The Union Budget 2024, presented by Finance Minister Nirmala Sitharaman, represents a pivotal moment in India’s economic planning and policy-making. Against global economic uncertainty and domestic challenges, this budget aims to lay the groundwork for a more resilient and dynamic Indian economy. Reflecting the changed political landscape, with BJP no longer enjoying sole majority in the Lok Sabha, it has a cautious reality check for observers, both within and outside the government. The government has finally realised that there is economic distress in the country, despite the GDP growth rates the broader economy is not doing well, the government recognised the political cost of denial and is looking at course correction. This was reflected in Sitharaman outlining the newer hold on structural issues like agriculture as the government’s priority, a focus on jobs and skilling, and measures to alleviate stress of Medium Small and Micro Enterprises (MSMEs). With a clear focus on inclusive growth, it addresses critical areas such as education, employment, urban development, and technological innovation. By allocating substantial resources and introducing forward-thinking policies, the budget seeks to bridge socio-economic divides, foster sustainable development, and position India as a global leader in various sectors.

In her speech in Lok Sabha, Sitharaman noted that amid the global economic uncertainty due to different factors, India’s growth story is a “shining exception”. She said that for the pursuit of ‘Viksit Bharat’, the Centre has narrowed nine key priorities related to employment, energy security, infrastructure, social justice among others. These 9 priorities are:

- Productivity and Resilience in Agriculture

- Employment and Skilling

- Human Resource Development and Social Justice

- Manufacturing and Services

- Urban Development

- Energy Security

- Infrastructure

- Innovation, Research and Development

- Next Generation Reforms

Sitharaman reiterated that the poor, women, farmers and youth are the four main focus groups for the Modi government.

Economic Outlook

According to the Economic Survey presented on July 22, India has demonstrated greater economic resilience than other emerging markets in the face of global supply chain disruptions caused by geopolitical tensions, showcasing its robust macro-growth trajectory. With a remarkable 8.2% growth in the financial year 2024, India has once again claimed its spot as the world’s fastest-growing large economy. This achievement is no small feat, especially considering the global economic challenges we’ve faced in recent years.

The driving force behind this growth is a surge in investments, particularly from government coffers. Both the Central and State Governments have opened their wallets, increasing capital expenditure by a whopping 27% compared to the previous year. This boost in spending has been a lifeline for key sectors like mining, manufacturing, and construction. On the supply side, the mining, manufacturing and construction sectors led the economic growth. These sectors have been the real MVPs of India’s economic story, benefiting from the government’s infrastructure push and a rising demand for office spaces and housing. It’s not just about building structures; it’s about building the foundation for India’s future.

However, it’s not all smooth sailing. The common man’s consumption and private sector investments have been sluggish, hinting at a slower recovery in overall demand. Private companies in India, are earning a lot of money but they’re not investing their profits because they’re afraid they won’t get any good returns owing to the decrease in domestic spending. At the distributive ends of this growth and the substitutive cost of replacing welfare expenditure for a higher capex, widened inequality and exacerbated existing divides in rural-urban areas and between higher and lower income groups.

Fiscal Position

Economists had offered several suggestions on how best to use the surplus funds from the RBI in the budget. It has used the bulk of the surpluses to lower the fiscal deficit ratio. It appears, therefore, that fiscal prudence was the starting point of the budget as the Government of India has balanced fiscal prudence with growth impetus in this budget by accelerating the fiscal consolidation path. The government has taken a fiscal deficit target of 4.9% compared to the 5.1% outlined in the (previous) interim budget, with a commitment to reach below 4.5% by FY 2025–26 and sustained reductions thereafter. This is a crucial development, as it lays the groundwork for a more robust and resilient economy capable of withstanding global financial headwinds. Tax collections are expected to be stronger in FY 2024–25, with an 11.2% increase in the Central Government’s net tax revenue from the FY 2023–24. The gross tax to gross domestic product (GDP) ratio is expected to increase to 11.8% in FY 2024–25, compared to 11.6% in FY 2023–24. This will create a platform for future growth with widening of the tax base. The tax revenue estimates seem conservative, and it is likely that these would be exceeded.

Market borrowing has also seen a reduction for the upcoming fiscal year. Gross market borrowing is now set at Rs 14.01 trillion, down from the initially projected Rs 14.13 trillion in the interim budget. Similarly, net market borrowing has been adjusted to Rs 11.63 trillion from Rs 11.75 trillion. This revised plan marks a significant decrease from the record borrowing in FY24, which saw gross borrowing of Rs 15.43 trillion and net borrowing of Rs 11.80 trillion. The reduction aligns with the government’s lowered fiscal deficit target and signals a move towards greater fiscal prudence. By decreasing its reliance on borrowing, the government aims to manage its finances more efficiently. This strategy reflects a commitment to maintaining fiscal discipline while balancing economic growth objectives.

Massive Thrust to Employment and Skill Development

The Indian government has made job creation a central focus in the Union Budget 2024-2025, announcing new schemes and allocating more funds for skill development. Job creation not only helps absorb the growing workforce but also drives higher productivity, increases disposable income, and enhances the purchasing power capacity of individuals, thereby fuelling overall economic prosperity. In her seventh budget address, Finance Minister Nirmala Sitharaman introduced three new employee-linked incentive schemes as part of the Union Budget for 2024-25.

These initiatives, included in the Prime Minister’s package, aim to enhance enrolment with the Employee Provident Fund Organization and emphasise support for first-time employees, as well as offer assistance to both employers and employees. The government aims to create approximately 4.1 crore jobs over the next five years. To support this ambitious goal, ₹2 lakh crore has been allocated. A significant portion of the budget, ₹1.48 crore, is designated for skilling initiatives, with the objective of training 20 lakh youth over the next five years. Additionally, Sitharaman announced the modernisation of 1,000 industrial training institutes to better prepare the workforce with the skills needed to meet industry demands. Additionally, the corporate tax on foreign firms was reduced from 40% to 35%, a move designed to attract more foreign investors to set up operations in India.

To enhance the participation of women in the workforce, the budget includes provisions for setting up working women’s hostels in collaboration with industry and establishing crèches. In support of women-led development, the budget allocates more than ₹3 lakh crore for schemes benefiting women and girls, promoting greater economic and social empowerment.

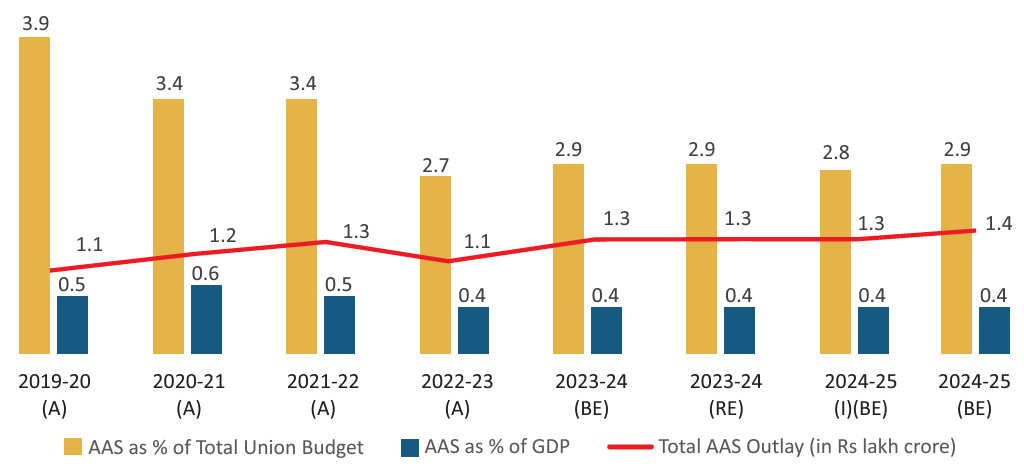

Agriculture

The Union Budget 2024 envisages sustained efforts towards productivity and resilience in agriculture, employment and skilling, women-led development, enhancement of digitization and technology, innovation and infrastructure growth, and credit flows, with earmarked allocation of INR 1.52 lakh crore for agriculture and allied sector. In spite of the absolute increase in budgetary spending towards agriculture, total expenditure in terms of percentage of the Union Budget and percentage of GDP has declined over me (2019-20 (A) to 2024-25 (BE)). A major highlight is the ambitious plan to integrate one crore farmers into natural farming practices over the next two years.

Union Government’s Budget Outlay for Agriculture and Allied Sectors (AAS) (%)

Source: Compiled by CBGA from Union Budget documents, various years.

This initiative will be bolstered by comprehensive support in the form of certification and branding, ensuring that farmers receive the recognition and market access needed for success. In addition, the establishment of 10,000 need-based bio-input resource centres will provide essential support and resources to farmers, promoting the use of eco-friendly agricultural inputs. Still, the legally backed MSPs for a diversified crop basket and a targeted intervention on increasing farm incomes remains an illusory goal.

The rollout of Digital Public Infrastructure (DPI) is set to “revolutionise” agricultural management. Over the next three years, according to the government, DPI will enhance coverage for farmers and their lands, streamlining operations and improving data accessibility. A significant part of this digital transformation includes a digital crop survey to be conducted across 400 districts, facilitating better monitoring and decision-making.

Further supporting farmers, the issuance of Jan Samarth based Kisan Credit Cards will provide crucial financial assistance, helping farmers access credit with greater ease and efficiency.

Infrastructure and Urban Development

FM Nirmala Sitharaman lays a strong foundation for infrastructure and urban development in India by prioritising significant investments aimed at rebuilding cities, enhancing connectivity, and promoting equitable growth. The budget allocates a total of INR 11,11,111 crore of capital expenditure for infrastructure and one of the standout provisions in the budget is the allocation of Long-term Interest -free loans, amounting to INR 1.5 lakh crore. This financial support is designed to assist states in enhancing their infrastructure projects.

The budget emphasises growth in several critical corridors, including the Amritsar-Kolkata Industrial Corridor, Vishakhapatnam-Chennai and Hyderabad-Bengaluru Industrial Corridors. Additionally, a plan for Transit Oriented Development is set to be formulated for 14 large cities.

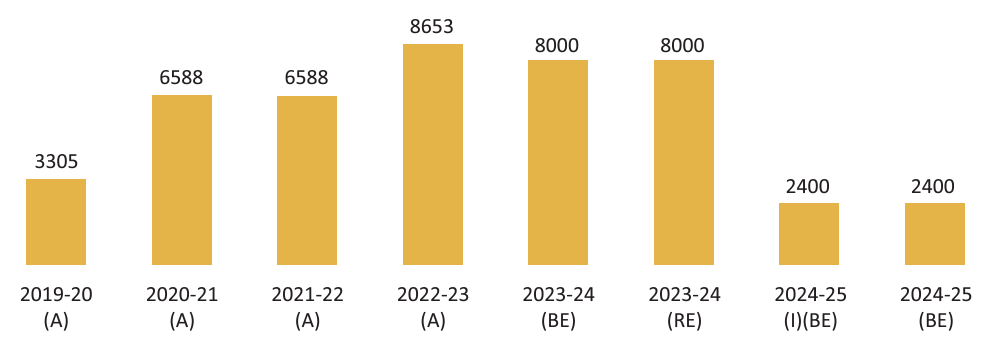

Union Government’s Budget Outlay for Smart Cities Mission (Rs crore)

Source: Compiled by CBGA from Union Budget documents, various years.

Another significant allocation is the amount set aside for Andhra Pradesh with INR 15,000 crore earmarked for comprehensive infrastructure development in the Andhra Pradesh Capital Region. With a strong emphasis on infrastructure development, the government is focused on creating equitable real estate hotspots across the country and is expected to have a multiplier effect, facilitating job creation and economic growth.

A major focus of the budget is rural connectivity initiatives. The Phase IV of Pradhan Mantri Gram Sadak Yojana (PMGSY) aims to provide all-weather connectivity to 25,000 rural habitations. Specific road connectivity projects have been funded at a cost of INR 7.3 lakh crore, targeting enhancements in road infrastructure across various states. Furthermore, the budget shows commitment towards support for flood management, with assistance allocated for flood management projects in regions like Assam, Himachal Pradesh, Uttarakhand, and Sikkim, addressing the significant losses caused by natural disasters.

Despite innovative financing in recent years, capital expenditure remains a key aspect of infrastructure funding. Between FY21 and FY24, capital expenditure by the Union Government increased by 2.2 times, while state government investment rose by 2.1 times during the same timeframe. The net flow of funds to infrastructure sectors through bank credit was around INR 79,000 crore from March 2023 to March 2024. Although this number is less than the budgeted allocations for railways and roads, credit growth in the infrastructure sector recovered to 6.5% in FY24 compared to 2.3% in FY23.

Tourism

The tourism sector received 3.3 % higher capex push of INR 2,479.62 crore in the financial year 2024-25, up from INR 2,400 crore allocated in the Union Budget 2023-24, however, the actual expenditure stood at INR 1692.10 crore. “Tourism has always been a part of our civilization. Our efforts in to positioning India as a global tourist destination will also create jobs, stimulate investment and unlock economic opportunity for other sectors,” Finance Minister Nirmala Sitharaman said in her Budget speech on July 23.

After the tourism sector was outlined as one of the four opportunities that could be transformative during the Amrit Kaal and achieve inclusive growth by Sitharaman in the Union Budget 2023-24, more initiatives were expected to be rolled out but this year’s budget seems to disappoint the industry which showed significant growth since post-covid period, clocking 43.5% YoY increase.

The Budget 2024-25 has allocated INR 2,080 crore for tourism infrastructure development, up from the revised outlay of INR 1,294 crore in 2023-24. Out of the total allocation earmarked for the tourism sector in FY2024-25, Rs 33 crore is allocated for overseas promotion and publicity, down from the revised allocation of INR 100 crore. For domestic promotion and publicity including market development assistance, the allocated budget increased to INR 176.97 crore.

FM Sitharaman proposed Vishnupad Temple corridor and Mahabodhi Temple corridor to be supported, modelled on the successful Kashi Vishwanath temple corridor to transform them into world class pilgrim and tourist destinations. She also said that a comprehensive development initiative for Rajgir will be undertaken. “Our government will support the development of Nalanda as a tourist centre besides reviving Nalanda university to its glorious stature,” Sitharaman added.

Defence

While there was expectation from Modi 3.0 that there would be greater budgetary allocation for defence. Although the Budget has not outrightly disappointed on this front, the distribution of allocations under the defence budget of 2024-25 are still skewed in favour of revenue expenditure. Nevertheless, overall spending under the Financial Year (FY) 2024-25 has only increased by 4.8 % from the previous FY 2023-2024. A close look at the defence budget shows that it constitutes only 12.9% of the total budget for the FY 2024-25 and remains inadequate in meeting the extent of the threats facing the country or the requirements of the armed forces. It is actually lower than the defence budget of FY 2023-24, which stood at 13.18% of the total national budget.

In an important move, the government has increased spending on innovation in defence, allocating an additional INR 400 crores through the Acing Development of Innovative Technologies with iDEX (ADITI) scheme. Capital expenditure, which stands at INR 1.72 lakh crore, roughly 27.67% and less than a third of the total defence budget. The government claims that 75 % of the capital outlay for modernisation will be spent on sourcing from domestic industry. Here, the government has taken a leap of faith by allocating most of the capital budget to secure supplies from domestic industry in a quest to boost manufacturing, production and innovation, being consistent with the government’s Atma Nirbhar Bharat initiative launch in 2020. The balance INR 43,000 crores will be spent on imports dedicated to capital acquisitions.

Energy

Emphasizing the Government’s commitment to energy security and employment generation in the clean energy sectors. The budget allocated INR 19,100 crore to the Ministry of New and Renewable Energy, highlighting a substantial increase in funding for solar energy and various other initiatives aimed at promoting sustainable energy development in India.

The allocation for the solar energy sector has been significantly increased to INR 10,000 crore, a 110% rise from the previous year’s budget. This increase is driven by the new PM Muft Bijli Yojana for rooftop solar installations. Despite past challenges, such as delays in subsidy disbursements and net-metering regulations, the Government aims to boost rooftop solar adoption through the PM Surya Ghar Muft Bijli Yojana, targeting 10 million households with a combined outlay of INR 75,000 crore until 2027. Additionally, the government will support MSMEs with financial mechanisms to facilitate their shift towards greener practices.

The budget introduced a policy for promoting pumped hydro storage projects to address the intermittency of renewable energy sources. This policy aims to facilitate the integration of renewable energy into the grid, ensuring continuous power supply and price moderation. However, the wind energy sector did not receive new allocations or support, despite its potential for repowering and efficiency improvements, especially in states like Tamil Nadu.

Nuclear energy is set to play a significant role in India’s energy mix as the country advances towards its “Viksit Bharat” vision. The Government plans to collaborate with the private sector to develop Bharat Small Reactors and Bharat Small Modular Reactors, supported by INR 13,208 crore allocated for R&D in the interim budget. Additionally, the development of Advanced Ultra Super Critical (AUSC) thermal power plants with higher efficiency is on the agenda, with NTPC and BHEL set to establish an 800 MW commercial plant using this technology.

To support domestic manufacturing and reduce reliance on imports, the budget exempts basic customs duty on 25 critical minerals essential for renewable energy, nuclear energy, and high-tech industries. This move is expected to enhance the domestic supply chain and manufacturing capacities. Additionally, the budget expands the list of exempted capital goods for solar energy projects while removing duty exemptions for solar glass and tinned copper interconnects, aiming to boost domestic production and job creation in the solar sector.

Gems and Jewellery

Budget 2024 presented a sharp cut in import duties on gold and silver, from 15 % to only 6 %. This move will end the decade-old approach of discouraging gold buying. Gold and silver basic customs duty (BCD) reduction from 10% to 5% and Agriculture Infrastructure & Development Cess (AIDC) from 5% to 1% will boost the overall competitiveness of the domestic jewellery industry. It will effectively reduce the overall taxes on gold from around 18.5% (including GST) to 9%.

The finance minister acknowledged that India is a world leader in the diamond cutting and polishing manufacturing, which employs more than a million skilled workers. The diamond industry’s major demand for safe harbour rates for foreign mining companies selling raw diamonds in the country has also been met. Major global diamond mining companies plan to sell their rough diamonds in India at Special Notified Zones (SNZs) where smaller players can directly buy from them instead of travelling to Belgium and Dubai. From now on, these foreign mines will not be considered as permanent entities, giving them a major relief. Moreover, Equalisation Levy at the rate of 2 % of consideration received for e-commerce supply of goods or services has been abolished to boost the e-commerce business of diamond jewellery though digital platforms.

The share price of jewellery companies such as Titan, Kalyan Jewellers, Senco etc. saw good gains on Budget Day, as the market seems to believe that lower gold prices will improve demand for organised players.

Taxation Analysis

The government has signalled a clear intent for taxpayers to move towards the new income tax system. It has looked only at the new income tax regime and not spoken of the old one. It has stated that two-thirds of taxpayers have opted for this alternative. Hereby, the old tax regime was completely ignored which translates to the Section 80C being pushed out of relevance. Section 80C has been crucial part of taxation as many people were introduced to savings and investments through Section 80C which will now be disturbed.

Benefits have been given in terms of an increase in standard deduction and tax slabs have been tweaked. In effect, the finance minister has stated that Standard deduction will be increased to INR 75,000 from INR 50,000 earlier and rebate of INR 17,500 per annum will be given. This is a plus as it will increase income and hence give people the option to either consume or save the amount. In the extreme case of adjusting for inflation, this will protect real disposable income. Therefore, there are benefits for the common man. It also gives the message that the government would like everyone to migrate to the new scheme.

New Tax Slab Rates

The Budget rather failed to address the rising higher consumer inflation issue more effectively, which currently stands at 5.08% as of June 2024. Although it aims to ensure that inflation moves towards the 4% target. It must be noted that inflation is based on CPI (Consumer Price Index) and does not take into account WPI (Wholesale Price Index) which jumped to 3.36% in June. Analysis suggests that WPI inflation was driven by food inflation as well as manufacturing related costs.

Capital Gains Tax and Indexation

The Budget proposed an increase in Long-Term Capital Gains Tax on all financial and non-financial assets to 12.5% from 10% earlier, and the indexation benefit available to taxpayers while determining the cost of acquisition has been withdrawn. The Short-Term Capital Gains Tax has also been increased to 20% from 15% earlier. A memorandum explaining the provisions of the Finance Bill (2024), stated that this was to “ease computation of capital gains for the taxpayer and tax administration”. This higher tax will eat into the gains from shares and equity-oriented funds. The Budget has extended some relief by increasing the tax exemption on LTCG from Rs.1 lakh to Rs.1.25 lakh in a financial year. Further, the securities transaction tax (STT) on trading in futures and options segment is set to be hiked to 0.02% and 0.1%, respectively. This will raise the cost for those engaging in trading activity.

There is a lot of dissent regarding the Capital Gains tax and abolition of Indexation that accompanied it. Industry experts view it as a discouragement for the common man to invest in properties. Other set of concerns as also pointed out by AAP MP Raghav Chadha in the Rajya Sabha, entail potential sale of properties at circle rates (minimum price at which a real estate is to be sold) only. Undervaluing the real estate helps furbish lower capital gains, thus, lesser taxation. Further, Mr Chadha also warned about increased black money transactions in the sector — another means to hide gains.

Let’s first understand what purpose does Indexation serve?

Indexation ensures that taxpayers are taxed on real gains than gains at prevailing prices, which are a result of general increase in prices, and not economic growth, during the course. Imagine, an individual buys a house for INR 25 lakh in 2003. For reasons such as inflation and/or a vibrant property market, they are able to sell the same property today at INR 1.5 crores. Here, it may appear that they gained INR 1.25 crores and should be taxed accordingly. However, the figure does not consider the price levels prevailing at the time of sale with that of purchase. This is where the Cost Inflation Index (CII) comes in. The indexed cost of property would come to INR 86.43 lakh, which means the taxable capital gains would be only INR 63.57 lakh. Under existing rules, the individual would pay a capital gains tax on immovable assets of 20% i.e. INR 12.71 lakh. Under the proposed rules, the indexation will be neglected and the unified capital gains tax of INR 1.25 crore would be taxed at 12.5%, resulting in a higher tax liability of INR 15.62 lakh, leading the seller to shell out INR 2.9 lakh more.

But there’s a catch! Removal of indexation and lower LTCG will affect property sellers differently. Some could end up paying more, while others could get away with lower tax. This will depend entirely on the period of holding and the gains accrued as if the property’s value has increased more than the inflation rate, the new 12.5% tax is expected to be more advantageous for real estate sellers, compared to the previous 20% tax rate even after adjusting for indexation.

On the other hand, the budget has open up a new avenue of relief for investors of international funds. The finance minister announced the holding period for equity Fund of Funds, overseas FoFs (international funds), and gold mutual funds was reduced from more than 36 months to more than 24 months along with change in LTCG tax rate to 12.5%, from earlier being taxed as per the tax slab rate with no change in STCG tax rate. This announcement made equity FoFs, overseas FoFs (international funds), and gold mutual funds more attractive among investors.

Market implications

The recent Budget’s capital gains tax revisions have eclipsed other fiscal measures, with the hikes in both short-term and long-term capital gains tax rates expected to raise the hurdle rate for financial assets. This shift is likely to dampen market sentiment, as it reflects investor unease over the stability of tax policy and fears of potential future increases. However, a case can be made for growth in the medium and long term for investors with a long investment horizon.

Prior to the announcement, the financial markets had been buoyant, reflecting a period of optimism. However, the immediate post-announcement reaction has been one of cooling, with benchmark indices closing slightly lower. On 23 July, the Sensex dropped to 80,429 (0.09%), while the Nifty50 dropped to 24,479 (-0.12%), despite recovering from intraday lows.

Conclusion

In conclusion, the Union Budget 2024-25 demonstrates a commitment to India’s long-term vision of Viksit Bharat, balancing economic growth with sustainability and distributive justice. The budget addresses global challenges and aligns with Sustainable Development Goals, showing foresight in navigating the complex “polycrisis” landscape. However, it falls short in fully addressing critical issues such as inflation and equitable access to resources for human capital development.

While the budget aims to stimulate both consumption and investment, with a focus on services and manufacturing sectors, concerns remain about the effective implementation of new schemes and the persistence of structural challenges. The widening inequality of access to essential services and resources across India remains a significant hurdle. As India’s former RBI Governor Raghuram Rajan says, “A big mistake India can make is to believe the hype around its economic growth” and warned that India’s strong economic growth is overshadowed by structural challenges like poor education, and skills and job creation. One key indicator to explain this is the nature of widening social, economic, and political inequality of ‘access’ that is plaguing states, rural areas, pan India. In almost all critical developmental measures, from measuring access to basic healthcare, education, social security, credit, legal recourse, the macro-realities of widening access inequality have made the average citizen worse off. Rajan commends that the budget rightly identifies the structural issues but criticised it for failing to allocate sufficient resources to address them affectively.

To truly achieve the vision of a developed India, the government must prioritize workforce improvement, enhance access to quality education and healthcare, and ensure more equitable distribution of economic benefits. While the budget sets a positive direction for macro-growth and fiscal stability, its success will ultimately depend on addressing these underlying issues and executing its policies efficiently.

Divij Saxena

Vice President

Deepseek: A journey from Hedge Funds to AI

Introduction: In this busy and bustling day to day life of ours managing our Finances…

Beyond Numbers: The Human Cost of Infosys’ Layoffs and the Global Normalization of Workforce Reduction

A Familiar Script: Infosys and the Corporate Playbook of Disposable Labor: On February 7, 2025,…

Understanding Tariffs and Their Impact on India

What Are Tariffs? Tariffs are taxes governments levy on foreign imports to make the goods more…

The Economics of Player Transfers in Football

Introduction: In the world of football player transfers are more than just transactions, they are…

Session 5

Session 5- Unraveling Equity Derivatives: Insights from the Fifth Development Session The Fifth Development Session…

An Attempt To Deteriorate The Creditworthiness of Indian Entities

Introduction: The growth story of India in almost every sector is not alien to the…