In this week’s newsletter, we talk about TCS’s source code theft, the BCCI taking Byju’s to court, P/E Ratios and a lot more.

If you’d like to receive our 3-min daily newsletter that breaks down the world of business & finance in plain English – click here. Or, download the Finshots app here.

Did copy-paste really cost TCS $200 million?

2 days ago, there was a tweet from a gentleman named Dale Vaz that said–“Copy Paste may cost TCS 1,750 crores in fines!!”

What?? How??

Well, that’s the question we had. So we went digging.

This case goes back to 2019 and involves a company called Computer Science Corporation (CSC). They are a software service provider primarily working with insurance companies. One of their products “Vantage” has been a staple of the insurance industry. It helps companies create new policies, calculate returns and manage claims and CSC has been licensing Vantage to some of the biggest insurance players in the world, including Transamerica–a US-based life insurance company.

This company had been using Vantage since at least 1994. However, in 2018, Transamerica announced that they were going to migrate from CSC’s Vantage to a different solution marketed by TCS, called BaNCS. And in the process, Tata Consultancy Services bagged a $2 billion contract.

CSC obviously wasn’t very happy with this development. They believed TCS did not have a product ready for the US market. The BaNCS software worked well in Europe. But the US market was different. It had different requirements, different regulations etc. CSC believed that it should have taken TCS at least 5-7 years to adapt BaNCS for the US market. However, TCS was promising to do it in record time. So either they were lying or there was something amiss.

And CSC pegged that there was in fact something more sinister brewing in the background.

What led them to this conclusion you ask?

Well, several things. First, TCS’s history with Transamerica. The Indian software giant had been helping the company maintain their IT systems since 2014. And as part of the maintenance work, they had access to Vantage. Then in 2019, they hired close to 2,200 Transamerica employees, many of whom were intimately familiar with CSC’s Vantage solution. And right around the same time, one of CSC’s employees found something very interesting. He had been working at one of Transamerica’s facilities overseeing the use of Vantage software. He was there to help, of course. But also to keep an eye on things. And on March 2019, he was marked in an email discussion between TCS and Transamerica employees. The folks at Transamerica were trying to figure out how the Vantage software did a particular set of calculations. And what happened afterwards, depends on whose version you want to believe.

Here is CSC’s version: TCS was having some difficulty replicating these complex calculations in the BaNCS platform. So in a set of email exchanges, they accessed and shared confidential information about Vantage with several colleagues, including those who worked on the BaNCS development team. One team member even copied the source code and shared it via email. Hence the name “copy-paste” saga.

But then, there is TCS’s version. They say that they were simply responding to a routine query. After all, they were expected to help Transamerica maintain Vantage. And so when one of Transamerica’s employees was concerned that a certain set of calculations wasn’t accurately accounting for a particular scenario, he reached out to the people at TCS. And they responded by accessing Vantage’s source code to troubleshoot this issue. The licensing agreement does in fact cover such use, so long as it helps Transamerica maintain their systems.

So who do you believe?

Well, it doesn’t matter who you believe. Because a jury in the US court has found TCS guilty and they have asked the company to pay $210 million in fines. But that’s not all. Even if you did want to side with TCS, this isn’t the first time they have been found guilty.

Take the case of Epic Systems vs TCS. Epic is a leading developer of electronic health record software. And in 2003, they licensed their software to the largest managed healthcare provider in the US–a company called Kaiser Permanente.

Kaiser in turn signed a deal with TCS back in 2011, to test and maintain their systems. Now at first, TCS had limited access to Epic’s electronic health record software even though they were expected to help Kaiser maintain and rigorously test the solution. They even asked Epic to offer better access, which the company promptly declined.

But then, TCS hired a gentleman out of Chennai. He had previously worked for a different company and he had gained full access to Epic’s health record solution by falsely identifying himself as an employee. And at the insistence of his superior at TCS, he shared his credentials (which surprisingly were still valid) with several TCS employees.

They then used this information to build a competing solution called Med Mantra and even drafted a comparative analysis between Med Mantra and Epic’s software to win clients in the US. The comparative analysis sheet had intimate details about Epic’s software that would have been available only to people with access to confidential information. And when a TCS employee, Philip Guionnet saw the document, he decided to blow the lid on this whole affair. Epic sued TCS and won $140 million in damages.

So did copy-paste really cost TCS millions of dollars?

Of course not. It’s not just copy-paste. It’s more than that. During the court case with Epic, TCS employees even lied to investigators. That isn’t an oopsie. That is deliberate misdirection. And perhaps it has to do something with how intellectual property is treated in India. TCS would have likely gotten away with this if this happened back home. However, courts in the US don’t give you a free pass. They will hold you accountable. And in this case, accountability has come at a very steep price.

In June this year both TCS and Transamerica decided to mutually terminate their $2 billion contract. So this is a lose-lose for TCS anyway you look at it.

Byju’s owes Indian cricket ₹160 crores?

Let’s take it from the top.

In 2017, Chinese phone maker Oppo won a 5-year deal to stamp its logo on the front of the Indian cricket team’s jersey. It spent a whopping ₹1,100 crores. But just a couple of years into the deal, Oppo had second thoughts. It felt that it had overpaid. We don’t know why but it probably didn’t see a big boost to its market share even after this prestigious sponsorship. Its other Chinese rivals seemed to be getting ahead. So Oppo looked for an exit.

Enter Byju’s, the most valuable edtech in the world. It promised to take over the rest of the contract. And Byju’s would pay the millions to BCCI.

Why though? If Oppo had already felt that the deal was too expensive, why would anyone willingly jump into the fire?

Well, maybe Byju’s had its rationale. After all, Oppo was a Chinese brand trying to appeal to the Indian psyche. Byju’s on the other hand was a Made in India brand that had already become the most valuable edtech in the world by then. It was valued at $6 billion and investors were lining up to deposit even more cash in Byju’s’ bank account.

Also, don’t forget that Byju’s was spreading its tentacles back then. It was expanding internationally to the UK, Australia, and New Zealand. Now these are cricket-loving countries too. Also, there’s a large Indian diaspora here. So you’d imagine there’d be a lot of eyeballs too.

But why spend all this money on a sports sponsorship? Why not just advertise on TV?

Well, as Andreas Kitzing, CEO and founder of sports sponsorship marketplace Sponsoo puts it:“TV advertising just informs someone that a startup exists, but sponsoring a football club creates an immediate emotional connection with the brand.”

Replace football club with cricket team and it just might be the same thing. Maybe Byju’s felt that it could create that emotional connection in the minds of Indian kids and their parents. Get them to open up their wallets more this way and rake in the money.

And within a few months of striking the deal, the pandemic hit. Everyone turned to learning online. And investors rushed to pump in more money to accelerate the company’s growth. Maybe all this money in the bank meant that, unlike Oppo, Byju’s didn’t bother about calculating the Return on Investment (ROI). After all, the valuation had soared further — even hitting the $20 billion mark. So when they had to renew the jersey sponsorship contract in 2022, Byju’s didn’t think twice. It offered a 10% higher price to the BCCI and extended the deal till November 2023. This way, the Byju’s name would still feature prominently on the Indian jersey during the T20 World Cup and the ODI World Cup. That would probably be a huge branding boost.

But as luck would have it, shortly after it signed on the dotted line, everything began to come crashing down.

See, Byju’s took 1.5 years to publish its financial accounts for FY21 (the year ending March 2021). And when it finally made this public in September 2022, everyone was in for a rude shock. While Byju’s was busy projecting revenues worth ₹4,400 crores, in reality, the revenues were only ₹2,500 crores. But what was even worse? The losses! It surged to a whopping ₹4,500 crores — 20 times higher when compared to FY20. People began questioning what was going on at the company. Investors didn’t want to put up more capital.

It had to cut costs quickly. And the jersey deal didn’t look attractive anymore. So in November 2022, Byju’s tried to wriggle its way out. It wanted to cancel its deal. Get out of it early.

And here’s where the crux of this dispute lies. See, BCCI knew it couldn’t find an alternative quickly. It was only in July 2023 that Dream11 finally came on board. Now apparently, Byju’s hasn’t paid its dues. And that’s probably why the BCCI took Byju’s to the NCLT. At least that’s what media reports indicate.

But wait…isn’t NCLT a bankruptcy court? And Byju’s isn’t actually bankrupt. Not yet anyway. So why did BCCI approach the NCLT for its ₹160 crores?

Well, NCLT might have started life under the Insolvency and Bankruptcy Code 2016 (IBC). And IBC’s raison d’etre is to salvage companies or liquidate them entirely before their assets lose all value. But here’s the thing — people have been using NCLT as a debt recovery platform.

See, there are two types of creditors to a company — a financial creditor and an operational creditor. The former are entities that lend money to the company i.e. banks and financial institutions. The latter are entities to whom money is owed in the course of normal business. It could be vendors or suppliers of goods. Or it could be someone like the BCCI which entered into a deal to supply part of the jersey for Byju’s logo in exchange for money. Now if Byju’s doesn’t pay up, BCCI will try to recover it. And since NCLT basically deals with company disputes, it ends up being the court of choice for money matters..

Also, here’s something Mint wrote in 2017, a year after NCLT was established.

Operational creditors have finally gotten hold of a useful tool to get their dues back from defaulting companies. When the bankruptcy code is triggered, an insolvency professional is given charge of the business and the management of the company can be temporarily dispossessed. The prospect of losing control is causing defaulting companies to settle, especially in cases where the dues are relatively small.

Basically, if the NCLT believes that this a case of a company fighting insolvency, it could trigger the IBC code and take over the management. Byju’s wouldn’t want that, right? After all, there’s plenty of news suggesting it hasn’t been able to pay employees or raise fresh capital. So it might fear that the NCLT could take a drastic step. Byju’s might try and settle the dues faster. Or at least part of it.

Maybe that’s why instead of giving a usual “No comments” statement about this matter, Byju’s actually said that they’re trying to settle the matter with the BCCI.

Now we’ll just have to see how this plays out for Byju’s. All we can definitely say is that the sponsorship which was supposed to be a branding exercise has probably done more harm than good.

Money Tips  : The 30-Day Savings Rule

: The 30-Day Savings Rule

Often we buy a lot of things we really want. But do we always take out the time to evaluate if we really need them?

Maybe not.

That habit can quickly add up and translate into constant impulse purchases because of which we might postpone necessary payments. To put things in perspective, imagine that you badly want to buy a pair of new shoes. Despite the purchase overstepping your monthly budget, you go for it.

And just so that you don’t go broke you request your landlord to defer your rent payment. Or even worse, you might decide to pay only the minimum amount due on your credit card and carry forward the rest. In both situations you’re inviting an additional cash crunch next month, plus a huge interest burden too.

But what if you were to follow the 30-day savings rule?

Here, you wait for 30 days before you actually decide to buy something that isn’t absolutely necessary. This way, you not only give yourself time to mull over the purchase but also push yourself to save by avoiding other unwanted buys.

See, impulse buying is an emotional decision. So, when you follow the 30-day savings rule you kick the emotion out of the picture.

At the end of it you’ll end up with one of the two results.

- Realise that you can do without those pair of shoes.

- Or have some money saved because you felt that you really have to get them.

What do you think of this saving hack? Let us know.

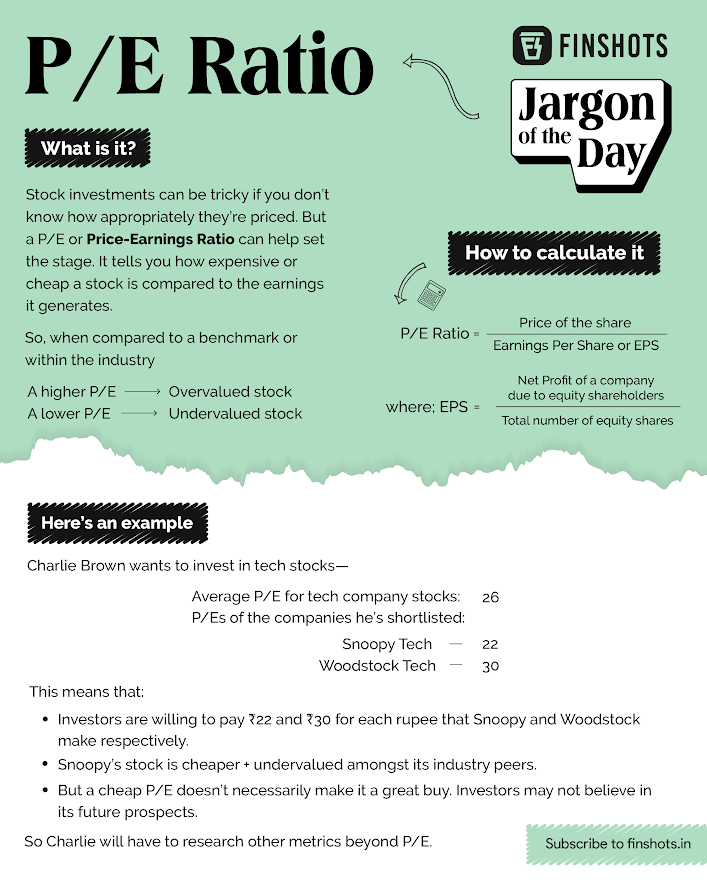

Jargon Explainer  : P/E Ratio

: P/E Ratio

And that’s all for today folks! If you learned something new, make sure to subscribe to Finshots for more such insights 🙂

Finshots is now on WhatsApp Channels. Click here to follow us and get your daily financial fix in just 3 minutes.

Finshots is now on WhatsApp Channels. Click here to follow us and get your daily financial fix in just 3 minutes.