The Union Budget 2023 has been released during a period of “polycrisis” in geopolitical, economy, and the environment. Yet, the IMF’s World Economic Outlook, published the day before the Budget, referred to India as a bright light with a growth rate of above 6%. Therefore, the Budget is aware of the potential and problems this brings.

Finance Minister Nirmala Sitharaman’s fifth consecutive Budget includes something for everyone, including adjustments to income tax bands, a capex bazooka, and a boost for affordable housing. Before the 2024 general elections, this was the last complete budget of the Modi 2.0 administration. While some would say that the Budget 2023 was populist, FM Sitharaman committed to the path of economic responsibility.

Despite being financially responsible, it makes investments in growth-promoting sectors including essential infrastructure and emerging industries like Data, AI, and Robotics. By concentrating on the changes required by climate change and achieving Net Zero, India’s GDP may increase by $371 billion (about ₹ 29 lakh crore) and 4 percentage points by 2030, leading to the creation of 12 million new employment and significant cost savings. In the Finance Minister’s Budget Speech, green growth played a significant role. Funding was provided for energy storage, energy transition, and sustained support for industries like green hydrogen.

This is the first budget in ‘Amrit Kaal‘ and the vision is to be a knowledge-based, technology-driven economy with sound public finances and a thriving financial sector. For this, Jan Bhagidari through ‘Sabka Saath, Sabka Prayas‘ is essential. The economic plan for realising this vision focuses on three key areas: first, creating enough chances for residents, particularly young people, to realise their dreams; second, giving growth and job creation tremendous impetus; and third, enhancing macroeconomic stability. In the journey to India@100, Economic Empowerment of Women, PM Vishwakarma Kaushal Samman (PM VIKAS), Tourism and Green Growth are the four opportunities that can be transformative during the Amrit Kaal.

The Budget adopts the following seven priorities and they complement each other and act as the ‘Saptarishi’:

- Inclusive Development

- Reaching the Last Mile

- Infrastructure and Investment

- Unleashing the Potential

- Green Growth

- Youth Power

- Financial Sector

INDUSTRY WISE ANALYSIS

The budget also covered a number of industries and Hon’ble FM Nirmala Sitharaman announced several new provisions for the same. Let’s delve deeper into each industry.

Agriculture

The support for the Agri-tech industry has increased this year after acknowledging the rising demand and supply of new-age tech in agriculture and related industries in last year’s budget by using the term “Agri-tech” for the first time in the announcement.

The budget for this year featured a number of new incentives designed to encourage agri-tech businesses across the nation. The most notable sector-related announcements included the creation of an Agriculture Accelerator Fund to support agri-business startups, an investment of ₹2,516 crore to computerise 63,000 primary agricultural credit societies, a stronger focus on digital payments through a programme for digital agriculture infrastructure.

The Agriculture Accelerator Fund will greatly benefit the industry by encouraging young entrepreneurs to enter the sector and by bringing in creative and affordable solutions to address the challenges faced by farmers, particularly in terms of enhancing profitability and outfitting modern technology. Despite being the largest contributor to the GDP, the agriculture sector still faces a wide range of challenges. Furthermore, disease infestation has been a serious issue that has adversely impacted 35% of all crop productivity. The Atma Nirbhar Clean Plant programme, which has been given a budget allocation of 2200 crore, will give farmers access to clean, disease-free planting material, which will significantly increase crop yield.

The rise in the agricultural credit target to ₹20 lakh crore demonstrates the government’s desire to strengthen the industry. The government’s support for organic farming and the establishment of 10,000 Bio Input Resource Centers will also be a major driver for the industry, improving crop quality and fostering sustainability in agricultural operations. The government wants to use public-private partnerships to implement a cluster-based value chain model. A national cooperative database will be put up to map decentralised storage capacities around the nation in order to achieve this objective. With the help of this effort, late-mile linkages farmers will have somewhere to keep their goods and receive fair compensation. The government plans to provide assistance in turning the Indian Institute of Millet Research into a premier facility. The cultivation of millet would help India maintain its status as the global centre for nutrition.

The government’s choice to provide digital public infrastructure for agriculture, with a focus on inclusive development for farmers, enables an open source, open standard, and interoperable public good that includes farmer-centric solutions. This would undoubtedly assist in enhancing farmers’ access to farm supplies while also enhancing market knowledge, supporting the expansion of agri-tech and startup companies. The government also unveiled plans to encourage farm mechanisation in order to increase farmer revenue. Three artificial intelligence centres of excellence will be established, where top corporations will work with the government to implement AI in the fields of agriculture and health.

Health

FM Nirmala Sitharaman proposed a rise of 3.82% over the prior budget by allocating ₹86,175 crore to the Department of Health and Family Welfare for the fiscal year 2023–24.

In reality, it represented a decrease. This is actually a decrease of funds when inflation is taken into account. Additionally, it was found in the budget records that the government did not give the Department of Health the funding it had requested during the previous fiscal year. For the FY 2022–23, the revised projections only totalled ₹76,370 crore, compared to the budget forecasts of ₹83,000 crore. The budgeted estimate was lower than the revised estimate for the first time this year, according to a review of the budgets for the five financial years before this one.

In her budget speech, FM Sitharaman announced the beginning of a specific mission to eradicate Sickle Cell Disease by 2047. It will involve raising awareness, screening everyone in the impacted tribal territories between the ages of 0 and 40, and providing counselling through joint efforts between federal and state administrations. The budget documents do not list a specific head that would indicate how much money would be allocated to fighting Sickle Cell Anaemia this year. However, the Health Ministry has made it clear that it will be a component of the National Health Mission, an overarching plan for administering a number of programmes, in which the Center is responsible for managing 60% of them and state governments are responsible for the other 40%. It should be mentioned that India has set yet another deadline for the elimination of this disease despite failing to meet earlier dates for other ailments. Examples include filariasis (2017) and kala azar (elimination target 2020). Their current deadlines are 2023 and 2030, respectively. India plans to eradicate tuberculosis by 2025, but experts doubt that this goal can be met.

In addition, 157 new nursing colleges are going to open, according to the Finance Minister. In addition to making India self-sufficient in nurses, this will also contribute to the creation of human capital for other nations, particularly those with ageing populations.

“Through centres of excellence, a new initiative to support pharmaceutical research and innovation will be implemented. Additionally, Sitharaman remarked, “We will encourage business to invest in R&D in certain key areas. According to the budget records, a significant increase in funding for this department is indeed made under the heading “development of the pharmaceutical industry.” In comparison to the previous year’s allocation of ₹100 crore, ₹1250 crore have been suggested this year. This is done with the intention of lowering the cost of producing medications or medical devices by building infrastructure facilities. The pharmaceutical sector has praised this increase.

The major concern is that the government did nothing to lessen the reliance on imports of equipment. In FY22, the imports of medical equipment increased by an alarming 41%.

Education

The Union government will redesign teacher education, create centres of excellence at the district level, and establish a national digital library to provide children and youth with high-quality books on a variety of subjects to help them recover from the learning losses brought on by the Covid-19 pandemic. The amount allotted for education in the Union Budget 2023, which was unveiled on Wednesday by Finance Minister Nirmala Sitharaman, is the highest amount ever and represents an increase of almost 8.2% above the amount estimated for 2022–2023. The sector was given a budgetary allocation of ₹1,04,277.72 crore in the 2022–23 budget projection, however this was reduced to 99,881.13 crore in the revised estimate. The allocation for this year has increased from the revised estimate by 13%. The Budget creates a comprehensive roadmap for India@100 and sets a strong basis for transforming India into a technology-driven knowledge-based economy by supporting entrepreneurship, education, skill development, research and development, digital infrastructure, green growth, and job creation.

Increased funding will hasten NEP 2020 implementation, benefiting students further by increasing their employability, and bolstering efforts to transform India into a knowledge- based economy. The National Book Trust has been tasked with fostering a reading culture by disseminating literature in a number of local languages. The National Education Policy, 2020, will be implemented in accordance with this budget at the local level.

The allocation for the Higher Education Funding Agency is not mentioned in the budget document (HEFA). HEFA provides higher education institutions with 10-year loans for infrastructure improvement. The agency’s budget was substantially reduced from ₹1 crore in 2021–2022 to ₹1 lakh in 2022–2023 budget.

Railways

In keeping with the Budget’s focus, the Railways were given their highest budget ever for 2023–24: ₹2.4 lakh crore, an increase of Rs 1 lakh crore over the previous year.

For FY24, the Railways have maintained a capital expenditure target of ₹2.6 lakh crore. The Finance Ministry provided the Railways with Gross Budgetary Support of ₹1.59 lakh crore in the Revised Estimates, which is more than Rs 20,000 crore than what was initially allotted in the previous Budget. This amount, ₹2.4 lakh crore, represents an unprecedented increase in Gross Budgetary Support for the upcoming fiscal year. In addition to a variety of initiatives (new lines and doubled current tracks), the Railways will concentrate on quickening the pace of development.

By the next year, four factories will work in tandem to build two to three Vande Bharat trainsets each week for the Railways. Additionally, Vande Metro trainsets will be available for transportation between cities and locations within 50–60 kilometres. Other regions of the nation’s production facilities could be expanded to allow for the weekly release of two to three trainsets. There are proposals for Railways to introduce hydrogen-powered trains, which will initially travel on historic routes. The Railways expects its commercial operations to generate an additional ₹22,000 crore in revenue the following fiscal year. As a result, instead of the ₹2.42 lakh crore estimated for current fiscal year, its revenue receipts are maintained at ₹2.65 lakh crore.

Aviation

Due in large part to a steep decrease in the amount set aside for Air India Asset Holding Ltd, the budget for the Ministry of Civil Aviation has been more than halved to ₹3,113.36 crore. It consists of ₹86.66 crore in capital and ₹3,026.70 crore in income.

The reduced allocation for the fiscal year 2022–2023 is ₹9,363.70 crore, which is less than the initial estimate of ₹10,667 crore. For the purpose of enhancing regional air connectivity, FM Nirmala Sitharaman announced the revival of 50 more airports, heliports, water aerodromes, and advanced landing grounds.

Despite the fact that the country has the fastest-growing aviation market in the world, Tier-I cities, particularly big metros like Delhi, Mumbai, Bengaluru, and Chennai, continue to produce the majority of air travellers. Although there has been a slight increase in air travel from Tier-II and Tier-III cities. The only way to effectively boost air travel penetration over the next two decades is to make it more widely available. All airports in Tier-I cities are now operating at capacity. Only 30% of Indian households now have access to an airport. Construction and operationalization of airports in smaller cities will expand air travel’s reach and greatly expand India’s aviation footprint under the new budget.

Automobile

The automotive industry will be forever changed by the Union Budget 2023. The budget echoes the GOI’s emphasis on green mobility and is futuristic. Notable programmes that will have a long-term effect on the industry include the extension of the customs tax exemption to imports of capital goods and equipment needed for the production of lithium-ion cells for batteries used in electric vehicles. This admirable action will strengthen the EV ecosystem by lowering the price of EVs throughout the nation. The government’s signature programmes

Make in India and Aatma Nirbhar Bharat will also benefit from the focus, with both consumers and automakers benefiting. The Indian Semiconductor Mission‘s funding of ₹3000 crore will undoubtedly contribute to the ecosystem’s growth in the semiconductor and display manufacturing sectors, ₹1000 crore for the updated plan to establish semiconductor factories in India and ₹4 lakhs for the plan to establish display fabrication facilities in India. This astounding action is a significant step toward alleviating the nation’s present semiconductor scarcity.

The FM’s recently announced Vehicle Scrappage Policy will make sure that pollution levels are under control. The elimination of automobiles older than 20 years will boost overall vehicle sales and hasten e-vehicle adoption. This will increase demand for parts generally.

Tourism

India’s emphasis on digitalization was reaffirmed by the announcement of the release of an app to improve domestic travel experiences. The “Dekho Apna Desh” initiative, which focuses on sector-specific skilling and entrepreneurship development while facilitating tourism infrastructure under the Vibrant Villages Programme, and setting up a “Unity Mall” to promote “One District, One Product” for GI products and other handicrafts, will significantly support domestic tourism.

The travel and tourist sector did not receive any relief from this budget’s tax reduction, nevertheless. Instead, without any threshold exemption, the proposals raised Tax Collected at Source (TCS) on outbound travel and other LRS transactions from 5% to 20%. Outbound passengers incur additional costs as a result of these high tax rates, which also have a detrimental effect on tour operators trying to recover from the pandemic. Along with raising clients’ upfront cash outlays, this will unfairly favour foreign-based online travel booking platforms against Indian travel agencies and tour operators. The SEIS benefit cap of ₹5 crore was also not eliminated in this budget, nor were incentives for corporations to host meetings and conferences in India through partial or full tax breaks included.

Both domestic and foreign tourists will benefit from the development of 50 tourist destinations through challenge mode in conjunction with an integrated and innovative approach to improve the tourist experience by bringing services on an app like connectivity, tourist guides, food standards, tourist security, etc. Although there are no direct subsidies, a few indirect areas that are extremely favourable to the industry have been provided. For example, allocating funds to a credit guarantee programme for MSMEs, increasing infrastructure spending to improve traveller connectivity across all means of transportation, and providing income tax relief to everyone will all boost consumer spending.

Gems and Jewellery

The FM advocated raising the import tax on silver bars, dores, and other items to 10% in order to bring them into line with the import taxes on gold and platinum while keeping the customs charge on gold at 10%. Silver dore currently has a basic customs charge of 6.1%, whereas semi-manufactured goods have a basic customs duty of 7.5%. To increase home production, the Finance Minister also suggested lowering import taxes on seeds used to create lab-grown diamonds.

While a research and development funding will be given to one of the IITs for the creation of Lab Grown Diamond seeds and equipment, other aspects of the industry, such as the elimination of customs taxes on gold, have been overlooked. It will seriously hurt the sector and promote the grey market.

Making gold an asset class would be hampered by high taxes, especially at a time when gold prices are rising globally. Additionally, the booming black market punishes organised and law-abiding actors while diluting efforts to limit cash transactions.

Budget also announced that the conversion of physical gold to Electronic Gold Receipt will not attract any capital gains. Hence giving the sector a digital boost as a whole and encouraging investment in the digital counterpart of gold. The direction of this year’s Budget is favourable for the sector.

Chemicals and Fertilisers

To help the government’s effort for an energy transition and to facilitate the ethanol blending programme, the Union Budget 2023–24 proposes to exclude basic customs duty on denatured ethyl alcohol. Additionally, the Budget waives customs duties on crude glycerine and fluorspar of the acid grade, which will increase the overall production capacity of Indian chemical industries. This raw material exemption will improve production and promote the export of specialised chemicals on the international market.

For the financial year 2023–2024, FM Nirmala Sitharaman allocated ₹1.75 lakh crore for fertiliser subsidies, which was 22 percent less than ₹2.25 lakh crore for FY23. After the minister finished speaking, the share prices of Chambal Fertilizers, National Fertilizers, GSFC, and Rashtriya Chemicals and Fertilizers all decreased by 3–4 percent. In expectation of a reduction in the import duty on some important raw materials, fertiliser stocks had risen over the previous few days.

Market players anticipated adjustments in the Budget 2023 to increase domestic phosphatic fertiliser producers’ competitiveness by lowering import taxes on essential raw materials like phosphoric acid and ammonia.

Energy

The green activities being carried out in accordance with this priority were emphasised in the budget:

- Green Hydrogen: The Minister announced a 19,700 crore investment for the recently created National Green Hydrogen Mission, which she claimed will help the country “assume technology and market leadership in this emerging sector,” as well as making it less reliant on fossil fuel imports.Spending: 19,700 crore. By 2030, the goal is to produce 500 MMT (million metric tonnes) of green hydrogen annually.

- Energy transition: The Union Ministry of Petroleum and Natural Gas would receive 35,000 crores in priority capital investments for energy security, net zero goals, and energy transition as part of the budget. Spending: 35,000 crore.

- Battery Storage: The Finance Minister announced viability gap funding for battery energy storage systems with a capacity of 4,000 MWh in order to promote sustainable growth (megawatt hour). Additionally, a thorough framework for pumped storage projects will be developed.

- Renewable energy evacuation: Re-evacuation enables quickly evacuating generated power to the power system for distribution. The construction of an interstate transmission line for the evacuation and grid integration of 13 Gigawatts of renewable energy from Ladakh will cost $20,700 crore, including $8,300 crore in central funding, according to Ms. Sitharaman.

- Green Credit Program: The Minister stated that a Green Credit Program will be notified under the Environment Protection Act of 1986 in order to promote behavioural change. According to her, this will encourage ecologically friendly and responsible acts by businesses, people, and local organisations and assist mobilise extra resources for such endeavours.

In order to make our economy greener, replacing old, polluting vehicles is a crucial step, according to the Finance Minister. The Minister provided funding to scrap outdated automobiles owned by the federal government, furthering the Vehicle Scrapping Policy announced in Budget 2021– 2022. States will also receive assistance in upgrading outdated automobiles and State ambulances.

Technology

The government’s dedication to integrating technology into every facet of the growth of the country was made clear in the 2023 Budget. The government plans to boost tech-enablement by taking steps like extending duty relief on mobile phone components, announcing a National Data Governance Policy, and establishing centres of excellence for robotics, drones and AI as well as the Skill India platform. The expansion of 5G services via 100 labs devoted to the technology furthers the government’s vision of a “Digital India.”

Through automation, data analysis, and predictive modelling, it will boost productivity, enhance decision-making, and speed up economic growth, bringing about a dramatic transformation in industries including healthcare, education, agriculture, and finance. In order for a nation to fully benefit from AI, it will be crucial for the public and commercial sectors to collaborate in order to address the ethical, legal, and social consequences of AI as well as to make sure that its use is consistent with national priorities and values.

The government has grand intentions to create a Center of Excellence in Artificial Intelligence as the country moves to the next stage of technological development and with the launch of 5G. India will become a digital nation, hence it is crucial to concentrate on digital transformation and cyber security solutions.

Financial Services

Initiatives on the financial inclusion agenda will significantly contribute to the development of an open, digital, and inclusive India with a long-term vision. The budget has given the financial services sector a boost for sustained growth.

A new credit guarantee programme for MSMEs with an investment of ₹9,000 crore will be introduced on April 1 and will aid in promoting the nation’s exports. Exports and investment will increase as a result. The pressure on India’s small and medium sized businesses would undoubtedly decrease thanks to this programme. The allocation for the interest equalisation (subsidy) plan has been increased, as requested by exporters, from ₹2,376 crore in 2022–23 to ₹2,932 crore in 2023–24, an increase of 23%.

FM Nirmala Sitharaman said that the Senior Citizens Savings Scheme’s maximum deposit limit would be increased. She declared, “The Senior Citizens Savings Scheme would be expanded to a deposit account of ₹30 lakhs from ₹15 lakhs. Previously, the small savings scheme had a deposit cap of ₹15 lakhs and offered interest at a risk-free rate of 7.40 percent annually. Additionally, the monthly income account scheme’s maximum deposit limit would increase from ₹4.5 lakhs to ₹9 lakhs for a single account and from ₹9 lakhs to ₹15 lakhs for a joint account. The middle class and senior citizens who park their money in secure government deposit plans that offer greater returns than banks will gain from the move to raise the investment ceilings in modest savings programmes. The government can raise money at a lower rate than the 8% interest it offers through the Senior Citizen Savings Scheme, therefore the move to change the ceilings would cost money.

The FM also proposed that she will launch the Mahila Samman Savings Certificate, a small savings programme designed specifically for women, to honour the Azadi ka Amrit Mahotsav. A two-year term and a 7.5% interest rate are offered by the modest savings programme.

The tax exemption for traditional life insurance policies was eliminated under the budget. High value traditional life insurance policy income proceeds are no longer excluded from taxes. Up until this point, all standard life insurance policies (non-ULIPs) allowed for unlimited tax-free distributions. According to the new policy, no tax-exemption shall be provided if the total premium for such plans exceeds INR 5 lakhs. For policies issued on or after April 1, 2023, this is applicable. The proceeds received in the event of the policyholder’s death will continue to be exempt from taxes. The industry has a poor impression of this new regulation since it may hurt sales of classic savings products with high sum assurance. Shares of LIC, HDFC Life, ICICI Prudential, and SBI Life plunged 10-12% around noon on February 1.

FM According to Nirmala Sitharaman, the federal government expects to meet its 6.4 percent of GDP fiscal deficit target for the current fiscal year (FY23) and is aiming for a 5.9 percent of GDP fiscal deficit for FY24. The administration has made a commitment to follow through on its aim to bring the fiscal deficit under 4.5% by 2025–2026. The simplification of indirect taxes to deliver higher exports and higher domestic manufacturing clubbed with changes to custom duty on key inputs for producing shrimp feed and seeds for manufacturing lab grown diamonds will help in reducing fiscal deficit. Such activities undertaken by the government shows that they are committed to the plan of getting the fiscal deficit below 4.5% by 2025-26.

TAX ANALYSIS

Let’s get the big question out of the way — “Is there a change in personal income tax rates?”

Yes. And no.

See, the Honourable Finance Minister said, “Currently, those with income up to 5 lakhs do not pay any income tax in both old and new tax regimes. I propose to increase the rebate limit to 7 lakhs”

Everyone cheered. And thumped the tables. And then she continued after a pause…“in the new tax regime.” Suddenly, there was pin-drop silence.

A Major change on the taxation front in the Union budget for the fiscal year 2023 presented on 1st February 2023 is in the New Tax Regime introduced in the year 2020 which provided concessional slab rates as an alternative to the existing tax regime to Individuals & HUFs.

In contrast to what the Government thought, the new tax Regime or 115BAC received less response due to the opportunity cost it brought in. This was because, while the new tax regime allows you to pay lower tax rates, it foregoes several allowances and deductions. On the contrary, you can claim more exemptions and deductions if you go for the existing tax regime.

However, it is important to note that it is still an optional tax regime. But why this section or the new tax regime suddenly became common talks after the announcement of Budget 2023?

115BAC – THE NEW TAX REGIME 2.0!

Here’s the comparative analysis of the before & after effects of Budget 2023:

Let me explain how this change increased the rebate slab limit from 5 lakhs to 7 lakhs.

If you earn less than ₹7 lakhs, you will not fall under any slab and will be completely exempt from paying income tax. But if you earn more than ₹7 lakhs, say ₹7.5 lakhs, then you’ll have to pay 5% on your income between ₹3 lakhs to ₹6 lakhs, and 10% between ₹6 lakhs and ₹7.5 lakhs.

Hence if you see the previous maximum rebate limit as per 87A, i.e., ₹12,500 (Tax up to 5 lakhs as per old regime) increased to ₹25,000 (Tax up to ₹7 lakhs as per New Regime after Budget 2023).

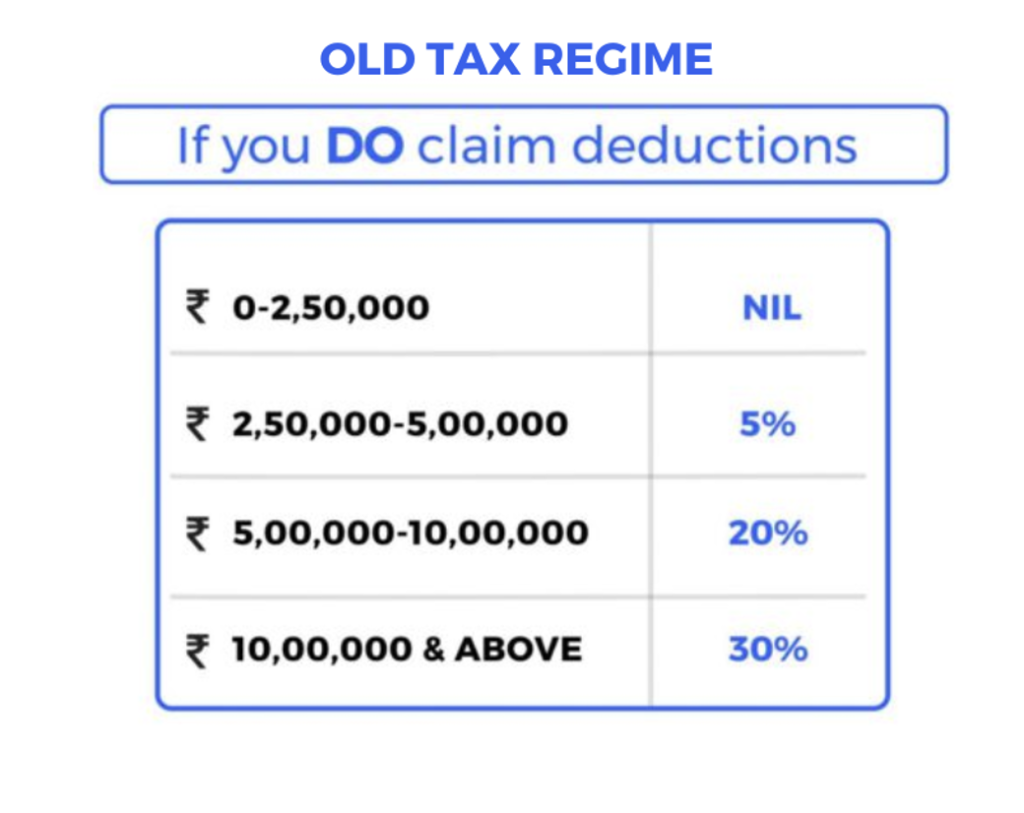

Here’s the Catch! If you stick to the old regime and claim your exemptions and deductions, nothing changes for you. Nothing.

In the old tax regime, you can avail of deductions under heading VI-A such as 80C, 80CCC, and 80CCD for making investments in specified funds and can claim a deduction of up to INR ₹2 lakhs. You can also avail of other deductions such as 80D for Medical Insurance, 80E for Interest Paid on Education Loans, House Rent Allowance, LTA, etc. Apart from these under specific head deductions such as standard deduction of salary under section 16, family pension deductions under other sources were also revoked. In the new tax regime, however, you cannot avail yourself of any of the deductions mentioned above.

The Budget 2023, however, allowed the salaried class to avail a standard deduction of 50,000 & family pension deduction even in the new tax regime.

The one clear thing is that this will definitely be a big boost to people who earn less than ₹7 lakhs. Their income can be said to be completely tax-free. Apart from that, they don’t need to worry about making investments & finding opportunities to save tax. But if you do think that the new regime works out better, be cautious of the fact that for each individual there is a different set of taxation plan that works out, there is no single tax regime to be recommended and it all depends upon your financial structure. Many people are forced to save and invest just because they want to save tax and claim deductions. You might invest in the Public Provident Fund (PPF) which has a 15-year lock-in, & get a deduction under 80C. The same also holds for medical benefits under 80D and interest rates from banks under 80TTA/TTB. In one way or other, this makes you plan out your future & current hospitalization & financial security.

Since these deductions are not available under the new tax regime, you could take a laissez-faire approach and your savings rate could decline and you might ignore life and health insurance. But we don’t want that, do we?

SURCHARGE – RICH TAX NOW JUSTIFIED?

A surcharge is an additional tax payable by Indian citizens if their income crosses 50LPA. The highest surcharge rate was 37% which was payable if the income of a person crosses 5 CR. The Finance minister herself said that India has one of the highest tax rates in the world being its highest rate at around 42% (Slab, surcharges, cesses combined).

This budget acted as a relief, but beware, only for the NEW TAX REGIME. If you opt for the new tax regime, your surcharge would be capped at 25%.

The highest surcharge rate was reduced from 37 per cent to 25 per cent in the new tax regime. This would result in a reduction of the maximum tax rate to 39 per cent. This means that, with effect from April 1, 2023, all income above ₹2 crore would be subject to a 25 per cent surcharge.

CAPITAL GAINS TAX – ADIEU UNLIMITED EXEMPTION

Capital gain on the sale of capital assets is exempted when invested in purchasing any other residential property and there is no maximum limit on such adjustment of capital gain the exemption has been provided under provisions of Sections 54 & 54F of the Income Tax Act 1961 until certain conditions have been fulfilled.

But the Budget 2023 changes this to curb the unnecessary benefit it possessed to the luxurious segment of society. Any capital gains arising from the sale of long-term assets, including residential houses, are now exempt from tax if the proceeds were invested in another residential property and there was no cap on the amount on which the deduction could be obtained. But under the new provisions, a cap of ₹10 crore has been put on capital gains on which deduction will be available. That’s all you can invest in a house to save tax. If you made a ₹15 crore profit and buy a house worth ₹15 crores, you’ll have to pay the dues on the ₹5 crores

OTHER CHANGES

- The tax exemption limit for leave encashment exemption has been increased from ₹3 lakhs to ₹25 lakhs.

- The presumptive taxation limits for Sec 44AD (for small businesses) and Sec 44ADA (for professionals) have been revised to ₹3 crore and ₹75 lakhs respectively. The increase in limits is subject to a condition that 95% of the receipts must be through online channels.

- The Union Budget 2023-24 has proposed to limit the income tax exemption on the proceeds of high-value life insurance policies. It is proposed to provide that where the aggregate of premium for life insurance policies [other than ULIP] issued on or after April 1, 2023, is above ₹5 lakhs, income from only those policies with aggregate premiums up to ₹5 lakhs shall be exempt.

CONCLUSION

In an otherwise volatile global macroeconomic environment, private spending and capital formation, which have been made possible by an effective immunisation policy, have written India’s growth tale. India’s position as a top investment location would be strengthened by Budget 2023. The creation of new capital and jobs would be significantly boosted by a 33% rise in capital investment spending, a reformed MSMEs loan guarantee programme, a slackened lending cycle, and the reduction of customs tariffs. The government’s green growth policy, in particular its focus on energy transition, aims to take the environmental effects of industrialization into account. Additionally, the expansion of tax breaks and the reduction of tax slabs for individual taxpayers would guarantee that they had more discretionary income, which would in turn encourage domestic consumption. The 20 lakh crore agricultural credit goal would pave the way for tackling food security issues and elevating India to a significant food exporter in the future. Overall, Budget 2023 is a growth-oriented budget that promotes progressive development, balances the budget’s fiscal position, and provides the groundwork for India to become a $5 trillion economy by 2026 and a developed country by 2047.

Deepseek: A journey from Hedge Funds to AI

Introduction: In this busy and bustling day to day life of ours managing our Finances…

Beyond Numbers: The Human Cost of Infosys’ Layoffs and the Global Normalization of Workforce Reduction

A Familiar Script: Infosys and the Corporate Playbook of Disposable Labor: On February 7, 2025,…

Understanding Tariffs and Their Impact on India

What Are Tariffs? Tariffs are taxes governments levy on foreign imports to make the goods more…

The Economics of Player Transfers in Football

Introduction: In the world of football player transfers are more than just transactions, they are…

Session 5

Session 5- Unraveling Equity Derivatives: Insights from the Fifth Development Session The Fifth Development Session…

An Attempt To Deteriorate The Creditworthiness of Indian Entities

Introduction: The growth story of India in almost every sector is not alien to the…