already making some stuff for Apple?

It is. When Tata Electronics was set up in 2020, it had set its eyes firmly on making the iPhone. But the first green light it got was only to make the enclosure or casings for Apple at its plant in Hosur. So Tata probably thought, “How can I save myself the trouble of setting up a brand-new factory and then the hassle of convincing Apple of my tech chops?” The answer was — just buy an existing Apple-certified factory.” Ergo, the acquisition of Taiwan-based Wistron’s India operations.

And as per a report in Rest of World, Tata has been doing everything in its power to get ready for what’s going to come next.

For instance, Tata’s training ‘factory-ready’ students by teaming up with local colleges. It has a unique ‘Digital Manufacturing’ diploma that’s a mix of on-the-job training and classroom programmes. And for 200 of its women workers, it’s even sponsoring a BSc in Manufacturing degree. Oh, and not to forget the crucial bit — it’s poaching engineers from rival Apple manufacturer Foxconn.

Yup, Tata is dead serious about taking a nice slice of the Apple pie. And it’s not surprising why that’s the case.

See, Apple’s hell-bent on diversifying its manufacturing beyond China. And India seems to be shaping up to be their preferred destination. We’re doling out incentives for manufacturing electronics. And don’t forget that labour is abundant and still fairly cheap. So if you believe the rumours, half of all iPhones could be made in India by 2027.

But wait… if there’s so much happening here, why on earth is Wistron exiting the iPhone business? Should Tata be worried about something?

Well, the primary reason appears to be that despite being Apple’s first supplier in India, Wistron hasn’t grown much. In fact, it isn’t actually a full-fledged manufacturer for Apple. It’s just an assembler. Wistron remained a tiny cog in the wheel. And that meant that it couldn’t squeeze Apple for higher margins for the work that it did. Apple would’ve just packed up and moved the business to its other suppliers.

The Economic Times also says that Wistron couldn’t get its foot in the door for the more lucrative ‘vendor-managed inventory holding’ either. Think of this as a warehouse that keeps all the components needed to make an iPhone. They forecast demand. And then, when the time comes, these components are quickly sent for final assembly to wherever it’s needed. This way, Apple needn’t break its head over inventory.

If Tata gets stuck in the same rut as Wistron, its money-making prospects will hit a wall.

The competition is intense too.

See, Apple has two big suppliers — Foxconn and Pegatron who’re both expanding in India. And the thing is, Apple has been in a relationship with Foxconn for at least two decades now. That means the China+1 diversification strategy can be executed in India through these existing relationships itself. These entities have far more experience in this business than the fledgling Tata Group. They’re bigger manufacturing experts. And Foxconn and Pegatron are already engaged in inventory management for Apple.

So why would the iPhone maker move its business into Tata’s camp?

Not to forget that Tata hasn’t quite made a great first impression either.

What do we mean?

Okay when Tata set up its factory in Hosur, a town in Tamil Nadu that’s close to the Bengaluru border, it was done in record time. Everyone was quite surprised at the quick progress and they expected big things from the Indian conglomerate. Unfortunately, when Apple asked for 25,000 cases or enclosures a day for the iPhone, Tata stumbled. It couldn’t churn out that many of them. But that’s not the worst part. 1 in 2 cases were found to be faulty. They were defective and didn’t meet Apple’s high standards.

Having said that however, this was to be expected. You can’t just set up a manufacturing plant and hope to produce something overnight with absolutely no defects. There’s a learning curve — a steep one at that. And Tata is likely on this path for now.

So yeah, Tata might buy out Wistron, but it’s going to have its work cut out. And the word on the street is that Tata’s throwing money at Wistron’s Taiwanese management in a desperate bid to get them to stay and offer their expertise.

It’s not going to be easy. And now we’ll just have to wait and see how Tata’s Apple ambitions play out.

What’s going on at Dunzo?

Dunzo has been in the news this week.

First, Deloitte, the hyperlocal firm’s auditor, said they feared the firm was going bankrupt. They said Dunzo had more liabilities than assets. And that if push came to shove, Dunzo may not be able to pay its dues.

Then, Dunzo announced that it would actually become “corporate-level profitable” in 12 months!

And you have to wonder — what on earth is really happening at Dunzo? Who’s telling the truth?

So let’s take it from the top.

In 2015, Kabeer Biswas had an idea. What if he didn’t want to run to the laundry store to pick up his clothes? Could he get someone else to do it? He created a WhatsApp group and began taking requests from friends. He would do the deliveries for others. Soon the word spread in Bengaluru and everyone wanted a piece of this personal concierge service. Anything to avoid being on the roads doing random tasks.

Soon, the idea morphed into a full-fledged business called Dunzo. And if you wanted evidence of the firm hitting the fabled “product-market-fit”, it’s when a new phrase began brewing — “Dunzo it”.

The brand had become a verb. At least in Bengaluru where the company had set up HQ. And when something magical like that happens, you’d like to believe that the company in question has made it. That it has built a loyal customer base. That brand loyalty would allow it to diversify into adjacent businesses. And that it’s going to be tough for rivals to dislodge it from the peak.

So, the question naturally was — what’s next for Dunzo? What could it do beyond a simple pick up and drop service?

Because the company needed something that was a daily use-case. After all, you probably won’t send packages with misplaced keys or documents everyday, no? So Dunzo figured that one way to solve this problem would be to simply pick up and deliver daily essentials from the local supermarket or the neighborhood kirana store.

But not everyone was a fan of this model.

You see, one argument is that running a pick-up-and-drop service for supermarkets isn’t efficient. If people want stuff delivered in 10 minutes, everything has to work like clockwork. For instance, the most ordered items have to be placed closer to the pickup zone so that packing can happen faster. But you can’t force a supermarket to change their layout. They might have their own rationale for how they’ve displayed products.

The other argument is that isn’t lucrative either. You’re just depending on commissions for the orders you’re delivering. Also, you can’t negotiate with FMCG companies and earn higher margins on the products.

So in order to fix these problems, the simplest solution was to open your own store. Or what’s known as a dark store in quick commerce parlance. It’s just a warehouse — you store, pack, and ship products from here.

And Dunzo decided to do this. After all, when the pandemic struck, grocery delivery became all the rage. So it seemed to make sense to double down on grocery delivery. Especially since the massive heft of Reliance jumped in to back the company. The oil-to-everything conglomerate handed over nearly ₹1,500 crores and picked up a 26% stake in Dunzo.

But maybe that money just wasn’t enough. Because the problem was that setting all this up came at a massive cost too. It’s not asset-light like a pick up and drop service where you only need a fleet. You have to pay rent on dark stores which is super high in the affluent areas you’d want to serve. There’s the need to buy and store inventory. And your delivery rider costs will also soar because you need more personnel to stick to your 10–20 minute delivery promise.

As per The Ken, Dunzo’s cost per task (CPT) which is the cost that it incurs on every order was ₹80 when using dark stores. But under the earlier third-party store model, it was just ₹30.

The pivot didn’t seem to work, huh?

And there was a bigger problem too. See, Dunzo was already quite late to this party. There was a new upstart in town called Zepto which had quickly raised boatloads of money. And then there was Swiggy, Zomato (through Grofers), and BigBasket too. Also, maybe ‘Dunzo it’ and the brand loyalty hadn’t quite seeped into the psyche of non-Bengalureans. So Dunzo had to do something — it offered massive discounts and it splashed money on advertising during the IPL.

Now you know that burning cash this way simply isn’t sustainable. And when these discounts were rolled back, customers went in search of other alternatives.

The end result?

Dunzo lost a mammoth ₹1,800 crores in FY23. It was 8 times the revenues it made.

But if you want a bigger picture of Dunzo’s troubles, Inc42 says that while Dunzo raised $408 million from FY19 to FY23, it spent $401 million.

And finally, that’s what led to Deloitte saying that Dunzo doesn’t have enough money in the bank anymore. Remember that it couldn’t even pay salaries to employees a few months ago.

So, is Dunzo done for?

Well, we don’t know yet, but, Dunzo certainly doesn’t seem to think so. It’s pivoting or tweaking its model again. And it has actually returned to home base. It said, “Hey, our brand became a verb because we could pick-up and drop anything in a jiffy. So why not offer this service to other businesses?”

Dunzo wants to focus on being a logistics player through its B2B vertical called Dunzo Merchant Services.

Meanwhile, it has realized that the dark stores aren’t quite working out. It has already shuttered a whole bunch of them — some estimates say over 70%. And of course, it laid off hundreds of employees.

So yeah, with a small fundraise, a different business model, and a leaner team, Dunzo believes that Deloitte’s got it all wrong. Because the caveat also is that Deloitte was looking at the FY23 numbers. Over 7 months have passed since then. And Dunzo now thinks the elusive profitability is inevitable and that it’s just a few months away.

We’ll just have to wait and see whether Deloitte or Dunzo will eventually turn out to be right.

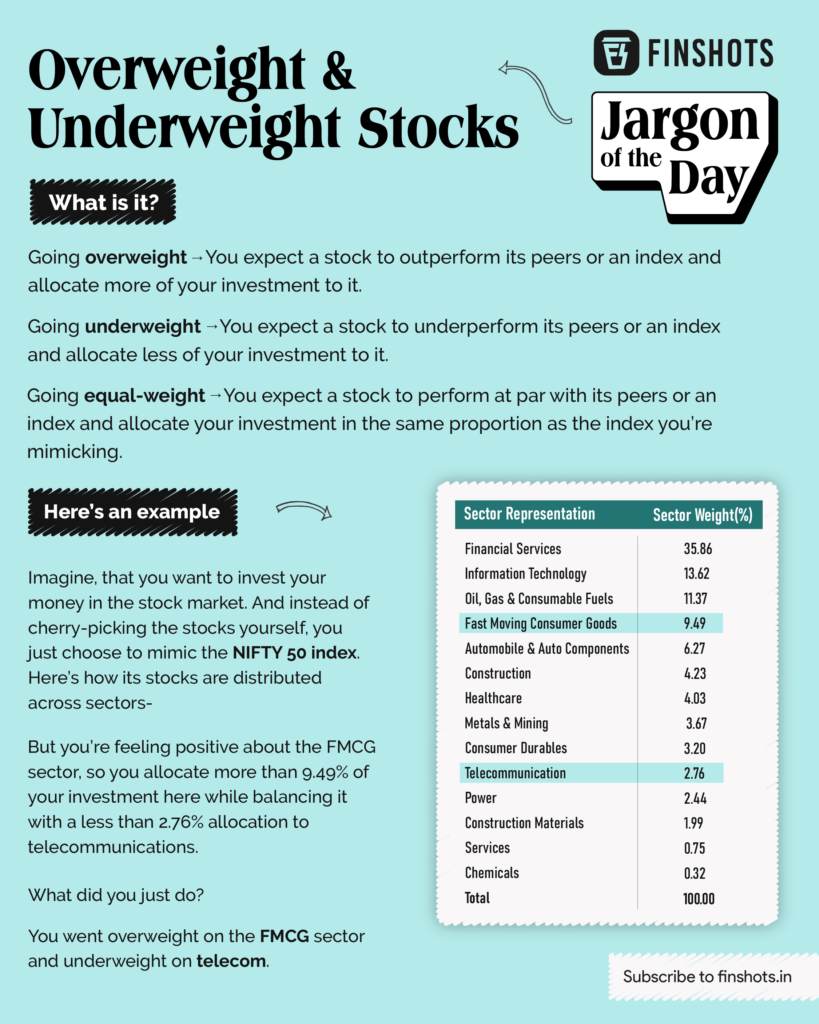

Jargon of the Day  : Overweight & Underweight Stocks

: Overweight & Underweight Stocks

And that’s all for today folks! If you learned something new, make sure to subscribe to Finshots for more such insights 🙂

Finshots is now on WhatsApp Channels. Click here to follow us and get your daily financial fix in just 3 minutes.

Finshots is now on WhatsApp Channels. Click here to follow us and get your daily financial fix in just 3 minutes.